Royal Commission fallout continues: Finance and bank executives have wages slashed up to 11%

The banking Royal Commission hadn’t even wrapped up before the CEOs of all the big four banks saw their personal pay packets cop a haircut.

CBA CEO Matt Comyn gave up $653,000 in 2018, and Westpac CEO Brian Hartzer took home $600,000 less.

ANZ chief Shayne Elliott got $950,000 less in 2018 than he did in 2017, while Andrew Thorburn, then–CEO of NAB, copped the largest pay cut of all at $2.073 million.

But a new report released by the Governance Institute of Australia has found that the pay of finance executives across the board have suffered as a result of the banking Royal Commission.

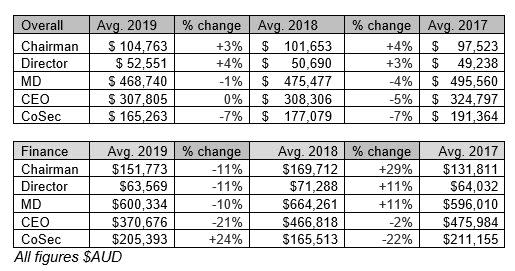

Paypackets for board chairs and directors across all industries and organisation types grew 3 per cent and 4 per cent respectively, according to the latest Australian Board Remuneration Survey report.

Related story: All the Big 4 bank CEOs have taken massive pay cuts

Related story: Bank bosses set to face even bigger pay cuts, watchdog warns

Related story: These finance jobs are GROWING in demand thanks to the Royal Commission

But when you drill down to the finance sector, the numbers look remarkably different.

Chairs and directors of financial and insurance companies saw an 11 per cent drop in their pay packets – but that’s following 11 per cent increases from the year before.

For chairmen, their $169,712 salary has gone down to $151,773 and directors who were paid $71,288 on average were paid $63,569 this year.

Managing directors similarly saw their pay packets reduced by 10 per cent (from $664,261 on average last year to $600,334), while unsurprisingly CEOs copped the biggest cut at 21 per cent (from $466,818 last year to $370,676).

But the Governance Institute pointed out that the cuts all follow “large increases” to pay for all these roles in 2017-2018.

“It is clear that the effects of the Banking Royal Commission are already being felt by Australia’s financial institutions, as shareholders and their boards move to act upon Commissioner Hayne’s recommendations,” said Governance Institute of Australia CEO Megan Motto.

The banking Royal Commission shed light on several cases of “poor corporate culture, poor ethics and risk management” that quickly led to a number of resignations from company board and executives, she added.

“Beyond that, there has been serious brand damage, hefty fines for poor conduct and, in some cases, criminal proceedings where the behaviour has been outright illegal,” Motto said.

“The customer was not put at the centre of the experience, and their organisations are paying the bill. That bill is of course then flowing down to board and executive remuneration.”

A risk management survey released last week by the Institute showed that the financial services industry is “extremely concerned” about the impact to regulation, brand damage and liability as a result of the banking Royal Commission fall-out.

“The leaders and boards of these organisations are seeing this reflected in their remuneration packages.”

Executives’ pay packets could get even slimmer: banking watchdog APRA has flagged it will be overhauling the way bank executives are paid.

While banking execs have seen their pay packets slimmed down, company secretaries of finance and insurance firms have seen their pay rise by 24 per cent (to $205,393) amid a 7 per cent drop across all organisations ($165,263).

The trust factor

Banks are left to pick up the pieces of a tarnished company image after being dragged through the dirt from the major inquiry.

It will have to pedal hard to regain customers’ trust, which won’t be an easy task.

Speaking at the World Business Forum in Sydney last week, US-based trust expert and best-selling author Stephen M. R. Covey indicated there was no shortcut to winning back trust.

“You can’t talk yourself out of a problem that you behaved yourself into,” he said last week.

“So think about that. If we lost trust through our behaviour, the only way to get it back is through our behaviour.”

The Ethics Centre executive director Dr Simon Longstaff said finance firms wouldn’t be able to fake their ethics for the purposes of improving their bottom line.

“If you do it for the dividend, you won’t get the dividend,” he said.

“It’s not a Pollyanna-world where every ethical decision is met with instant rewards. It’s a case of being ethical for its own sake. The rewards of trust only flow to the trustworthy.”

And it’s also not just the financial services sector that has taken a hit from the banking Royal Commission: trust in the real estate industry, the government as well as media fell.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, property and tech news.

Yahoo Finance

Yahoo Finance