Factors Likely to Decide Macy's (M) Fate in Q3 Earnings

Macy's, Inc. M is scheduled to report third-quarter fiscal 2019 results on Nov 21, before the opening bell. In the last reported quarter, this department store retailer posted a negative earnings surprise of 37.8%. However, the company’s bottom line has outperformed the Zacks Consensus Estimate by 25% on average in the trailing four quarters.

The Zacks Consensus Estimate for third-quarter earnings has decreased by 50% in the past seven days and is currently pegged at 1 cent a share. This estimate suggests a sharp decline from 27 cents reported in the year-ago period. The Zacks Consensus Estimate for revenues currently stands at $5,310 million, indicating a decline of 1.7% from the year-ago quarter.

Key Factors to Note

In spite of taking a slew of measures, Macy’s continues to struggle with soft top-line performance. The company has been making every effort to adjust to rapidly changing retail landscape that has turned highly competitive with the increasing dominance of e-commerce players. This has compelled the company to strengthen digital ecosystem, and bolster shipping and delivery capabilities.

While these endeavors support sales, they entail high costs. Additionally, any deleverage in SG&A rate, and increased marketing and other store-related expenses are concerns. In fact, margins remain one of the key areas to watch out. In the last reported quarter, Macy’s stated that it resorted to markdowns to clear the excess inventory and enter Fall season with right size. However, this had weighed upon gross margin.

Nonetheless, Macy’s focus on price optimization, inventory management, merchandise planning and private label offering, and developing omni-channel capabilities and online order fulfillment centers bode well. Again, Macy’s Backstage locations, Vendor Direct, Store Pickup, Loyalty Program and Growth150 stores strategies remain primary growth drivers.

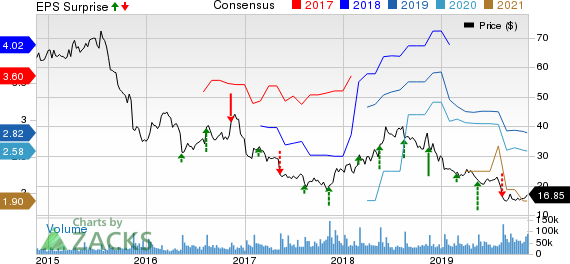

Macy's, Inc. Price, Consensus and EPS Surprise

Macy's, Inc. price-consensus-eps-surprise-chart | Macy's, Inc. Quote

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Macy’s this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Macy’s carries a Zacks Rank #4 (Sell) and Earnings ESP of -200%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Dollar General DG has an Earnings ESP of +2.34% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Burlington Stores BURL has an Earnings ESP of +2.75% and a Zacks Rank #2.

Tiffany TIF has an Earnings ESP of +3.49% and a Zacks Rank #3.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.5% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dollar General Corporation (DG) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

Tiffany & Co. (TIF) : Free Stock Analysis Report

Macy's, Inc. (M) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance