Factors to Know Ahead of Capri Holdings' (CPRI) Q3 Earnings

Capri Holdings Limited CPRI is slated to release third-quarter fiscal 2020 results on Feb 5, before the market opens. In the last reported quarter, the company witnessed negative earnings surprise of 7.2%. This designer, marketer, distributor and retailer of branded apparel and accessories has a trailing four-quarter positive earnings surprise of 3.4%, on average.

The Zacks Consensus Estimate for third-quarter earnings stands at $1.61, suggesting a decline of 8.5% from the year-ago period. We note that the Zacks Consensus Estimate has remained stable in the last 30 days. The consensus estimates for revenues is pegged at $1,534 million, indicating an improvement of 6.7% from the year-ago quarter.

Key Factors to Note

Capri Holdings’ commitment toward deploying resources to expand product offerings, build “shop-in-shops”, and upgrading information system and distribution infrastructure is likely to get reflected in the top line in the to-be-reported quarter. Notably, the company has been expanding product mix beyond handbags into men’s, footwear and women’s ready to wear. Moreover, the company’s third-quarter results are anticipated to reflect gains from inventory management and focus on the e-commerce platform.

In the last earnings call, management guided mid-single digit growth in revenues for the third quarter revenues. This includes revenue contribution of about $180 million and $165 million from Versace and Jimmy Choo, respectively, and marginally below $1.2 billion from Michael Kors.

For a while now, revenues have been soft for Michael Kors, which accounts for a major portion of the company's top line. Nonetheless, Capri Holdings had forecast a low single-digit increase in comparable store sales for the brand. Further, management envisioned flat comparable store sales for Jimmy Choo and Versace brands.

We also note that costs associated with investments in e-commerce expansion, technological advancements and global infrastructure (including new store openings and international expansions) are likely to get reflected in margins, and consequently the bottom line in the third quarter.

Capri Holdings projected a decline of 450 basis points in operating margin to 17.5% for the third quarter. The company anticipates a contraction in Michael Kors brand operating margin. The company also guided earnings per share in the range of $1.55-$1.60 down from $1.76 reported in the year-ago period. The projection took into account dilution from Versace of about 15 cents.

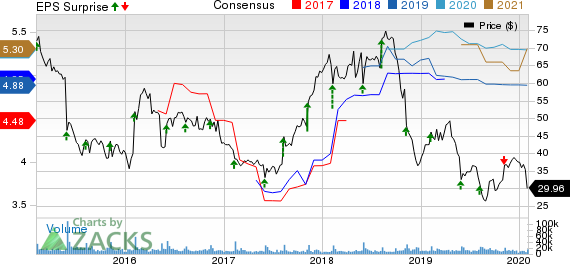

Capri Holdings Limited Price, Consensus and EPS Surprise

Capri Holdings Limited price-consensus-eps-surprise-chart | Capri Holdings Limited Quote

What the Zacks Model Unveils?

Our proven model does not conclusively predict an earnings beat for Capri Holdings this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Capri Holdings has a Zacks Rank #4 (Sell) and an Earnings ESP of -2.22%.

3 Stocks With Favorable Combination

Here are three companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Zumiez Inc. ZUMZ has an Earnings ESP of +0.24% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Gap GPS has an Earnings ESP of +5.43% and a Zacks Rank #2.

Nordstrom JWN has an Earnings ESP of +1.43% and a Zacks Rank #3.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

See 5 Stocks Set to Double>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Zumiez Inc. (ZUMZ) : Free Stock Analysis Report

Nordstrom, Inc. (JWN) : Free Stock Analysis Report

Capri Holdings Limited (CPRI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance