Exploring Undervalued Small Caps With Insider Action In Australia June 2024

Over the last 7 days, the Australian market has remained flat, though it has shown a robust increase of 9.9% over the past year with earnings forecasted to grow by 14% annually. In this context, identifying undervalued small-cap stocks with insider buying can be particularly compelling as these actions often signal confidence in the company's future prospects amidst current market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Australia

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Corporate Travel Management | 17.8x | 2.7x | 39.96% | ★★★★★★ |

Neuren Pharmaceuticals | 16.5x | 11.1x | 46.55% | ★★★★★★ |

Tabcorp Holdings | NA | 0.6x | 23.48% | ★★★★★☆ |

Codan | 27.6x | 4.0x | 24.75% | ★★★★☆☆ |

GUD Holdings | 14.7x | 1.5x | 2.71% | ★★★★☆☆ |

Eagers Automotive | 10.0x | 0.3x | 27.12% | ★★★★☆☆ |

Orora | 18.2x | 0.6x | 37.47% | ★★★★☆☆ |

Dicker Data | 21.3x | 0.8x | -0.40% | ★★★☆☆☆ |

Gold Road Resources | 15.5x | 3.8x | 46.20% | ★★★☆☆☆ |

Coventry Group | 268.4x | 0.4x | -22.67% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Eagers Automotive

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eagers Automotive is an automotive retailer primarily engaged in car retailing, with a market capitalization of approximately A$3.5 billion.

Operations: Car Retailing is the primary revenue generator, contributing A$9.85 billion, with a notable gross profit margin of 18.60%. Over recent periods, gross margins have shown slight fluctuations but remain under 19%, indicating consistency in cost management relative to sales.

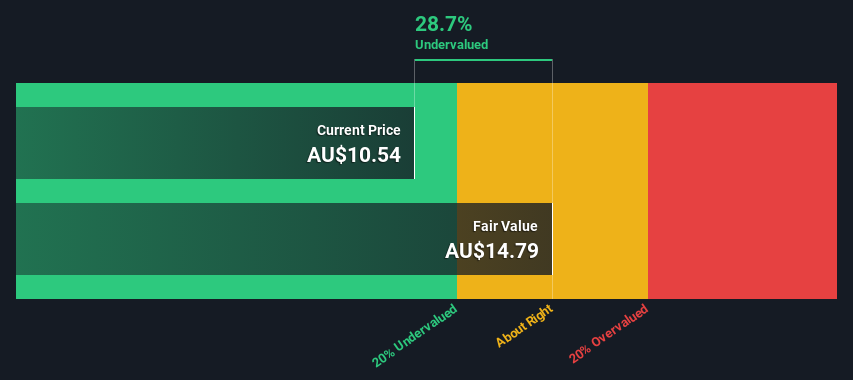

PE: 10.0x

Eagers Automotive, amid its strategic expansion, recently announced a significant share repurchase program, planning to buy back 10% of its shares by June 2025—a move reflecting strong insider confidence. Concurrently, the company is actively pursuing mergers and acquisitions to bolster its revenue, which is projected to grow annually. Despite a high debt level and reliance on external borrowing posing risks, these aggressive growth tactics coupled with insider purchases suggest a potentially underappreciated asset in the market.

GUD Holdings

Simply Wall St Value Rating: ★★★★☆☆

Overview: GUD Holdings is a diversified company that operates in the automotive and water products industries, with a market capitalization of approximately A$1.08 billion.

Operations: APG and Automotive segments collectively generated A$955.64 million in revenue, with the company achieving a gross profit margin of 43.53% by the end of the most recent fiscal period. The net income for this period was A$106.997 million, reflecting a net income margin of approximately 9.94%.

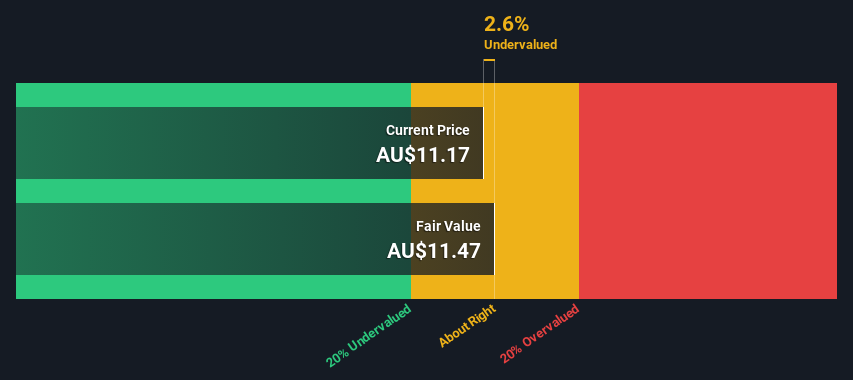

PE: 14.7x

GUD Holdings, a lesser-known entity in the Australian market, recently saw significant insider confidence with purchases reflecting a strong belief in the company's prospects. With earnings expected to grow by 6.51% annually, this financial trajectory suggests that GUD is priced below its potential market value. Notably, their funding relies entirely on external borrowing—considered riskier but also indicative of aggressive growth strategies. The firm will soon hold a special meeting to discuss a potential name change, signaling possible strategic shifts ahead.

Unlock comprehensive insights into our analysis of GUD Holdings stock in this valuation report.

Examine GUD Holdings' past performance report to understand how it has performed in the past.

NRW Holdings

Simply Wall St Value Rating: ★★★★☆☆

Overview: NRW Holdings is a diversified provider of mining and civil construction services with a market capitalization of approximately A$1.07 billion.

Operations: The company's revenue primarily derives from its mining segment, which generated A$1.49 billion, complemented by significant contributions from its MET and Civil segments at A$739.07 million and A$593.62 million respectively. Over the years, gross profit margin has shown a fluctuating trend with a notable figure of 47.41% in the latest recorded period.

PE: 16.1x

NRW Holdings, reflecting a promising trajectory with earnings expected to grow by 14.4% annually, recently saw insiders confidently increasing their stakes, signaling strong belief in the company's prospects. Despite relying solely on external borrowing—a riskier funding method—this reflects a strategic focus not deterred by conventional financing routes. This approach underlines NRW's potential as an attractively priced entity within Australia’s lesser-known investment opportunities, poised for noteworthy growth.

Make It Happen

Embark on your investment journey to our 26 Undervalued ASX Small Caps With Insider Buying selection here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:APE ASX:GUD and ASX:NWH.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance