Exploring Three Top Dividend Stocks On The TSX

As the Canadian market experiences a stabilization phase, with signs of economic recovery buoyed by rate cuts from the Bank of Canada, investors may find it prudent to consider dividend stocks. These stocks can offer potential steady income and stability in a portfolio, aligning well with the current environment where economic and employment conditions are normalizing.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.56% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.22% | ★★★★★★ |

Enghouse Systems (TSX:ENGH) | 3.58% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.45% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.31% | ★★★★★☆ |

Canadian Western Bank (TSX:CWB) | 5.51% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.88% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.42% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.34% | ★★★★★☆ |

Firm Capital Mortgage Investment (TSX:FC) | 9.13% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top TSX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

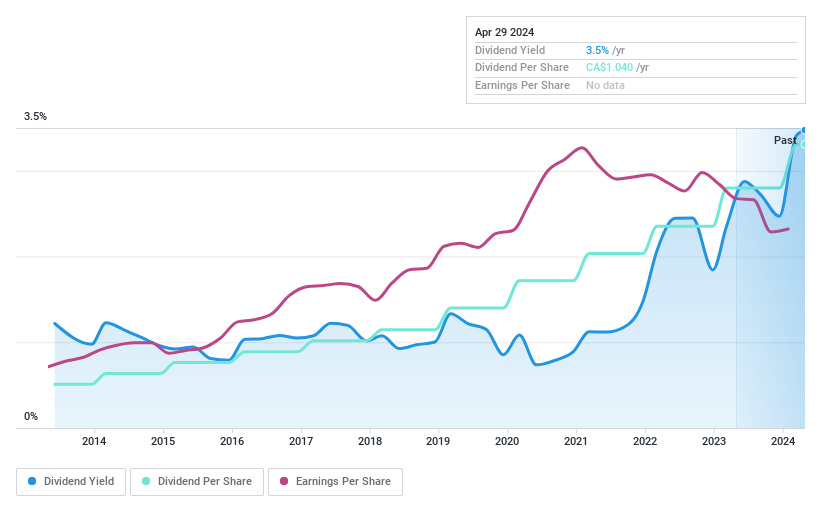

Enghouse Systems

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Enghouse Systems Limited operates globally, developing enterprise software solutions with a market capitalization of approximately CA$1.61 billion.

Operations: Enghouse Systems Limited generates its revenue through two primary segments: the Asset Management Group, which brought in CA$184.48 million, and the Interactive Management Group, with revenues of CA$283.60 million.

Dividend Yield: 3.6%

Enghouse Systems Limited, a Canadian firm, has shown a consistent commitment to returning value to shareholders through dividends and share repurchases. Recently, the company increased its quarterly dividend by 18.2% to CA$0.26 per share, reflecting confidence in its financial health and future prospects. Additionally, Enghouse announced a significant share buyback program targeting up to 5.41% of its outstanding shares for cancellation by May 2025. Despite a dividend yield (3.59%) below the top tier in Canada's market, the company supports these payouts with a stable earnings base and cash flows—evidenced by an earnings coverage ratio of 69.3% and cash payout ratio of 55%. These actions underscore Enghouse's strategy of shareholder value enhancement while maintaining fiscal prudence.

Get an in-depth perspective on Enghouse Systems' performance by reading our dividend report here.

Upon reviewing our latest valuation report, Enghouse Systems' share price might be too pessimistic.

North West

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The North West Company Inc. operates as a retailer offering food and everyday products and services in northern Canada, rural Alaska, the South Pacific, and the Caribbean, with a market cap of CA$2.06 billion.

Operations: The North West Company Inc. generates CA$2.50 billion in revenue from its retail operations across various geographical regions.

Dividend Yield: 3.6%

North West Company Inc. has consistently increased its dividend over the past decade, with a recent declaration of CA$0.39 per share for Q2 2024. The company's dividends are well-supported by earnings and cash flow, with a payout ratio of 55.2% and a cash payout ratio of 59.7%, indicating sustainability in its dividend payments. Despite a modest yield of 3.61%, which is below the top quartile for Canadian dividend payers, North West's reliable and growing dividends, coupled with a solid earnings growth of 15.8% year-over-year, reflect its steady financial performance and commitment to shareholder returns.

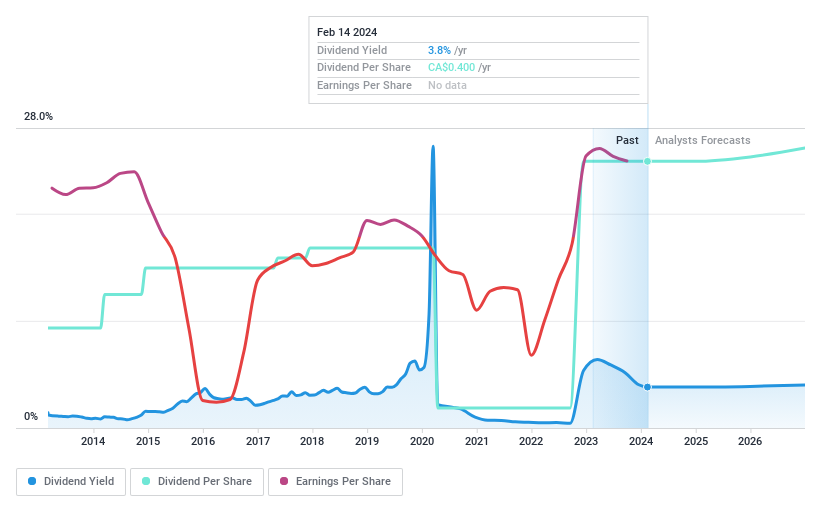

Secure Energy Services

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Secure Energy Services Inc. operates in waste management and energy infrastructure primarily in Canada and the United States, with a market capitalization of approximately CA$3.18 billion.

Operations: Secure Energy Services Inc. generates revenue through two main segments: Energy Infrastructure, which brought in CA$7.81 billion, and Environmental Waste Management (EWM), contributing CA$1.09 billion.

Dividend Yield: 3.3%

Secure Energy Services Inc. recently extended its $800 million credit facility until 2027, enhancing financial stability and supporting a low cost of capital. The company also executed a substantial issuer bid, repurchasing shares for $250 million, funded by existing facilities and cash on hand. Despite these positives, the dividend yield at 3.31% remains below the top quartile for Canadian stocks, and earnings are expected to decline by an average of 32.9% annually over the next three years.

Seize The Opportunity

Take a closer look at our Top TSX Dividend Stocks list of 32 companies by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:ENGHTSX:NWC TSX:SES and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance