Exploring Three Swedish Dividend Stocks In June 2024

As global markets navigate mixed signals, with some regions showing signs of economic slowing and others rebounding, Sweden's market remains a point of interest for investors looking for stability and yield. In this context, Swedish dividend stocks present an intriguing option for those seeking to balance growth with income in these fluctuating times. A good dividend stock typically offers not just a steady income stream but also the potential for capital appreciation. Given the current economic landscape, companies with robust financial health and a history of consistent dividend payouts are particularly appealing as they are better positioned to weather market volatility.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Betsson (OM:BETS B) | 6.18% | ★★★★★☆ |

Zinzino (OM:ZZ B) | 4.20% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.24% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.15% | ★★★★★☆ |

Axfood (OM:AXFO) | 3.11% | ★★★★★☆ |

Duni (OM:DUNI) | 4.72% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.49% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 7.85% | ★★★★★☆ |

Bilia (OM:BILI A) | 4.56% | ★★★★☆☆ |

Husqvarna (OM:HUSQ B) | 3.30% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

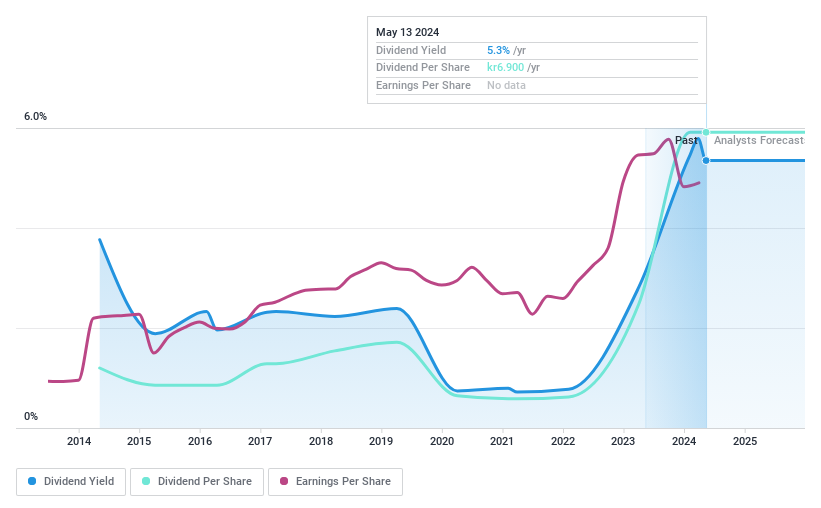

BioGaia

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BioGaia AB, a healthcare company based in Sweden, specializes in the development and distribution of probiotic products globally, with a market capitalization of approximately SEK 12.66 billion.

Operations: BioGaia AB generates revenue primarily through its Pediatrics and Adult Health segments, with reported revenues of SEK 999.84 million and SEK 293.44 million respectively.

Dividend Yield: 5.5%

BioGaia's recent strategic expansion into Australia and New Zealand, significant probiotic markets, aligns with its growth strategy. However, despite a slight increase in Q1 2024 earnings with sales reaching SEK 369.8 million and net income at SEK 121.85 million, the company faces challenges regarding dividend stability. BioGaia's dividend payments have shown volatility over the past decade and are not well-covered by cash flows, reflecting a high cash payout ratio of 215.5%.

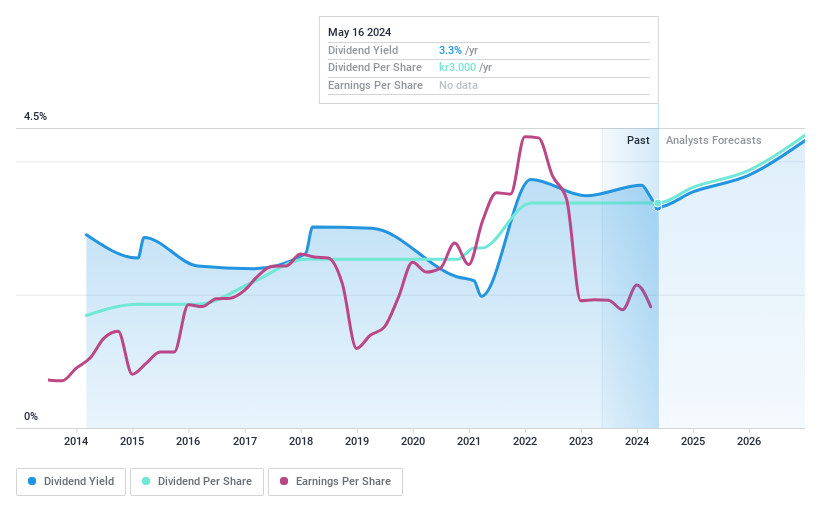

Husqvarna

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Husqvarna AB (publ) specializes in manufacturing and distributing outdoor power products, watering products, and lawn care equipment, with a market capitalization of approximately SEK 51.27 billion.

Operations: Husqvarna AB's revenue is primarily generated from three segments: Gardena at SEK 13.06 billion, Husqvarna Construction at SEK 8.23 billion, and Husqvarna Forest & Garden at SEK 29.38 billion.

Dividend Yield: 3.3%

Husqvarna's dividend yield of 3.3% trails behind the top Swedish dividend payers, and with a payout ratio of 92.8%, its dividends are poorly covered by earnings, signaling potential sustainability issues. However, dividends have been stable over the past decade and are reasonably covered by cash flows with a cash payout ratio of 58.6%. Recent executive changes and product innovations may impact future performance but have yet to influence dividend policies directly as evidenced by consistent payouts in recent AGMs.

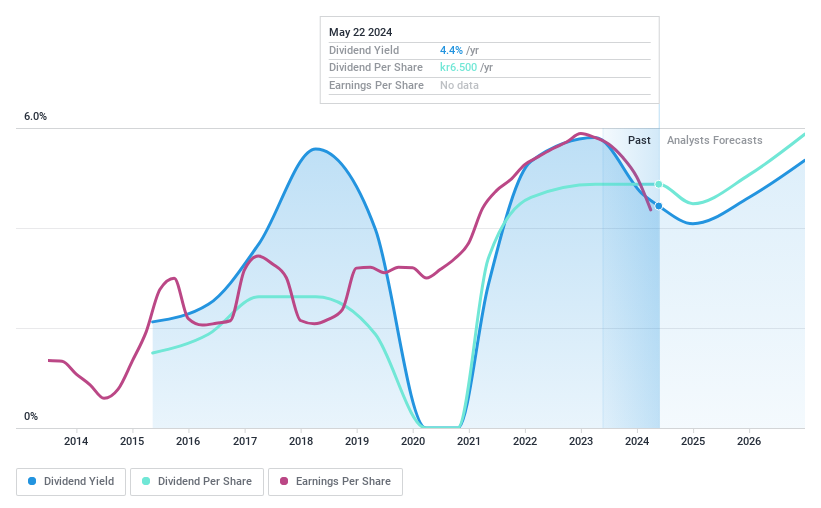

Inwido

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inwido AB (publ) specializes in the development, manufacturing, and sale of windows and doors through its subsidiaries, with a market capitalization of approximately SEK 8.44 billion.

Operations: Inwido AB generates its revenue from various regional segments, with Scandinavia contributing SEK 4.21 billion, Eastern Europe SEK 1.92 billion, Western Europe SEK 1.54 billion, and E-Commerce SEK 1.04 billion.

Dividend Yield: 4.3%

Inwido's dividend history, though only spanning 9 years, shows inconsistency with significant annual fluctuations exceeding 20%. Despite this, both earnings and cash flows substantiate the current dividend levels, with payout ratios of 63.9% and 62.8% respectively. Recent affirmations at the AGM on May 16, 2024, maintained a dividend of SEK 6.50 per share. However, a sharp decline in Q1 earnings from SEK 110.4 million to SEK 21.3 million year-over-year raises concerns about future sustainability amidst volatile payments.

Key Takeaways

Investigate our full lineup of 20 Top Dividend Stocks right here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:BIOG BOM:HUSQ B OM:INWI

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance