Finance Stock Q3 Earnings Roster for Oct 25: CME, DFS, JEF

The third-quarter earnings season has picked up pace with 84 members of the elite S&P 500 index having already reported financial numbers so far. Per the latest Earnings Preview, performances of these index participants indicate a 19.2% increase in total earnings on 8.4% higher revenues. The beat ratio is impressive with 82.1% companies surpassing bottom-line expectations and 61.9% outperforming on the top-line front.

Earnings for the Finance sector (of the 16 Zacks sectors) are expected to surge 35.4% on 3.2% revenue rise per the Earnings Preview. Of the 15.5% of companies that have already reported, earnings have improved 20% on 5.3% higher revenues, better than the S&P 500’s results.

Following a solid first-half performance, the Finance sector is expected to have consistently benefited from a strong U.S. economy as reflected through the already three rate hikes alone this year. Improving rates have likely dragged refinancing activities affecting mortgage business.

Also, flattening yield curve remains a concern.

Rising interest rates, benefits of a lowered tax rate, improving credit quality, improvement in lending as well as a sturdy labor market have possibly favored the finance sector’s performance. However, exposure to catastrophe loss might have weighed on insurers’ performance (integral to the Finance sector), property and casualty in particular.

Performance of equity markets remained positive, evident from about 7% growth of the S&P 500 index. Increasing IPOs and follow-on offerings have probably influenced equity issuances globally.

A line-up of 600 companies (154 S&P 500 members) was scheduled to announce earnings results this week.

Let’s find out how the following insurers are placed prior to their quarterly releases on Oct 25.

CME Group Inc. CME is anticipated to have witnessed an increase in clearing and transaction fees as well as improved access and communication fees. Further, this must have led to growth in the top line. Average daily volume was 15.6 million contracts in the third quarter, slipping 1% year over year as three product lines witnessed lower volume. Lower tax incidence should have supported the bottom line during the third quarter. An estimated rise in expenses could be mainly attributable to investments in several strategic initiatives.

The Zacks Consensus Estimate of $1.42 earnings per share for the yet-to-be-reported quarter reflects a 19.3% year-over-year rise. CME Group carries a Zacks Rank #3 (Hold), which increases the predictive power of ESP. However, the company’s Earnings ESP of 0.00% makes surprise prediction difficult.

(Read more: CME Group Q3 Earnings: What Lies Ahead for the Stock?)

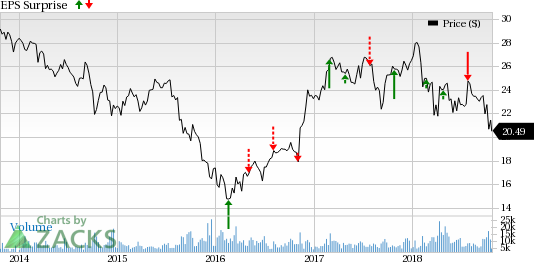

CME Group Inc. Price and EPS Surprise

CME Group Inc. Price and EPS Surprise | CME Group Inc. Quote

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Discover Financial Services’ DFS third-quarter earnings are likely to benefit from increase in revenues, driven by growth in receivables, particularly in the card business. Direct Banking business and Payment Services are expected to benefit from a strong U.S. economy. However, investments to develop new capabilities and drive growth are likely to result in higher operating expenses.

The Zacks Consensus Estimate of $2.09 bottom line per share for the third quarter represents a 28.9% year-over-year increase. Discover Financial carries a top Zacks Rank #2 (Buy) and an Earnings ESP of +0.23%, indicative of a likely positive surprise. Thus, this combination, makes us reasonably confident of an earnings beat this reporting cycle.

(Read more: Will Revenue Growth Aid Discover Financial Q3 Earnings?)

Discover Financial Services Price and EPS Surprise

Discover Financial Services Price and EPS Surprise | Discover Financial Services Quote

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Leucadia National Corporation’s JEF third-quarter earnings is pegged at 58 cents, up 114.8% year over year. The company has a Zacks Rank #5 (Strong Sell), which lowers the predictive power of ESP. Moreover, its Earnings ESP of 0.00% makes surprise prediction difficult.

Leucadia National Corporation Price and EPS Surprise

Leucadia National Corporation Price and EPS Surprise | Leucadia National Corporation Quote

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics.

Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Discover Financial Services (DFS) : Free Stock Analysis Report

Leucadia National Corporation (JEF) : Free Stock Analysis Report

CME Group Inc. (CME) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance