ExxonMobil (XOM) Projects $11B Upstream Earnings for Q2

Exxon Mobil Corporation XOM indicated that the escalating margins in fuel and crude sales could contribute a record profit to its first-quarter 2022 earnings.

The integrated energy giant expects its upstream business to generate a maximum of $3.3 billion in additional earnings in the second quarter sequentially. ExxonMobil expects operating profits from oil and gas operations of up to $11 billion, the highest for any quarter since 2017.

The company expects high oil and gas prices to boost earnings of its production business. It expects operating results in the second quarter from the oil and liquid businesses to reflect an improvement of $1-$1.4 billion from that reported in the March-end quarter of 2022. The improvement in natural gas prices is likely to have contributed $1.5-$1.9 billion to the upstream business’s profits.

ExxonMobil stated that the rising refining margins could result in $4.4-$4.6 billion of sequential improvement in earnings in the quarter. Moreover, the value of unsettled derivatives may have contributed an additional $700-$900 million. The margins in the company’s chemical and specialty product units are expected to have remained flat in the second quarter compared with the first quarter.

Although Russia’s invasion of Ukraine pushed commodity prices significantly higher, ExxonMobil expects the loss of Russia production to impact the second-quarter results by $100-$200 million. According to the latest filing, ExxonMobil implied a contribution of $200-$400 million from asset divestments in the second quarter.

Improving fuel demand and the skyrocketing commodity prices are likely to have aided the energy businesses in the second quarter. Per Zacks Earnings Trends, the energy sector is on track to generate $51.8 billion in earnings in the second quarter of this year, suggesting an improvement from $17.9 billion recorded in the prior-year quarter.

Company Profile & Price Performance

Headquartered in Irving, TX, ExxonMobil is one of the leading integrated energy companies in the world.

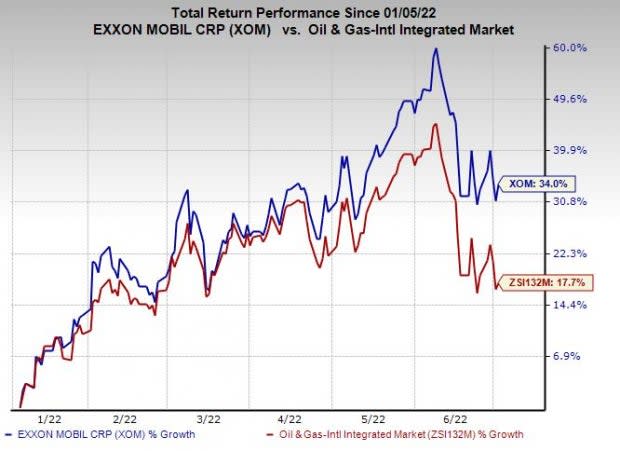

Shares of ExxonMobil have outperformed the industry in the past six months. The stock has gained 34% compared with the industry’s 17.7% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

ExxonMobil currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Matador Resources Company MTDR is a leading oil and gas explorer in the unconventional resources of the United States. MTDR has hedging deals for 2022 oil and gas production in place, which will help it navigate through any weak price environment.

Matador recently announced a quarterly cash dividend of 10 cents per share, which doubled from the previous cash dividend of 5 cents initiated last year. MTDR has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 60 days.

Imperial Oil Limited IMO is one of the largest integrated oil companies in Canada. IMO’s debt-to-capitalization of 18.9% is quite conservative versus 32.1% for the sub-industry to which it belongs.

Imperial Oil remains strongly committed to returning money to investors via dividends. The company’s board of directors approved a hike in the quarterly dividend payment. The new payout of 34 Canadian cents is 26% above the prior dividend. Further, Imperial Oil revised its existing share repurchase policy to buy up to 4% of outstanding common shares.

Range Resources Corporation RRC is among the top 10 natural gas producers in the United States. RRC expects the free cash flow to exceed $1.4 billion this year, which could be the highest among Appalachian players.

Range Resources reinstated its regular quarterly cash dividend, expected to start in the second half of this year. RRC anticipated its annual dividend rate at 32 cents per share. RRC’s board of directors approved a $500-million share repurchase program, which is likely to be funded with its free cash flow generation.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Range Resources Corporation (RRC) : Free Stock Analysis Report

Imperial Oil Limited (IMO) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance