Fintech investment doubled while Australian banks got hammered

Investment in financial technology startups more than doubled last year while Australian banks came under intense public scrutiny for their treatment of customers.

Globally, fintechs managed to attract US$55.3 billion of investments in 2018, which was 107 per cent more than the year before, according to Accenture analysis of CB Insights data.

The increase could be directly attributed to fintech’s explosive growth in China, where the amount of money that went into the sector stunningly increased nine-fold. Its US$25.5 billion of capital raising in this nation alone almost matched the US$26.7 billion generated in the rest of the world.

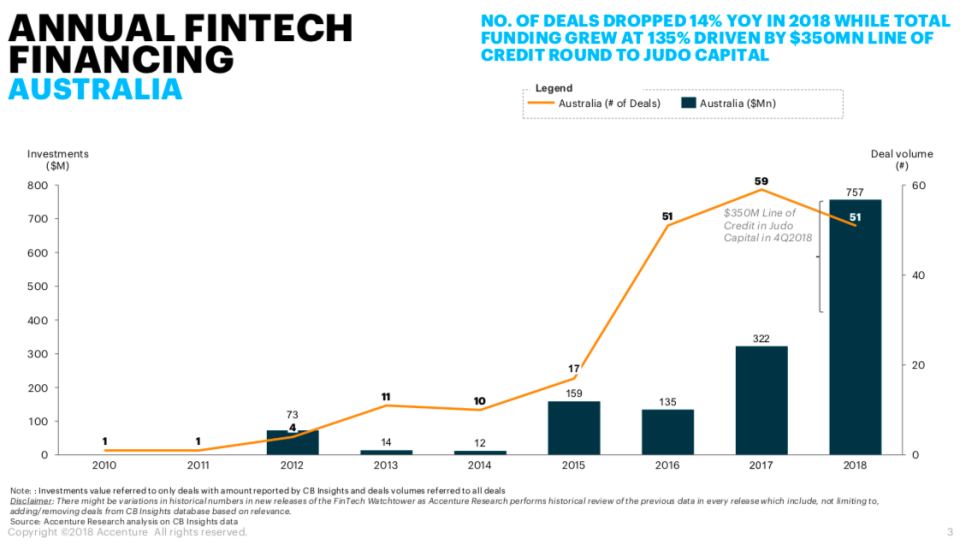

Australia saw similar growth with US$756.7 million total investment into the fintech sector, which is more than 135 per cent up from the previous year’s US$322.3 million.

The traditional banking industry in this country is facing low public trust and higher expectations, said Accenture Australia banking lead Alex Trott.

“There’s a significant opportunity for financial technology firms, as recognised by this analysis, to partner with, as well as compete with, traditional financial firms,” he said.

The imminent arrival of open banking laws and the issuing of new banking licences would further open up the market, Trott said.

“There is also an opportunity for financial technology innovations in the wake of the banking Royal Commission, with various local fintech players working to improve remediation and compliance through artificial intelligence and other emerging technologies.”

A caveat to the Australian numbers for last year is that a $350 million line of credit granted to Judo Capital was a massive contributor to the total figure.

Lending fintechs did especially well in attracting investors, nabbing 68 per cent of the funds (US$512 million) raised in 2018, while the payments accounting sector accounted for 17 percent (US$131 million).

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Now read: 10 startups that Telstra just poured money into

Now read: DRUNK & PASSED OUT – QANTAS flight attendant loses unfair dismissal appeal

Yahoo Finance

Yahoo Finance