Factors Setting the Tone for Cree (CREE) in Q4 Earnings

Cree, Inc. CREE is scheduled to report fourth-quarter fiscal 2019 earnings results on Aug 20.

Notably, the company has surpassed the Zacks Consensus Estimate in the trailing four quarters, with an average positive earnings surprise of 45.28%.

Q3 Results Sneak-Peak

Cree had reported non-GAAP earnings of 20 cents per share in the third quarter of fiscal 2019, improving 17.6% year over year. Moreover, the figure surpassed the Zacks Consensus Estimate by 25%.

Revenues came in at $274.1 million, up 22% year over year. However, the figure lagged the Zacks Consensus Estimate of $275 million.

Guidance & Estimates for Q4

Cree was compelled to trim fiscal fourth-quarter outlook owing to addition of Huawei to the entity list. Markedly, in the fourth quarter of fiscal 2019, the company had anticipated revenues from products and materials in connection with Huawei’s wireless infrastructure to be up to $15 million, which remains a major concern.

Per the revised guidance, Cree anticipates fiscal fourth quarter revenues in the range of $245 million to $252 million. The Zacks Consensus Estimate is pegged at $248.34 million, suggesting a decline of 39.4% on a year-over-year basis.

Non-GAAP earnings have been forecast to be between 8 and 12 cents per share. The Zacks Consensus Estimate for earnings is pegged at 10 cents, indicating a decline of 9.1% from the year-ago quarter. Notably, the consensus has remained unchanged for the past 30 days.

Let’s see how things are shaping up prior to this announcement.

Factors Likely to Influence Q4 Results

Cree is expected to benefit from ongoing momentum in Wolfspeed business. The segment includes silicon carbide (or SiC) materials, power solutions and RF devices. Robust adoption of the company’s SiC, RF and Power solutions, primarily by automakers to accelerate deployment of electric vehicles (EVs) remains noteworthy.

During the quarter under review, Volkswagen Group selected Cree as silicon carbide partner for Volkswagen’s FAST (or Future Automotive Supply Tracks) Initiative. The company’s expertise in SiC technology will be utilized by the automaker to efficiently implement global vehicle projects.

Expanding clientele is infusing confidence in the stock. Shares of Cree have returned 33.7% year to date, outperforming the industry’s growth of 16.3%.

Moreover, during the to-be-reported quarter, Cree concluded the divestiture of Cree Lighting to IDEAL INDUSTRIES, with an aim to focus on RF power business.

Nonetheless, the company has been compelled to increase investment on product innovation to deal with stiff competition, from peers like Analog Devices ADI, Qorvo QRVO, among others. This is likely to hurt profitability.

In fact, during the quarter, the company announced plans to invest up to $1 billion to expand SiC capacity. The move is aimed at developing the state-of-the-art, automated 200 mm SiC fabrication facility and a materials mega factory at its headquarter in Durham, NC. With this increase in capacity, Cree aims to address the evolving requirements of 5G and electric vehicle markets by 2024.

Although, this investment favors the company’s growth prospects over the longer haul, it is likely to limit margin expansion in the near term.

Notably, for fourth-quarter fiscal 2019, the company projects Wolfspeed revenues to lie in the range of $132-$135 million. The Zacks Consensus Estimate for Wolfspeed revenues is pegged at $133 million, suggesting growth of 20.9% from year-ago reported figure.

Meanwhile, owing to uncertainty in macroeconomic conditions, management remains cautious and revised LED revenues outlook. For fourth-quarter fiscal 2019, Cree anticipates LED product revenues in the range of $113 million to $117 million. The Zacks Consensus Estimate for LED products revenues is pegged at $115 million, indicating year-over-year decline of 26.2%.

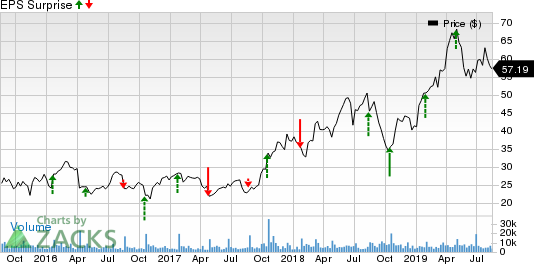

Cree, Inc. Price and EPS Surprise

Cree, Inc. price-eps-surprise | Cree, Inc. Quote

What Our Model Says

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. Sell-rated stocks (Zacks Rank #4 or 5) are best avoided.

Cree has a Zacks Rank #3 and an Earnings ESP of 0.00%, which makes surprise prediction difficult. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stock to Consider

Here is a stock you may consider, as our proven model shows that it has the right combination of elements to post an earnings beat this quarter.

The Cooper Companies, Inc. COO has an Earnings ESP of +1.50% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here. The company is scheduled to report third-quarter fiscal 2019 results on Aug 29.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Qorvo, Inc. (QRVO) : Free Stock Analysis Report

The Cooper Companies, Inc. (COO) : Free Stock Analysis Report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Cree, Inc. (CREE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance