Factors to Know Ahead of Office Depot's (ODP) Q3 Earnings

Office Depot, Inc. ODP is slated to release third-quarter 2019 results on Nov 6. In the preceding four quarters, this provider of business services and supplies, products and technology solutions outperformed the Zacks Consensus Estimate by average of 19.4%. In the last reported quarter, the company delivered a positive earnings surprise of 40%.

The Zacks Consensus Estimate for third-quarter earnings is currently pegged at 14 cents, which indicates an improvement of 7.7% from the year-ago quarter figure. We note that the Zacks Consensus Estimate has remained stable in the past 30 days. The Zacks Consensus Estimate for revenues is pegged at $2,830 million, suggesting a decline of about 2% from the prior-year period.

Key Factors to Note

Office Depot has been focusing on business operating model, viable projects and cost structure, and making incremental investments to increase the revenue contribution from services. It has been concentrating on enhancing e-commerce platforms, increasing penetration into adjacent categories and providing innovative products. Cumulatively, these are likely to contribute to third-quarter results. Notably, the company’s Business Solutions Division has been a performing well, a trend that is likely to have continued in the third quarter.

However, softness across CompuCom and retail divisions has been a concern. We note that the company’s retail division has been witnessing dismal comparable-store sales for a while now. Persistence of such performance across both these divisions is likely to get reflected on the company’s top line number in the third quarter.

Nonetheless, the company’s bottom line is likely to benefit from Business Acceleration Program that involves reducing costs, improving operational efficiencies, enhancing service delivery, effective use of technology and automation and identifying strategic investment opportunities.

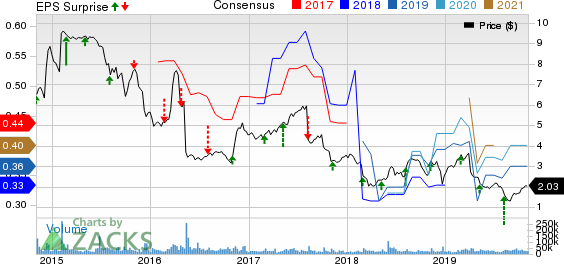

Office Depot, Inc. Price, Consensus and EPS Surprise

Office Depot, Inc. price-consensus-eps-surprise-chart | Office Depot, Inc. Quote

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Office Depot this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Office Depot carries a Zacks Rank #3 and an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With Favorable Combination

Here are companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Lowe's Companies LOW has an Earnings ESP of +1.25% and a Zacks Rank of #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

AutoZone AZO has an Earnings ESP of +0.77% and a Zacks Rank #3.

Target TGT has an Earnings ESP of +5.62% and a Zacks Rank #3.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AutoZone, Inc. (AZO) : Free Stock Analysis Report

Lowe's Companies, Inc. (LOW) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Office Depot, Inc. (ODP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance