Exploring Top Dividend Stocks In Japan June 2024

As of June 2024, Japan's stock market presents a mixed landscape, with the Nikkei 225 experiencing slight declines while the broader TOPIX Index shows gains. This divergence underscores the nuanced dynamics at play in Japan's financial markets amidst ongoing monetary policy adjustments by the Bank of Japan and global economic shifts. In such an environment, identifying top dividend stocks requires a focus on companies with robust fundamentals and stable dividends, which can offer investors potential resilience against market volatility and uncertain economic conditions.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.76% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.67% | ★★★★★★ |

Mitsubishi Shokuhin (TSE:7451) | 3.63% | ★★★★★★ |

Globeride (TSE:7990) | 3.74% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.64% | ★★★★★★ |

Ryoyu Systems (TSE:4685) | 3.49% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 3.49% | ★★★★★★ |

Mitsubishi Research Institute (TSE:3636) | 3.44% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 4.91% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.19% | ★★★★★★ |

Click here to see the full list of 400 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

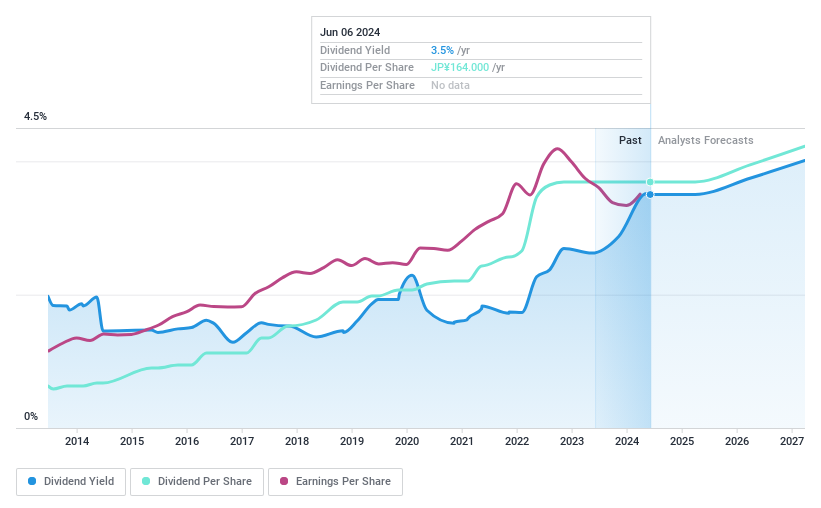

Nissan Chemical

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nissan Chemical Corporation operates in the chemicals, performance materials, agricultural chemicals, and pharmaceuticals sectors both in Japan and globally, with a market capitalization of approximately ¥647.18 billion.

Operations: Nissan Chemical Corporation generates revenue primarily through its trading (¥103.79 billion), chemical (¥35.56 billion), performance materials (¥84.57 billion), agricultural chemicals (¥82.11 billion), and healthcare businesses (¥6.30 billion).

Dividend Yield: 3.5%

Nissan Chemical has demonstrated a consistent dividend policy, maintaining stable dividends over the past decade with a recent affirmation of ¥94.00 per share for FY 2024. However, despite this reliability, the sustainability is questionable as dividends are not well covered by earnings or cash flows, indicated by a high cash payout ratio of 167.6%. Recent strategic moves include an expanded share buyback program to ¥10 billion and increased authorization up to 2.5 million shares, reflecting flexible capital management amid changing market conditions.

Dive into the specifics of Nissan Chemical here with our thorough dividend report.

Our valuation report unveils the possibility Nissan Chemical's shares may be trading at a premium.

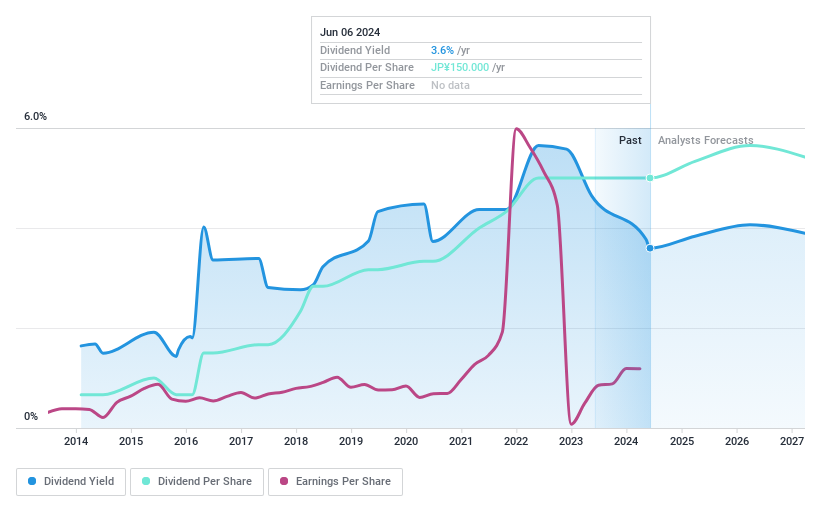

SBI Holdings

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SBI Holdings, Inc. operates primarily in online securities and investment sectors, with a market capitalization of approximately ¥1.26 trillion.

Operations: SBI Holdings, Inc. focuses on online securities and investments, achieving a market capitalization of roughly ¥1.26 trillion.

Dividend Yield: 3.6%

SBI Holdings offers a dividend yield of 3.6%, slightly above the Japanese market average, but its dividend history has been inconsistent over the past decade. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 47.4% and 3.5% respectively, suggesting financial stability in covering dividend payments. Recently, SBI announced a special commemorative dividend and continues to pursue strategic alliances that may influence future financial flexibility and growth opportunities in sectors like green hydrogen and desalination projects internationally.

Japan Transcity

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Japan Transcity Corporation operates in the logistics sector both domestically and internationally, with a market capitalization of approximately ¥58.97 billion.

Operations: Japan Transcity Corporation generates its revenue primarily through logistics services, both in Japan and globally.

Dividend Yield: 3.6%

Japan Transcity Corporation recently raised its dividend to JPY 7.00 per share and anticipates further increases, projecting dividends of JPY 16.50 and JPY 17.00 per share for upcoming quarters, reflecting a robust commitment to enhancing shareholder returns. Despite this positive trend in dividend growth, the company's financial health shows mixed signals; while the payout ratio is low at 17.9%, indicating sustainability from earnings, there are no free cash flows to support ongoing payments, which raises concerns about long-term sustainability amidst a volatile share price environment. Additionally, a recent buyback program aims to optimize capital structure by repurchasing shares worth up to JPY 1 billion by March 2025.

Unlock comprehensive insights into our analysis of Japan Transcity stock in this dividend report.

Our valuation report here indicates Japan Transcity may be overvalued.

Make It Happen

Delve into our full catalog of 400 Top Dividend Stocks here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:4021TSE:8473 and TSE:9310.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance