Exploring Top Dividend Stocks In Singapore May 2024

As of May 2024, the Singapore market continues to attract attention with its robust economic indicators and stable financial environment, fostering confidence among investors. Amidst this backdrop, dividend stocks remain a focal point for those seeking steady income streams in a landscape marked by ongoing global economic adjustments. In light of current market conditions, a good dividend stock typically combines reliable payouts with strong business fundamentals, making it an appealing choice for investors navigating through times of economic recalibration.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

Civmec (SGX:P9D) | 6.30% | ★★★★★★ |

Singapore Exchange (SGX:S68) | 3.68% | ★★★★★☆ |

Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | 3.80% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.87% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.55% | ★★★★★☆ |

BRC Asia (SGX:BEC) | 8.08% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 7.08% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.36% | ★★★★★☆ |

UMS Holdings (SGX:558) | 4.31% | ★★★★☆☆ |

Sing Investments & Finance (SGX:S35) | 6.19% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

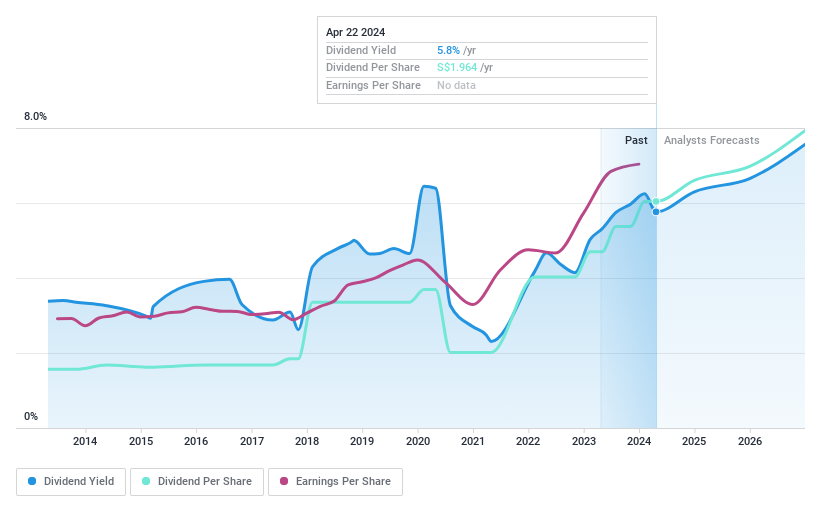

DBS Group Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DBS Group Holdings Ltd operates as a commercial bank offering financial services across Singapore, Hong Kong, Greater China, South and Southeast Asia, and globally, with a market capitalization of approximately SGD 102.19 billion.

Operations: DBS Group Holdings Ltd generates its revenue through commercial banking and financial services across various key regions including Singapore, Hong Kong, Greater China, South and Southeast Asia, and other international markets.

Dividend Yield: 5.5%

DBS Group Holdings recently proposed a dividend of S$0.54 per share for Q1 2024, maintaining consistency with the final dividend for 2023. Despite an unstable and unreliable track record over the past decade, dividends are currently supported by earnings with a payout ratio of 50.8%. However, DBS's dividend yield of 5.47% is below the top quartile in Singapore's market at 6.19%. The company’s earnings have grown by 16.7% over the past year, suggesting some potential for future stability in dividends.

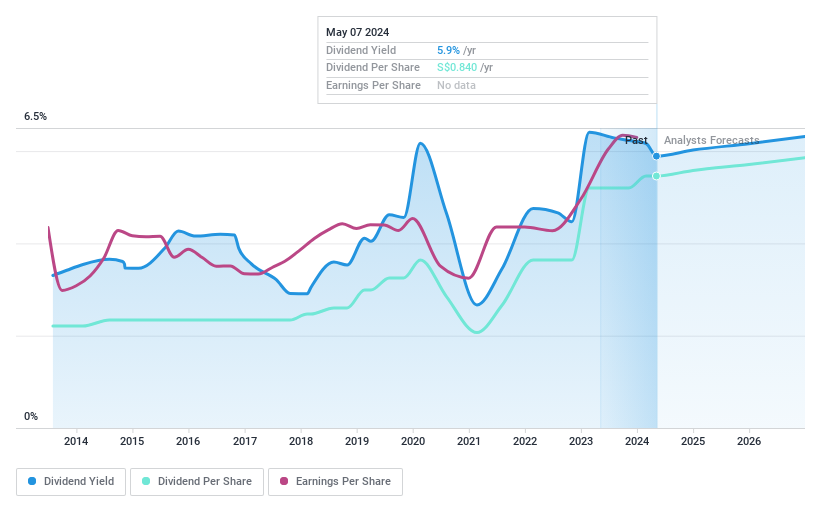

Oversea-Chinese Banking

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oversea-Chinese Banking Corporation Limited operates globally, providing financial services across Singapore, Malaysia, Indonesia, Greater China, and other Asia Pacific regions, with a market capitalization of approximately SGD 64.19 billion.

Operations: Oversea-Chinese Banking Corporation Limited generates revenue primarily through Global Wholesale Banking at SGD 5.59 billion, Global Consumer/Private Banking at SGD 5.06 billion, and Insurance at SGD 1.11 billion.

Dividend Yield: 5.9%

Oversea-Chinese Banking Corporation's dividends have shown volatility over the past decade, with a notable drop exceeding 20% annually at times. Despite this, recent earnings growth of 27.1% and a modest revenue forecast increase of 3.57% per year suggest some potential for stabilization. The dividend payments are reasonably covered by earnings with a current payout ratio of 52.9%, projected to slightly increase to 54.6% in three years, indicating ongoing coverage but not significant growth in dividend security. The recent fixed-income offerings totaling S$35 million could provide additional financial flexibility, although the bank's dividend yield at 5.89% remains below the top quartile benchmark of 6.19%.

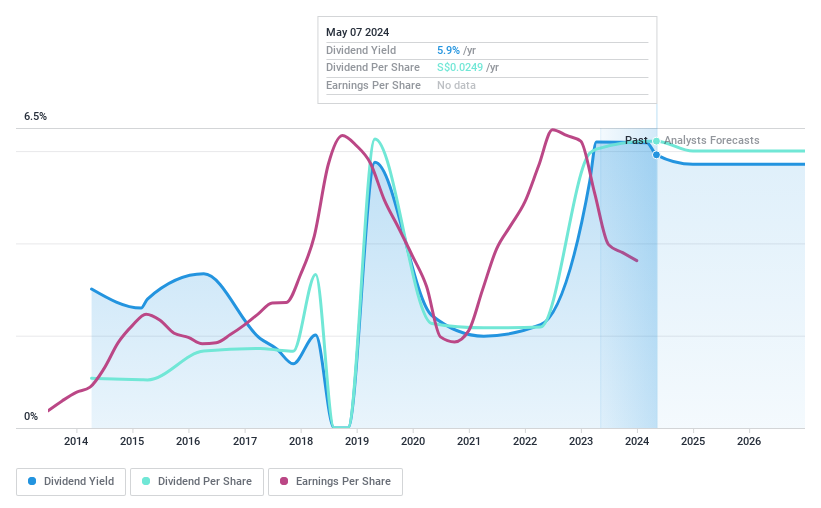

China Sunsine Chemical Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that produces and markets specialty chemicals across China, other parts of Asia, the United States, and Europe, with a market capitalization of SGD 402.10 million.

Operations: China Sunsine Chemical Holdings Ltd. generates revenue primarily through its Rubber Chemicals segment, which brought in CN¥4.38 billion, supplemented by smaller contributions from Heating Power and Waste Treatment segments totaling CN¥221.29 million and CN¥29.76 million respectively.

Dividend Yield: 5.9%

China Sunsine Chemical Holdings recently declared a final one-tier tax-exempt dividend of S$0.015 and a special dividend of S$0.01 per share for FY 2023, signaling potential appeal to dividend seekers despite its unstable historical payout record. The company's recent board reshuffles could impact governance and future financial strategies, essential for maintaining or improving its dividend distributions. However, its dividends are not among the highest in Singapore's market, with a yield lower than the top quartile of SGX-listed dividend payers.

Summing It All Up

Access the full spectrum of 21 Top Dividend Stocks by clicking on this link.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:D05 SGX:O39 and SGX:QES.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance