Factors Likely to Set the Tone for Allstate's (ALL) Q1 Earnings

The Allstate Corporation ALL is scheduled to release first-quarter 2023 results on May 3, after the closing bell.

Q1 Estimates

The Zacks Consensus Estimate for Allstate’s first-quarter earnings per share is pegged at a loss of $1.70. Notably, earnings of $2.58 per share were reported in the prior-year quarter.

The consensus mark for revenues stands at $12,835 million, suggesting 1.8% growth from the year-ago quarter’s reported number. We project revenues to grow 1.9% year over year to $12,845.7 million.

Earnings Surprise History

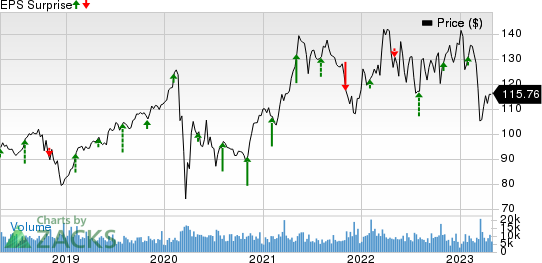

Allstate has a decent earnings surprise history. Its bottom line beat estimates in three of the trailing four quarters and missed the mark once, the average surprise being 8.38%. This is depicted in the chart below:

The Allstate Corporation Price and EPS Surprise

The Allstate Corporation price-eps-surprise | The Allstate Corporation Quote

Factors to Note

Revenues of Allstate are likely to have benefited on the back of improved premiums in the Property-Liability segment in the first quarter. Higher average premiums resulting from frequent rate increases in its auto insurance business coupled with policy growth in the homeowners’ insurance business are likely to have aided the Property-Liability segment. However, escalating loss costs resulting from persistent inflationary pressure are expected to have hurt both the auto and homeowners insurance businesses in the to-be-reported quarter.

The Zacks Consensus Estimate for first-quarter net premiums earned in the Property-Liability segment is pegged at $11,507 million, which indicates an improvement of 9.6% from the prior-year quarter’s reported figure.

ALL’s top line is expected to have received an impetus from the rising net investment income as a result of growing market-based investment income. This, in turn, is likely to have been aided by increased yields from fixed-income securities. The consensus mark for net investment income stands at $598 million, implying 0.7% growth from the year-ago quarter’s reported number.

However, the continued incidence of catastrophe losses is likely to have dampened the underwriting performance of Allstate in the first quarter. Management anticipates pre-tax catastrophe losses of $1.7 billion in the to-be-reported quarter.

Needless to say, softer underwriting results are expected to have led to a deteriorating combined ratio. The Zacks Consensus Estimate for the combined ratio of the Property-Liability segment is pegged at 103%, which hints toward a deterioration of 60 basis points from the year-ago quarter’s reading but stands lower than our consensus mark of 104.9%.

Improved Allstate Protection Plans and Allstate Dealer Services revenues might have contributed to the sound performance of the Protection Services segment of Allstate in the first quarter. The consensus mark for the adjusted net income of the segment stands at $46.2 million, higher than our estimate of $42 million.

Meanwhile, the Allstate Health and Benefits segment of ALL is likely to have gained on expanding premiums from group health products coupled with an improving benefit ratio in the to-be-reported quarter.

Despite prudent cost-curbing initiatives, margins of Allstate are expected to have suffered due to elevated property and casualty insurance claims and claims expenses in the first quarter.

What Our Quantitative Model Predicts

Our proven model does not conclusively predict an earnings beat for Allstate this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that’s not the case here, as you see below.

Earnings ESP: Allstate has an Earnings ESP of 0.00%. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Zacks Rank: ALL currently carries a Zacks Rank of 3.

Stocks to Consider

While an earnings beat looks uncertain for Allstate, here are some companies from the insurance space, which according to our model, have the right combination of elements to beat on earnings this time around:

Primerica, Inc. PRI has an Earnings ESP of +0.17% and a Zacks Rank of 1, currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for PRI’s first-quarter 2023 earnings is pegged at $3.45 per share, indicating a surge of 63.5% from the prior-year quarter’s reported figure.

The consensus mark for Primerica’s first-quarter earnings has been revised 1.5% north over the past 30 days.

ProAssurance Corporation PRA has an Earnings ESP of +41.89% and a Zacks Rank of 3, currently. The Zacks Consensus Estimate for PRA’s first-quarter 2023 earnings is pegged at 15 cents per share, suggesting 7.1% growth from the prior-year quarter’s reported figure.

ProAssurance’s earnings beat estimates in two of the trailing four quarters and missed the mark twice, the average surprise being 50.23%.

American Equity Investment Life Holding Company AEL has an Earnings ESP of +1.44% and a Zacks Rank of 3, currently. The Zacks Consensus Estimate for AEL’s first-quarter 2023 earnings is pegged at $1.09 per share, indicating an increase of 18.5% from the year-ago quarter’s reported figure.

American Equity’s bottom line beat estimates in two of the trailing four quarters and missed the mark twice, the average surprise being 5.26%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Allstate Corporation (ALL) : Free Stock Analysis Report

ProAssurance Corporation (PRA) : Free Stock Analysis Report

American Equity Investment Life Holding Company (AEL) : Free Stock Analysis Report

Primerica, Inc. (PRI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance