FDA Delays Decision on Ascendis' (ASND) Hormone Therapy Filing

Shares of Ascendis Pharma ASND lost more than 5% on Tuesday after management announced that the FDA extended the review period for its regulatory filing for a hormone replacement therapy by an additional three months. A final decision is now expected by Aug 14, 2024.

The company’s filing seeks approval for TransCon PTH (palopegteriparatide) to treat adults with hypoparathyroidism, a rare condition in which the body produces abnormally low levels of parathyroid hormone (PTH). Low production of this hormone causes deficiencies of calcium and phosphorus compounds in the blood, resulting in muscular spasms.

The delay is on account of the additional data submitted by Ascendison the FDA’s request during the ongoing review of TransCon PTH. Per the agency, the information submitted by the company constitutes a ‘major amendment’ to the data filed in its earlier regulatory filing.

This filing is a resubmission that was accepted by the FDA last year in December. Little over a year ago, the agency had issued a complete response letter (CRL) to the company’s initial filing, citing a manufacturing issue and questioning the variability of delivered doses of the treatment for dose variability of the therapy. The FDA did not raise any concerns about clinical data in the CRL.

The FDA filing is supported by data from the phase III PaTHway and phase II PaTH Forward studies, which showed that treatment with TransCon PTH led to significant reductions in disease-specific physical and cognitive symptoms and significant improvements in their quality of life. Participants treated with the drug also achieved normalization of serum calcium and independence from conventional therapy.

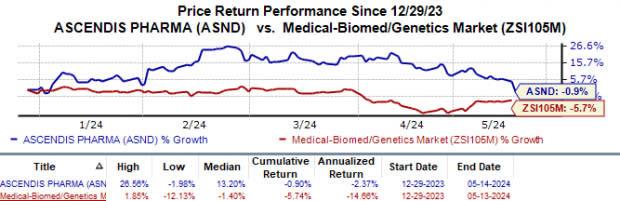

Year to date, Ascendis’ shares have declined 0.9% compared with the industry’s 5.7% fall.

Image Source: Zacks Investment Research

Last year in November, the European Commission granted marketing authorization to the therapy in chronic hypoparathyroidism, which is being marketed under the trade name Yorvipath. The therapy was commercially launched earlier this year in Europe and raked in €1.5 million in product sales. The therapy received a similar marketing approval for the drug in the United Kingdom last month.

Though not approved, the FDA allowed Ascendis to start an expanded access program (EAP) for TransCon PTH to treat eligible adults with hypoparathyroidismpreviously treated with PTH. Through an EAP, the FDA allows using an investigational drug like TransCon PTH in patients for treatment outside of clinical studies when no comparable or satisfactory alternative therapy options are available. This EAP remains open for enrollment for eligible patients.

Currently, Ascendis has only one marketed drug in its portfolio, Skytrofa (lonapegsomatropin), which was approved by the FDA in 2021 for treating growth hormone deficiency in children aged one year and older. A potential approval for TransCon could help the company diversify and expand its top line, which is currently solely dependent on one marketed product for revenues.

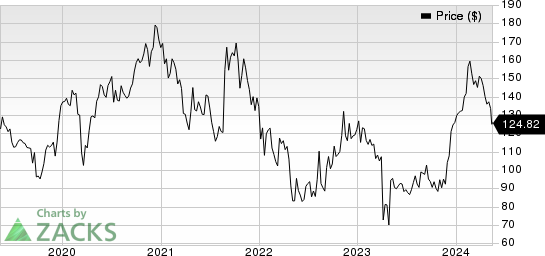

Ascendis Pharma A/S Price

Ascendis Pharma A/S price | Ascendis Pharma A/S Quote

Zacks Rank & Key Picks

Ascendis currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include ANI Pharmaceuticals ANIP, Ligand Pharmaceuticals LGND and Heron Therapeutics HRTX, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 earnings per share (EPS) have risen from $4.40 to $4.44. During the same period, EPS estimates for 2025 have improved from $5.01 to $5.04. Year to date, shares of ANIP have increased 19.8%.

Earnings of ANI Pharmaceuticals beat estimates in each of the last four quarters. ANI delivered a four-quarter average earnings surprise of 53.90%.

In the past 60 days, estimates for Ligand Pharmaceuticals’ 2024 EPS have risen from $4.42 to $4.56. During the same period, EPS estimates for 2025 have improved from $5.11 to $5.27. Year to date, LGND’s shares have appreciated 19.4%.

Earnings of Ligand Pharmaceuticals beat estimates in each of the last four quarters. Ligand delivered a four-quarter average earnings surprise of 56.02%.

In the past 60 days, estimates for Heron Therapeutics’ 2024 loss per share have improved from 22 cents to 14 cents. During the same period, loss estimates for 2025 have narrowed from 9 cents to 2 cents. Year to date, shares of HRTX have surged 65.3%.

Earnings of Heron Therapeutics beat estimates in three of the last four quarters while missing the mark on one occasion. HRTX delivered a four-quarter average earnings surprise of 30.33%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

Heron Therapeutics, Inc. (HRTX) : Free Stock Analysis Report

Ascendis Pharma A/S (ASND) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance