Exploring Undervalued Small Caps With Insider Insights In Australia July 2024

The Australian market has shown robust growth, climbing 3.0% in the past week and achieving a 10% increase over the last twelve months, with earnings projected to grow by 14% per annum. In this context, identifying undervalued small-cap stocks can offer potential opportunities for investors looking to capitalize on companies with promising prospects yet to be fully recognized by the broader market.

Top 10 Undervalued Small Caps With Insider Buying In Australia

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Corporate Travel Management | 17.2x | 2.6x | 49.28% | ★★★★★★ |

Healius | NA | 0.6x | 41.53% | ★★★★★☆ |

Eagers Automotive | 9.7x | 0.3x | 33.32% | ★★★★☆☆ |

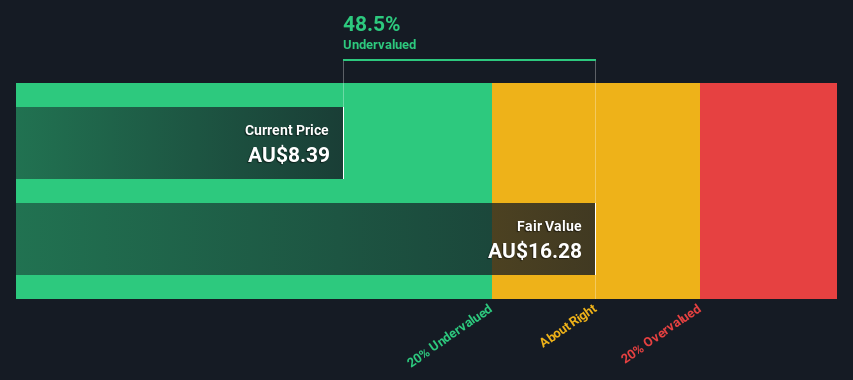

Elders | 23.0x | 0.5x | 43.25% | ★★★★☆☆ |

Codan | 29.1x | 4.3x | 26.95% | ★★★★☆☆ |

Strike Energy | 301.9x | 73.9x | 48.54% | ★★★★☆☆ |

Orora | 18.9x | 0.7x | 41.73% | ★★★★☆☆ |

RAM Essential Services Property Fund | NA | 5.9x | 37.41% | ★★★★☆☆ |

Dicker Data | 22.3x | 0.8x | -0.95% | ★★★☆☆☆ |

Coventry Group | 325.0x | 0.5x | -19.71% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Elders

Simply Wall St Value Rating: ★★★★☆☆

Overview: Elders is an Australian company involved in providing a range of services and products across branch network operations, wholesale products, feed and processing services, with a market capitalization of approximately A$1.47 billion.

Operations: Branch Network is the primary revenue contributor, generating A$2.54 billion, supplemented by Wholesale Products and Feed and Processing Services at A$341.19 million and A$120.14 million respectively. The company's gross profit margin has shown variability over recent periods, with a recent figure of 0.194% as of mid-2024, reflecting changes in cost of goods sold and operational efficiency.

PE: 23.0x

Elders, reflecting a mix of challenges and potential, recently reaffirmed its earnings guidance for FY 2024 with expected EBIT between A$120 million to A$140 million. Despite a significant drop in sales and net income in the first half of the year, insider confidence is evident as they recently purchased shares, signaling belief in long-term value. The company's reliance on external borrowing underscores a higher-risk financial structure but also points to possible growth avenues from strategic leadership additions like Damien Frawley starting July 2024.

Click here and access our complete valuation analysis report to understand the dynamics of Elders.

Evaluate Elders' historical performance by accessing our past performance report.

Neuren Pharmaceuticals

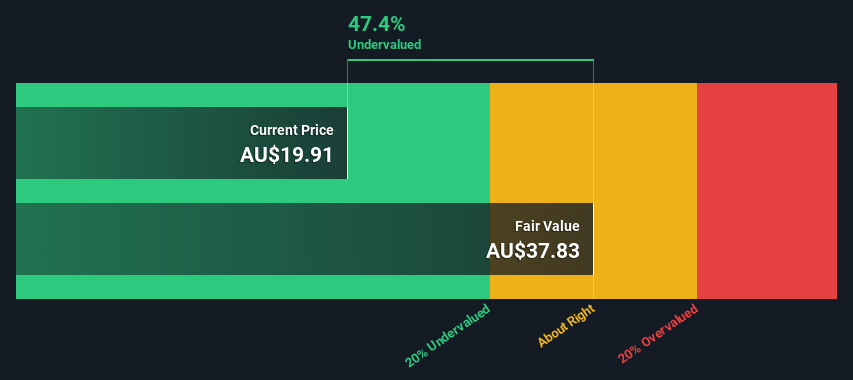

Simply Wall St Value Rating: ★★★★★☆

Overview: Neuren Pharmaceuticals is a company focused on the development of pharmaceutical products, specifically targeting neurological disorders, with a market capitalization of approximately A$231.94 million.

Operations: Pharmaceutical Products generated A$231.94 million in revenue, with a gross profit of A$205.19 million after accounting for COGS of A$26.75 million, leading to a gross profit margin of 88.47%.

PE: 16.9x

Neuren Pharmaceuticals, a notable player in the biopharmaceutical sector, recently showcased promising Phase 2 results for NNZ-2591 in treating Pitt Hopkins syndrome, with significant improvements noted across all primary efficacy measures. This progress underpins the stock's potential, further bolstered by insider confidence demonstrated through recent share purchases. With earnings expected to grow annually by 3.37%, Neuren's strategic positioning and innovative pipeline suggest a bright outlook, aligning with its undervalued status in the market.

Orora

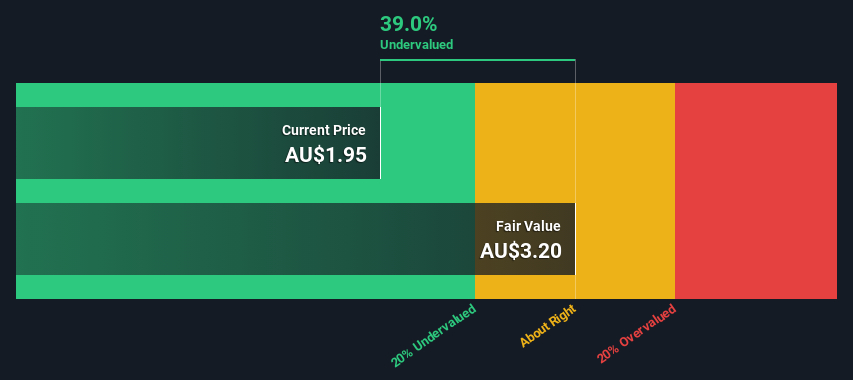

Simply Wall St Value Rating: ★★★★☆☆

Overview: Orora is a company specializing in packaging solutions, operating primarily across Australasia and North America with a market capitalization of approximately A$3.17 billion.

Operations: Australasia and North America are significant contributors to the company's revenue, generating A$1.03 billion and A$3.02 billion respectively. The gross profit margin has shown a trend of slight increase over recent periods, reaching 0.19% by the latest date recorded.

PE: 18.9x

Orora, a lesser-discussed player in the Australian market, recently saw insider confidence bolstered by significant share purchases. With earnings projected to climb 14.68% annually, this company stands out for its financial trajectory despite challenges like high-risk funding and substantial shareholder dilution over the past year. Their strategy avoids reliance on customer deposits, leaning instead on external borrowings—a testament to their unique market approach amidst evolving industry dynamics.

Delve into the full analysis valuation report here for a deeper understanding of Orora.

Explore historical data to track Orora's performance over time in our Past section.

Key Takeaways

Discover the full array of 21 Undervalued ASX Small Caps With Insider Buying right here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:ELD ASX:NEU and ASX:ORA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance