Exploring Undervalued Small Caps With Insider Actions In The United States June 2024

As the United States grapples with mixed economic signals, evidenced by recent downturns in key indices like the S&P 500 and heightened concerns over housing and job markets, investors are navigating a complex landscape. In such an environment, exploring undervalued small-cap stocks with significant insider actions might offer unique opportunities for those looking to potentially capitalize on market inefficiencies.

Top 10 Undervalued Small Caps With Insider Buying In The United States

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

PCB Bancorp | 8.5x | 2.3x | 47.05% | ★★★★★☆ |

Columbus McKinnon | 21.6x | 1.0x | 41.56% | ★★★★★☆ |

Thryv Holdings | NA | 0.7x | 27.99% | ★★★★★☆ |

AtriCure | NA | 2.7x | 42.89% | ★★★★★☆ |

Hanover Bancorp | 8.7x | 2.0x | 48.43% | ★★★★☆☆ |

Franklin Financial Services | 9.2x | 1.9x | 37.34% | ★★★★☆☆ |

Chatham Lodging Trust | NA | 1.3x | 17.92% | ★★★★☆☆ |

Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Alta Equipment Group | NA | 0.2x | -168.33% | ★★★☆☆☆ |

Titan Machinery | 3.9x | 0.1x | -8.21% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

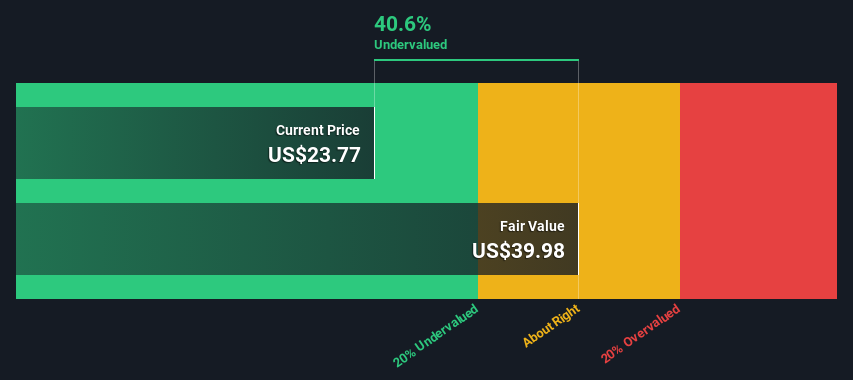

AtriCure

Simply Wall St Value Rating: ★★★★★☆

Overview: AtriCure is a medical device company specializing in surgical and medical equipment, with a market capitalization of approximately $2.41 billion.

Operations: Surgical & Medical Equipment generates a revenue of $414.60 million, with a gross profit margin consistently over 74%. Operating expenses for the latest period stand at $348.26 million.

PE: -29.8x

AtriCure, recently spotlighted at various healthcare conferences, has unveiled significant advancements with their cryoSPHERE®+ device, promising a 25% reduction in freeze times—a development that could enhance surgical efficiencies and patient outcomes. Despite a net loss of US$13.27 million in Q1 2024, the company projects robust revenue growth between 15% to 17%, reaching up to US$466 million for the year. This financial trajectory, coupled with insider confidence demonstrated by recent share purchases, underscores a potential rebound and growth phase for AtriCure amidst its innovative strides in medical technology.

Unlock comprehensive insights into our analysis of AtriCure stock in this valuation report.

Understand AtriCure's track record by examining our Past report.

Chimera Investment

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Chimera Investment operates by investing on a leveraged basis in a diversified portfolio of mortgage assets, with a market capitalization of approximately $2.07 billion.

Operations: The entity generates revenue primarily through investments in mortgage assets, with a reported gross profit of $260.12 million and a net income margin of 42.62% for the most recent fiscal quarter. Operating expenses for the same period were $54.35 million.

PE: 8.8x

Chimera Investment's recent 1-for-3 reverse stock split and a dividend increase to $0.35 per share reflect strategic adjustments amid its financial landscape. Despite a slight earnings forecast dip, the company remains intriguing due to insider confidence, evidenced by recent purchases, signaling potential undervalued status. With $65 million raised through fixed-income offerings and robust Q1 earnings growth, Chimera is navigating its challenges while maintaining shareholder value. These moves could hint at promising prospects for discerning investors looking beyond current volatility.

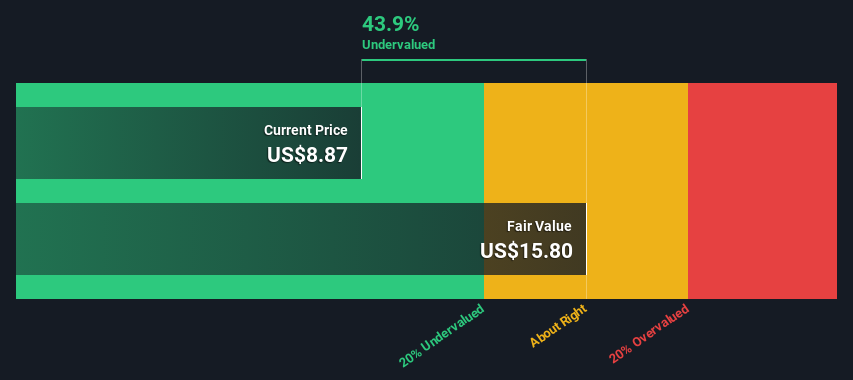

Enviri

Simply Wall St Value Rating: ★★★★★☆

Overview: Enviri operates primarily in environmental solutions, focusing on segments including Clean Earth and Harsco Environmental, with a market capitalization of approximately $1.21 billion.

Operations: The company generated a revenue of $2.11 billion in the latest quarter, with a gross profit margin of 21.29%. Over recent quarters, gross profit margins have shown fluctuations, highlighting variability in cost management relative to sales.

PE: -13.2x

Enviri, a discernibly undervalued entity within the niche of smaller companies, recently uplifted its yearly earnings outlook significantly, signaling robust operational improvements. Despite a net loss in Q1 2024, revenue surged to US$600.32 million from US$560.71 million year-over-year. Insider confidence is evident as they recently purchased shares, underscoring belief in the company's trajectory amidst external borrowing as its sole funding source—highlighting potential financial agility or risk. Enviri's presence at key industry conferences further showcases its strategic intent to fortify industry standing and investor relations.

Navigate through the intricacies of Enviri with our comprehensive valuation report here.

Examine Enviri's past performance report to understand how it has performed in the past.

Where To Now?

Unlock our comprehensive list of 60 Undervalued Small Caps With Insider Buying by clicking here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGM:ATRC NYSE:CIM and NYSE:NVRI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance