4 simple tips to financially prepare for a disaster

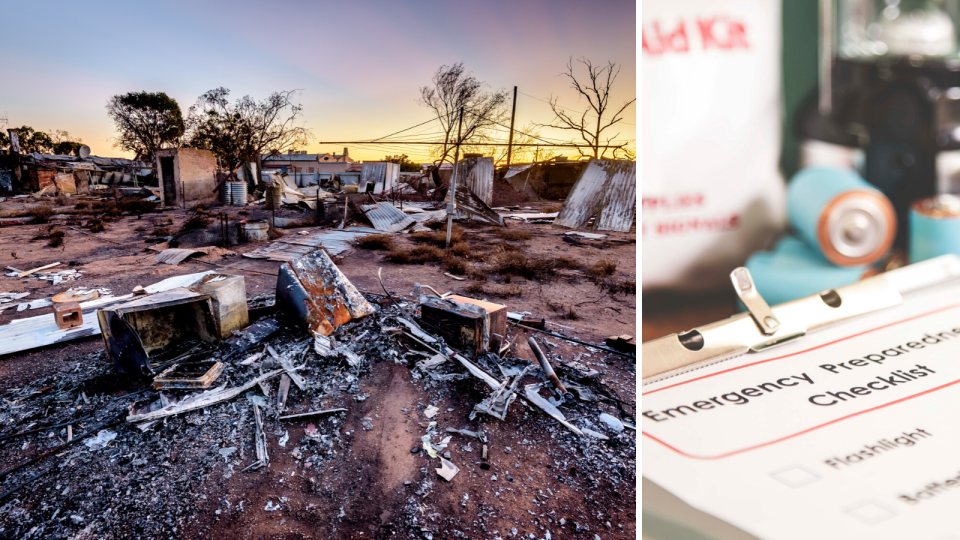

The Australian bushfires have caught many by surprise, and thousands of people have now found themselves without homes, livelihoods, or with badly damaged properties.

And though some disasters can’t be predicted, there are small – but handy – ways you can prepare yourself if you’re in danger of losing your home and your belongings.

Often, small things done ahead of time can save yourself from further stress later on when you’re focusing on rebuilding and getting in touch with insurers and service providers.

Read more: Bushfire insurance claims: Everything you need to know

Read more: How bushfire-affected Australians can get free tax help

Related story: Free legal help offered to Aussies hit by bushfires

According to Ladies Finance Club founder Molly Benjamin, here are some simple things you can do to prepare yourself for the worst:

1. Set aside an emergency fund

Do you have a ‘rainy day’ savings account already? If you don’t, consider setting $1,000 aside into a high-interest, fee-free savings account that you contribute to regularly.

“Once you have that $1000 then aim to build up this fund with 3-6 month’s worth of living expenses (how much it costs to be you ie. rent, bills, food etc),” said Benjamin.

You can set this up yourself online, or call your bank to set up an automatic transfer into the new account.

2. Make copies of and protect important documents

Have extra hard copies and/or soft copies of important financial and personal documents such as your driver’s license, passports, birth certificates, banking documents, wills, financial certificates, photos, and insurance policies. You may also wish to include other documents like marriage licenses and property licenses.

Benjamin recommends purchasing a water- and fireproof safe (you can find these at Bunnings), and also uploading the documents to an external hard drive – and then keeping this in a safe location.

“If using the cloud, double check what sort of security the platform uses to protect your data online before uploading online. If nothing else, take a photograph of them on your phone,” she said.

3. Check and review your insurance

Benjamin distinguishes between two types of building insurance: total replacement cover, which covers the cost of rebuilding your home, or sum-insured cover, a popular option that covers your house to a set amount determined by you.

“Take care to make sure the amount selected is actually sufficient to rebuild your home,” she said.

According to the Insurance Council of Australia, more than 40 per cent of homes are underinsured, but there are ways to check if you’re insured adequately.

Note that many insurers won’t cover your home if it’s been unoccupied for more than 60 days, so look through Product Disclosure Statement documents carefully and understand what you are and aren’t covered for.

If your home is in danger of being destroyed by a bushfire, there is likely an embargo in place for your area. If you want to check up on your insurance cover, give your insurer a ring.

Read more: Bushfire insurance claims: Everything you need to know

Read more: How to make a bushfire insurance claim

But it’s a good idea to check all your insurance policies, not just home and contents policies, including life, income protection, health, motor vehicle, and even pet insurance, said Benjamin.

“Whether you own or rent your home, it's vital that your insurance covers the cost of replacing or repairing your valuable household items and possessions if they are damaged in a disaster. Keep written and visual records of any valuable items including laptops, phones, jewellery, artwork etc.”

Take pictures of valuables and note the cost and serial numbers of each item, and make use of free insurance calculators online to work out how much your items are worth, she said.

4. Pack an emergency bag

If a disaster hits, you won’t have lots of time to gather your most important things – so prepare one beforehand. This should contain important documents (passport, birth certificate, etc), medical prescriptions, copies of insurance cards policies, as well as bank cards and cash, since ATMs are known to be out of commission when power lines get cut.

For those affected by bushfires needing financial assistance, the government has made available emergency relief payments through the DisasterAssist website.

There is also free tax and legal help for bushfire-affected victims.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance