Is First Financial Northwest, Inc. (NASDAQ:FFNW) A Smart Pick For Income Investors?

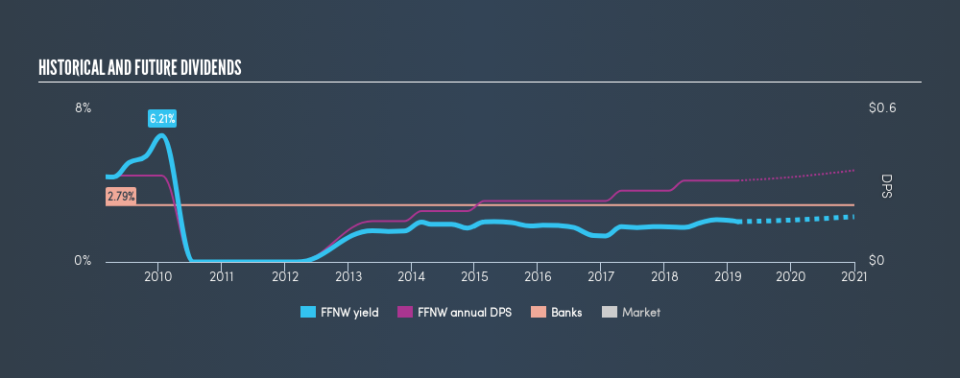

Dividends play a key role in compounding returns over time and can form a large part of our portfolio return. Historically, First Financial Northwest, Inc. (NASDAQ:FFNW) has paid dividends to shareholders, and these days it yields 2.0%. Should it have a place in your portfolio? Let’s take a look at First Financial Northwest in more detail.

See our latest analysis for First Financial Northwest

5 checks you should do on a dividend stock

When researching a dividend stock, I always follow the following screening criteria:

Is its annual yield among the top 25% of dividend-paying companies?

Has it paid dividend every year without dramatically reducing payout in the past?

Has the amount of dividend per share grown over the past?

Can it afford to pay the current rate of dividends from its earnings?

Will the company be able to keep paying dividend based on the future earnings growth?

How does First Financial Northwest fare?

The current trailing twelve-month payout ratio for the stock is 21%, meaning the dividend is sufficiently covered by earnings. In the near future, analysts are predicting a higher payout ratio of 31% which, assuming the share price stays the same, leads to a dividend yield of around 2.1%. However, EPS is forecasted to fall to $1.01 in the upcoming year. Therefore, although payout is expected to increase, the fall in earnings may not equate to higher dividend income.

When considering the sustainability of dividends, it is also worth checking the cash flow of a company. A business with strong cash flow can sustain a higher divided payout ratio than a company with weak cash flow.

If there is one thing that you want to be reliable in your life, it’s dividend stocks and their constant income stream. The reality facing FFNW investors is that whilst it has continued to pay shareholders dividend, dividends are lower today, than they were a decade ago. Though this may not be a serious red flag, strong dividend stocks should always strive to increase its payout over time.

In terms of its peers, First Financial Northwest has a yield of 2.0%, which is on the low-side for Banks stocks.

Next Steps:

Considering the dividend attributes we analyzed above, First Financial Northwest is definitely worth keeping an eye on for someone looking to build a dedicated income portfolio. Given that this is purely a dividend analysis, you should always research extensively before deciding whether or not a stock is an appropriate investment for you. I always recommend analysing the company’s fundamentals and underlying business before making an investment decision. Below, I’ve compiled three essential factors you should further research:

Future Outlook: What are well-informed industry analysts predicting for FFNW’s future growth? Take a look at our free research report of analyst consensus for FFNW’s outlook.

Valuation: What is FFNW worth today? Even if the stock is a cash cow, it’s not worth an infinite price. The intrinsic value infographic in our free research report helps visualize whether FFNW is currently mispriced by the market.

Other Dividend Rockstars: Are there better dividend payers with stronger fundamentals out there? Check out our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance