Finance Stocks Jul 26 Q2 Earnings Roster: CME, DFS, JEF, HLI

The second-quarter earnings season is gathering momentum with 87 members of the elite S&P 500 index having reported financial numbers so far. Per the latest Earnings Preview, performances of these index participants indicate a 20.9% increase in total earnings on 10.3% higher revenues. The beat ratio is impressive with 86.2% companies surpassing bottom-line expectations and 77% outperforming on the top-line front.

Earnings for the Finance sector (of the 16 Zacks sectors) are expected to grow 24.7% on 4.2% higher revenues per the Earnings Preview.

Following a solid first-quarter performance, the sector should have continued to benefit from the strengthening U.S. economy. However, concerns looming over the U.S.-China trade war and some other geo-political tensions induced volatility. Flattening of the yield curve raises a concern.

Rising interest rates, lowered tax incidence, a benign catastrophe environment, moderate improvement in lending and a strong labor market are expected to have favored the finance sector’s performance.

However, mortgage business is likely to have witnessed a slowdown due to slackened refinancing activities as interest rates improve.

Performance of equity markets remained favorable, evident from nearly 3% growth of the S&P 500 index. Increasing IPOs and follow-on offerings have possibly influenced strong equity issuances globally.

A lineup of 750 companies (175 S&P 500 members) was scheduled to announce earnings results this week. Let’s find out how the following insurers are placed prior to their quarterly releases on Jul 26.

CME Group CME has likely generated a better top line plus strength of higher clearing and transaction fees as well as access and communication fees. The exchange operator witnessed double-digit volume growth across five product lines in the second quarter. Also, the shutdown of London-based derivatives exchange and clearing house might lead to annual savings of $10-$12 million, which will primarily impact 2018. An estimated rise in expenses should have been driven, mainly by investments in several strategic initiatives.

The Zacks Consensus Estimate of $1.72 earnings per share for the yet-to-be-reported quarter reflects a 39.8% year-over-year surge. CME Group carries a Zacks Rank #3 (Hold), which increases the predictive power of ESP. However, the company’s Earnings ESP of 0.00% makes surprise prediction difficult.

(Read more: Can Higher Volumes Drive CME Group's Earnings in Q2?)

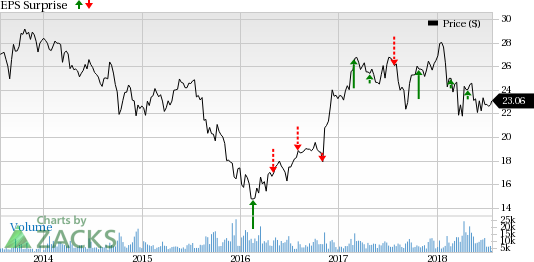

CME Group Inc. Price and EPS Surprise

CME Group Inc. Price and EPS Surprise | CME Group Inc. Quote

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Consistent growth in card sales should have added to Discover Financial Services’ DFS revenue base. A healthy U.S. economy might have aided the company’s personal and student loan, which in turn, should favor its top line. The rising rate environment must have driven its interest income. Given the company’s efficient operating model, the magnitude of its expenses is likely to remain lower than revenue growth, which should boost margins in the process.

The Zacks Consensus Estimate of $1.89 bottom line per share for the second quarter represents a 35% year-over-year increase. CME Group carries a Zacks Rank #2 (Buy), which increases the predictive power of ESP. However, combined with an Earnings ESP of -0.27%, the surprise prediction is left inconclusive as the company needs a positive ESP to be confident about a likely earnings beat.

(Read more: Can Card Sales Boost Discover Financials' Q2 Earnings?)

Discover Financial Services Price and EPS Surprise

Discover Financial Services Price and EPS Surprise | Discover Financial Services Quote

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Leucadia National Corporation’s JEF second-quarter earnings is pegged at $1.88, up 1,075% year over year. Though the company is a Zacks #2 Ranked player, its Earnings ESP of 0.00% makes surprise prediction difficult.

Leucadia National Corporation Price and EPS Surprise

Leucadia National Corporation Price and EPS Surprise | Leucadia National Corporation Quote

The Zacks Consensus Estimate for Houlihan Lokey, Inc.’s HLI fiscal second-quarter earnings stands at 61 cents, up 22% year over year. Though the company is a #2 Ranked player, its Earnings ESP of 0.00% makes surprise prediction difficult.

Houlihan Lokey, Inc. Price and EPS Surprise

Houlihan Lokey, Inc. Price and EPS Surprise | Houlihan Lokey, Inc. Quote

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Discover Financial Services (DFS) : Free Stock Analysis Report

Leucadia National Corporation (JEF) : Free Stock Analysis Report

Houlihan Lokey, Inc. (HLI) : Free Stock Analysis Report

CME Group Inc. (CME) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance