Financially Strong And High Value Stocks

Undervalued companies, such as Pacific Energy and NetComm Wireless, are those that trade at a price below their actual values. Investors can profit from the difference by investing in these stocks as the current market prices should eventually move towards their true values. If capital gains are what you’re after in your next investment, I’ve put together a list of undervalued stocks you may be interested in, based on the latest financial data from each company.

Pacific Energy Limited (ASX:PEA)

Pacific Energy Limited, together with its subsidiaries, develops, builds, operates, and manages electricity generation facilities in Australia. Pacific Energy is currently run by James de Barran Cullen. The company currently has a market cap of AUD A$227.78M, putting it in the small-cap stocks category

PEA’s shares are currently hovering at around -42% beneath its actual level of $1.02, at a price tag of AU$0.59, according to my discounted cash flow model. signalling an opportunity to buy the stock at a low price. Moreover, PEA’s PE ratio stands at 14.02x compared to its index peer level of, 17.18x indicating that relative to its comparable company group, PEA’s shares can be purchased for a lower price. PEA is also a financially robust company, as short-term assets amply cover upcoming and long-term liabilities. It’s debt-to-equity ratio of 29.23% has been dropping over the past couple of years signalling PEA’s capacity to pay down its debt. Interested in Pacific Energy? Find out more here.

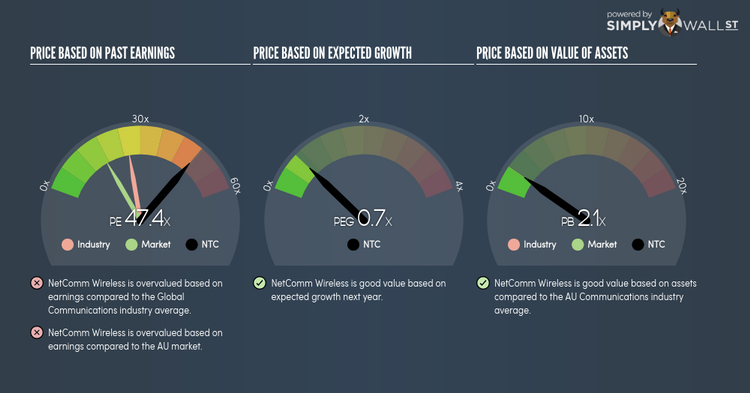

NetComm Wireless Limited (ASX:NTC)

NetComm Wireless Limited develops and sells broadband products for telecommunications carriers, core network providers, system integrators, and government and enterprise customers worldwide. The company was established in 1982 and with the company’s market cap sitting at AUD A$169.01M, it falls under the small-cap category.

NTC’s shares are currently floating at around -68% lower than its actual worth of $3.56, at a price tag of AU$1.16, based on its expected future cash flows. This discrepancy signals a potential opportunity to buy NTC shares at a low price.

NTC also has a healthy balance sheet, as near-term assets sufficiently cover liabilities in the near future as well as in the long run. NTC also has a miniscule amount of debt on its balance sheet, which gives it headroom to grow and financial flexibility. Continue research on NetComm Wireless here.

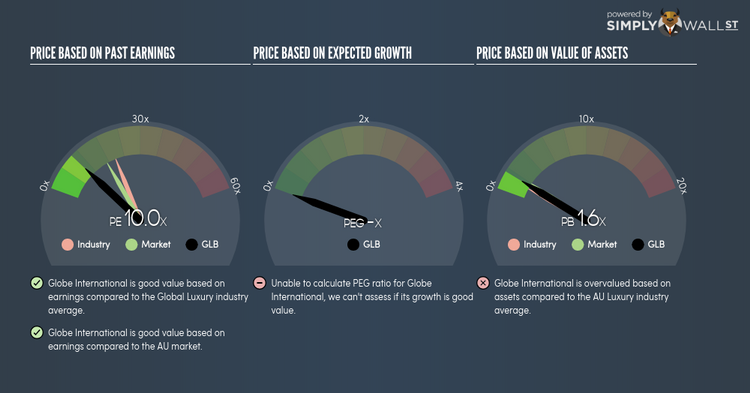

Globe International Limited (ASX:GLB)

Globe International Limited produces and distributes purpose-built apparel, footwear, and skateboard hardgoods for the board sports, street fashion, and workwear markets. The company was established in 1984 and with the stock’s market cap sitting at AUD A$60.12M, it comes under the small-cap category.

GLB’s stock is currently hovering at around -67% lower than its intrinsic level of $4.34, at the market price of AU$1.45, based on its expected future cash flows. This price and value mismatch indicates a potential opportunity to buy the stock at a low price. What’s even more appeal is that GLB’s PE ratio stands at around 10.03x against its its Luxury peer level of, 20.65x meaning that relative to its peers, we can buy GLB’s stock at a cheaper price today. GLB also has a healthy balance sheet, as current assets can cover liabilities in the near term and over the long run. GLB has zero debt on its books as well, meaning it has no long term debt obligations to worry about. More on Globe International here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance