Exploring Three Top Undervalued Small Caps With Insider Action In The Region

Amid a relatively quiet week in global markets, U.S. small-cap stocks and tech sectors showed notable performance, outpacing their larger counterparts as investors adjusted positions ahead of quarterly earnings reports. This context sets an intriguing stage for exploring undervalued small-cap stocks, particularly those with recent insider actions suggesting potential under-the-radar value in these turbulent times.

Top 10 Undervalued Small Caps With Insider Buying

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Tokmanni Group Oyj | 16.7x | 0.5x | 39.47% | ★★★★★★ |

Nexus Industrial REIT | 2.4x | 3.0x | 20.97% | ★★★★★★ |

Guardian Capital Group | 10.4x | 4.0x | 32.47% | ★★★★☆☆ |

CVS Group | 20.4x | 1.1x | 43.29% | ★★★★☆☆ |

Sagicor Financial | 1.2x | 0.4x | -95.33% | ★★★★☆☆ |

Trican Well Service | 8.4x | 1.0x | -18.11% | ★★★☆☆☆ |

Papa John's International | 20.8x | 0.7x | 34.05% | ★★★☆☆☆ |

Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Freehold Royalties | 15.2x | 6.6x | 49.15% | ★★★☆☆☆ |

Alta Equipment Group | NA | 0.1x | -147.37% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Map Aktif Adiperkasa

Simply Wall St Value Rating: ★★★★☆☆

Overview: Map Aktif Adiperkasa operates in retail and non-retail sales, primarily in Indonesia, with a market capitalization of approximately IDR 12.80 billion.

Operations: Retail and non-retail sales generate a combined revenue of IDR 14.60 billion for the company, with a notable gross profit margin increase from 39.56% in late 2015 to 47.36% by mid-2024, reflecting improved cost management over the periods analyzed.

PE: 15.8x

Reflecting strong insider confidence, Miquel Staal recently acquired 3.7 million shares of Map Aktif Adiperkasa for IDR 2.96 billion, a move underscoring belief in the firm's potential despite its reliance on higher-risk external borrowing. With a significant increase in sales to IDR 3.69 billion and net income rising to IDR 281 million as reported in their latest quarterly results, the company shows promising growth prospects. This financial uplift aligns with an earnings forecast predicting an annual growth rate of 18.3%, positioning Map Aktif Adiperkasa as a compelling entity within its sector for those eyeing underappreciated market opportunities.

Kinetic Development Group

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kinetic Development Group is a company engaged in diverse business operations with a market capitalization of approximately CN¥1.23 billion.

Operations: The company's revenue has grown from CN¥102.90 million in 2013 to CN¥4745.07 million by the end of 2024, while gross profit margin improved significantly from 9.05% to 59.07% over the same period. This growth trajectory is marked by an increasing net income margin, which turned positive and expanded to 43.79% by the latest recorded date, reflecting enhanced profitability and operational efficiency.

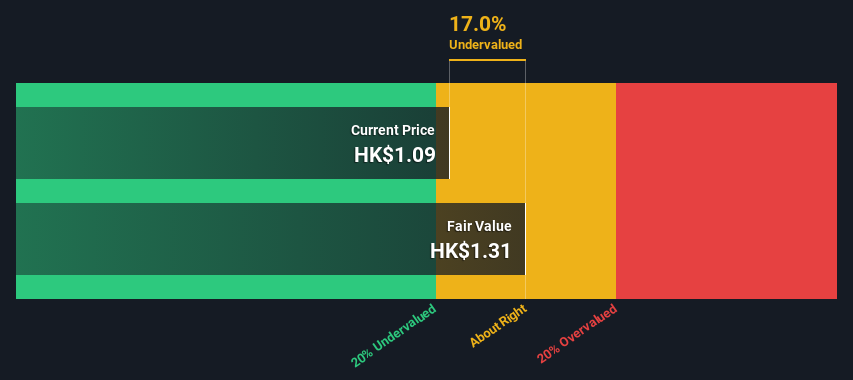

PE: 4.3x

Kinetic Development Group, reflecting a strategic stance in its sector, recently bolstered its governance framework and dividend policy amidst market fluctuations. On May 7, 2024, they revised their corporate bylaws to enhance operational flexibility and declared a modest HK$0.05 final dividend per share for the fiscal year ended December 31, 2023. Insider confidence is evident as they purchased shares recently, signaling belief in the company’s potential despite external funding risks highlighted in their financial structure. With these developments and upcoming Q1 results expected on May 31, Kinetic appears poised for interesting dynamics ahead.

Hammond Power Solutions

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hammond Power Solutions specializes in the manufacture and sale of transformers, with a market capitalization of approximately CA$120 million.

Operations: The company's gross profit margin has shown an increasing trend, reaching 32.49% in the most recent period, up from previous years. This improvement reflects a more efficient management of production costs relative to its revenue from the manufacture and sale of transformers, which totaled CA$729.61 million in the latest reporting period.

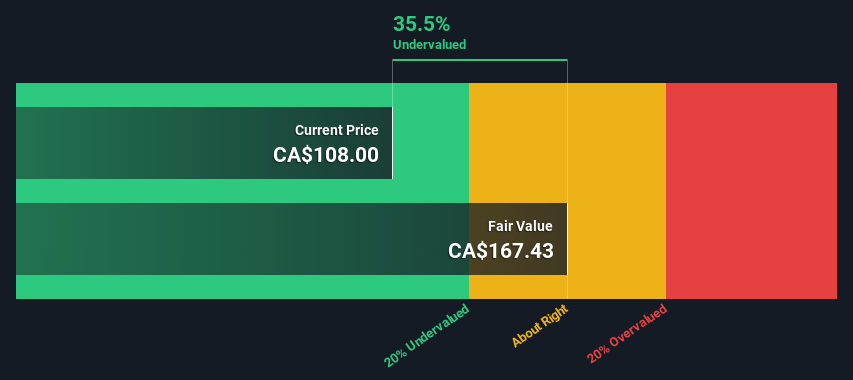

PE: 23.9x

Hammond Power Solutions, a lesser-known entity in the market, recently showcased its financial resilience despite a challenging quarter. With first-quarter sales rising to CAD 190.68 million from CAD 171.13 million year-over-year and net income at CAD 7.95 million, down from last year's CAD 15.73 million, the figures reflect a mixed financial health yet an upward trajectory in revenue. Insider confidence was evident as they recently purchased shares, signaling belief in long-term value despite current earnings volatility. The company's reliance on external borrowing underscores a higher risk yet necessary strategy for growth, expected to increase by 18.59% annually.

Click to explore a detailed breakdown of our findings in Hammond Power Solutions' valuation report.

Gain insights into Hammond Power Solutions' past trends and performance with our Past report.

Next Steps

Investigate our full lineup of 224 Undervalued Small Caps With Insider Buying right here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include IDX:MAPA SEHK:1277 and TSX:HPS.A.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance