Extended Stay (STAY) Q4 Earnings & Revenues Top Estimates

Extended Stay America, Inc. STAY reported impressive fourth-quarter 2020 results, wherein earnings and revenues beat the Zacks Consensus Estimate. The top line declined on a year-over-year basis, owing to a drop in comparable company-owned RevPAR due to the coronavirus outbreak. However, the bottom line improved from the year-ago quarter.

Nonetheless, the company witnessed a sequential improvement in RevPAR in each month of fourth-quarter 2020. In this regard, Extended Stay America’s president and CEO Bruce Haase stated, “Through last week, Extended Stay America has now had 65 consecutive weeks of RevPAR index gains dating back to well before the pandemic, demonstrating the growing strength of our model relative to the overall lodging industry.”

Following the results, shares of the company grew 0.3% during after-hour trading session on Feb 25.

Earnings & Revenue Discussion

During the fourth quarter, adjusted earnings per share of 16 cents not only beat the Zacks Consensus Estimate of 3 cents but also surged 14.3% from 14 cents reported in the prior-year quarter. The upside can be primarily attributed to an income tax benefit, decline in corporate overhead expense and a reduction in paired shares outstanding. However, this was partially offset by a decline in comparable system-wide RevPAR.

For the quarter under review, total revenues came in at $259.3 million, beating the consensus mark of $250 million by 3.7%. However, the top line declined 8.8% on a year-over-year basis primarily due to the negative impacts of COVID-19.

Comparable system-wide RevPAR of $42.46 fell 9.4% on a year-over-year basis owing to a 7.3% drop in average daily rate and a 170-basis point (bps) decrease in occupancy rate.

Meanwhile, comparable company-owned RevPAR fell 9.9% to $43.28 during the fourth quarter compared with $48.06 in the prior-year quarter.

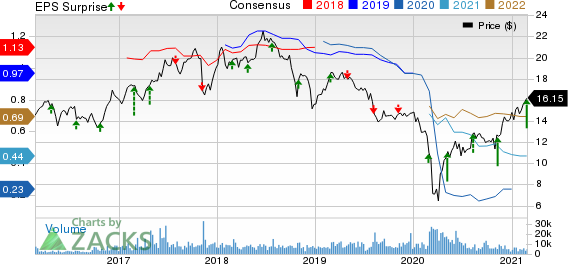

Extended Stay America, Inc. Price, Consensus and EPS Surprise

Extended Stay America, Inc. price-consensus-eps-surprise-chart | Extended Stay America, Inc. Quote

Operating Highlights

In the quarter under review, Extended Stay’s hotel operating margin came in at 42.5%, reflecting a decline of 580 bps from the prior-year quarter. The downside was primarily due to a fall in RevPAR (owing to the pandemic) as well as a rise in hotel operating expenses.

Adjusted EBITDA totaled $89.3 million, down 17.9% from the comparable year-ago period due to a decline in comparable system-wide RevPAR.

Balance Sheet

Cash and cash equivalents as of Dec 31, 2020, were $396.8 million compared with $346.8 million on Dec 31, 2019. At the end of the fourth quarter, total debt (net of unamortized deferred financing costs and debt discounts) amounted to $2,683.6 million, up from $2,639.8 million at 2019-end.

Extended Stay’s capital expenditures in the quarter under review came in at $47.7 million. Notably, renovation capital of $7.3 million and new hotel development capital of $13.9 million were included in the same.

Coming to share repurchases, the company did not repurchase any Paired Shares during the fourth quarter of 2020. As of Dec 31, 2020, total shares remaining under its share repurchase authorization were approximately $101.1 million.

Unit Developments

During the fourth quarter, the company opened two company-owned hotel and seven franchised hotels.

As of Dec 31, 2020, the company had a pipeline of 56 hotels out of which eight hotels were company-owned and 48 hotels were third-party related. Altogether, the hotels have approximately 6,800 rooms.

2020 Highlights

Total revenues in 2020 came in at $1,042.3 million, down 14.4% from $1218.2 million in 2019.

Adjusted EBITDA in 2020 came in at $374.1 million compared with $535 million in 2019.

Net income in 2020 was $96.3, down 41.7% from $165.1 million in 2019.

Adjusted earnings per share in 2020 came in at 37 cents compared with 95 cents in 2019.

2021 Outlook

For the first quarter of 2021, the company expects comparable system-wide RevPAR in the range of (6%) to (3%). Adjusted EBITDA is projected in the band of $78 to $84 million. Net loss for first quarter 2021 is expected in the range of $8 to $4 million.

For 2020, the company expects capital expenditures in the band of $155-$175 million and depreciation expenses between $202 million and $207 million. Net interest expenses are anticipated in the range of $126-$130 million. The company also expects effective tax rate between 10% and 12%.

Zacks Rank

Extended Stay — which shares space with Hyatt Hotels Corporation H, Hilton Worldwide Holdings Inc. HLT and Choice Hotels International, Inc. CHH in the Zacks Hotels and Motels industry — currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.9% per year. These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Extended Stay America, Inc. (STAY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance