FATE To End Janssen Deal and Prioritize Pipeline Development

Fate Therapeutics, Inc. FATE announced that it has declined a proposal from Janssen Biotech, Inc., a Johnson & Johnson JNJ company, for the continuation of the collaboration and option agreement between the two on revised terms and conditions. Consequently, the agreement has been terminated and all collaboration activities will be wound down in the first quarter of 2023.

During the fourth quarter of 2022, the FDA approved an investigational new drug (IND) application for a first collaboration product for the treatment of B-cell lymphoma. FATE expects to receive a $3 million milestone payment for the same product. With the termination of the collaboration, Fate Therapeutics will wind down its activities with Janssen, including discontinuing the development of all collaboration products at the expense of Janssen.

In May, Johnson & Johnson’s Janssen exercised its commercial option on FT555, a multiplexed-engineered, iPSC-derived CAR NK cell product candidate targeting GPRC5D, a tumor-associated orphan G-protein-coupled receptor found to be highly expressed on myeloma cells. In September, Janssen exercised its commercial option for a second multiplexed-engineered, iPSC-derived CAR NK cell product candidate, which targets an undisclosed antigen expressed on certain blood cancers.

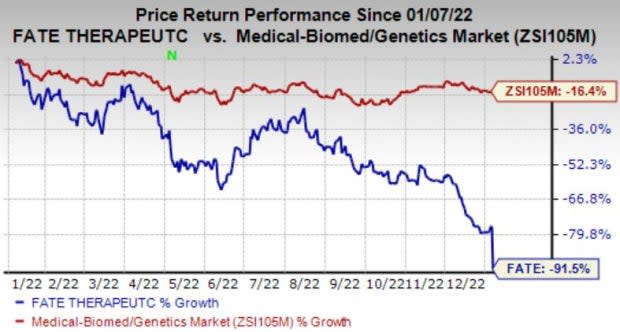

Shares of the company are down in pre-market trading on the news. Shares of Fate have declined 91.5% in the past year compared with the industry’s fall of 16.4%.

Image Source: Zacks Investment Research

Concurrently, Fate Therapeutics has also decided to advance its most innovative and differentiated programs, which have a multiplexed-engineered cellular framework of novel synthetic controls designed to promote multi-antigen targeting, increase potency, extend functional persistence, and enable patient dosing with reduced conditioning chemotherapy. The decision follows a strategic review.

This pipeline prioritization and expense reduction will provide a 3-year operational runway.

Fate ended the fourth quarter with approximately $475 million in cash, cash equivalents and receivables. Based on its pipeline prioritization and expense reduction efforts, Fate expects to have sufficient financial resources through the end of 2025 to capitalize on its iPSC-derived chimeric antigen receptor (CAR) NK and CAR T-cell programs.

Fate will reduce its headcount to approximately 220 employees in the first quarter of 2023. The company will discontinue clinical development of its FT516 and FT538 NK cell programs in acute myeloid leukemia, its FT516 and FT596 NK cell programs in B-cell lymphoma, and its FT538 and FT536 NK cell programs in solid tumors.

Fate intends to submit an investigational new drug (IND) application to the FDA in mid-2023 to commence a phase I study of its second-generation program in combination with CD20-targeted mAb therapy for the treatment of NHL, including without the administration of intensive conditioning chemotherapy to patients.

Fate Therapeutics, Inc. Price and Consensus

Fate Therapeutics, Inc. price-consensus-chart | Fate Therapeutics, Inc. Quote

The ongoing phase I study of the FT576 BCMA-targeted CAR NK cell program will accrue higher-dose, multi-dose treatment cohorts.

Among T-cell programs, the ongoing phase I study is assessing conventional single-dose and novel split-dose treatment schedules of FT819 to compare pharmacokinetics, safety, and efficacy.

Meanwhile, under the company’s collaboration with ONO Pharmaceutical Co., the companies are conducting IND-enabling activities for FT825/ONO-8250, a multiplexed-engineered, iPSC-derived CAR T-cell product candidate targeting human epidermal growth factor receptor 2 (HER2)-expressing solid tumors. The parties expect to submit an IND application to the FDA in 2023 to commence a phase I study of FT825/ONO-8250 for patients with HER2-positive solid tumors.

Zacks Rank & Other Stocks to Consider

Fate currently carries a Zacks Rank #2 (Buy). Some other top-ranked stocks in the biotech sector are Syndax Pharmaceuticals, Inc. SNDX and Immunocore Holdings plc IMCR. While Syndax carries a Zacks Rank #1 (Strong Buy), Immunocore carries the same rank as FATE. You can see the complete list of today’s Zacks #1 Rank stocks here.

Loss per share estimates for Syndax Pharmaceuticals for 2022 and 2023 have narrowed by 11 cents and 20 cents, respectively, over the past 60 days. Earnings of Syndax Pharmaceuticals surpassed estimates in three of the trailing four quarters and met the same on the other occasion. SNDX witnessed an earnings surprise of 95.39% on average.

Loss per share estimates for Immunocore have narrowed by 77 cents and 92 cents, respectively, in the past 60 days. Earnings of Immunocore surpassed estimates in three of the trailing four quarters and missed on the remaining occasion. IMCR witnessed an earnings surprise of 68.34% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Fate Therapeutics, Inc. (FATE) : Free Stock Analysis Report

Syndax Pharmaceuticals, Inc. (SNDX) : Free Stock Analysis Report

Immunocore Holdings PLC Sponsored ADR (IMCR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance