Exploring Three SEHK Growth Companies With Significant Insider Ownership

As global markets experience varied performance with technology stocks showing strong growth, the Hong Kong market remains a focal point for investors looking at Asia. In this context, exploring growth companies in the SEHK (Stock Exchange of Hong Kong) with high insider ownership could offer valuable insights, especially given current economic conditions where insider confidence might signal robust future prospects.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

Fenbi (SEHK:2469) | 32.4% | 43% |

DPC Dash (SEHK:1405) | 38.2% | 89.7% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.5% | 79.3% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 75.4% |

Beijing Airdoc Technology (SEHK:2251) | 28.2% | 83.9% |

Lianlian DigiTech (SEHK:2598) | 19.4% | 84.2% |

We'll examine a selection from our screener results.

Pacific Textiles Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pacific Textiles Holdings Limited is a company engaged in the manufacturing and trading of textile products, with a market capitalization of approximately HK$2.15 billion.

Operations: The company's primary revenue, amounting to HK$4.55 billion, is generated from the manufacturing and trading of textile products.

Insider Ownership: 11.2%

Earnings Growth Forecast: 33.7% p.a.

Pacific Textiles Holdings, despite a significant forecasted profit drop to HK$105.9 million in 2024, maintains strong growth prospects with expected revenue and earnings growth outpacing the Hong Kong market at 11.5% and 33.7% per year respectively. However, challenges persist with a recent decline in profit margins to 3.2% and low projected Return on Equity at 11.4%. Additionally, the company has secured a renewed agreement with Toray Group until 2027, ensuring continued business relations and stable revenue streams from fabric sales.

Zylox-Tonbridge Medical Technology

Simply Wall St Growth Rating: ★★★★★☆

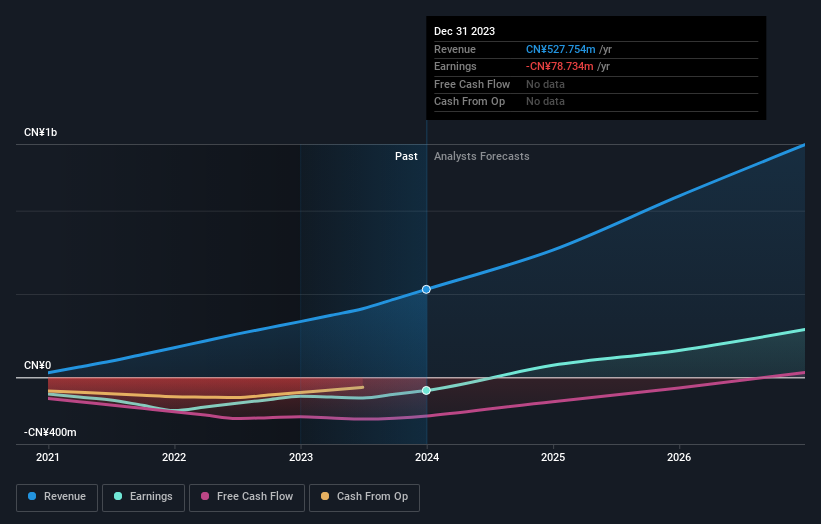

Overview: Zylox-Tonbridge Medical Technology Co., Ltd. is a medical device company specializing in neuro- and peripheral-vascular interventional products, operating both in the People's Republic of China and internationally, with a market capitalization of approximately HK$3.65 billion.

Operations: The company generates revenue primarily through the sale of neurovascular and peripheral-vascular interventional surgical devices, totaling CN¥527.75 million.

Insider Ownership: 18.5%

Earnings Growth Forecast: 79.3% p.a.

Zylox-Tonbridge Medical Technology, with substantial insider ownership, is poised for significant growth. The company's earnings are expected to increase notably, with a forecasted annual growth rate of 79.31%. Despite a modest earnings growth of 0.1% over the past five years, its future revenue growth at 24.1% per year outpaces the Hong Kong market significantly. However, its projected Return on Equity remains low at 7.6%. Recently approved marketing for ZYLOX Unicorn® Suture-mediated Closure System could further bolster its market position and drive domestic brand competitiveness in medical technology.

Adicon Holdings

Simply Wall St Growth Rating: ★★★★★☆

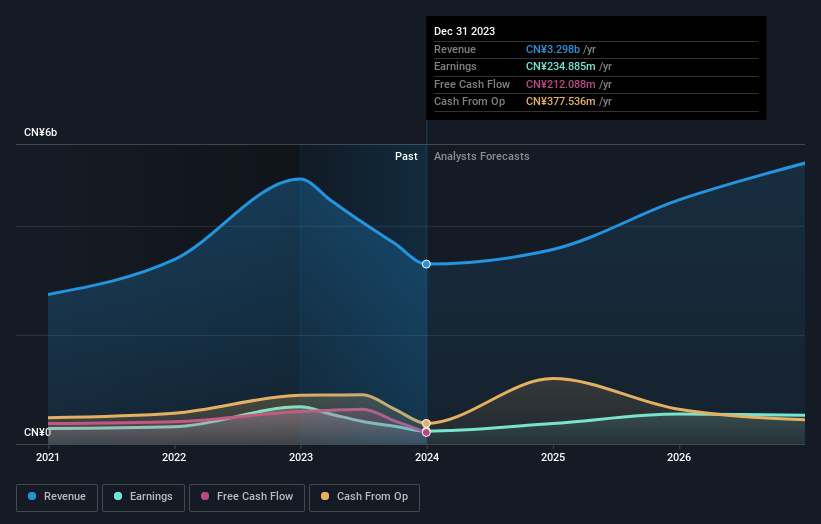

Overview: Adicon Holdings Limited, operating medical laboratories in the People’s Republic of China, has a market capitalization of approximately HK$6.05 billion.

Operations: The company generates revenue primarily from its healthcare facilities and services segment, totaling CN¥3.30 billion.

Insider Ownership: 22.3%

Earnings Growth Forecast: 29.6% p.a.

Adicon Holdings, a growth company with high insider ownership in Hong Kong, is navigating mixed financial waters. The firm recently initiated a substantial share repurchase program, signaling confidence from management despite a notable drop in annual sales and net income for the year ended December 31, 2023. While revenue growth projections (15.2% per year) lag behind some peers, earnings are expected to surge by 29.6% annually over the next three years, outpacing the local market's average. This forecasted profitability improvement alongside strategic board changes could enhance operational focus and market agility.

Click to explore a detailed breakdown of our findings in Adicon Holdings' earnings growth report.

Upon reviewing our latest valuation report, Adicon Holdings' share price might be too optimistic.

Taking Advantage

Click here to access our complete index of 51 Fast Growing SEHK Companies With High Insider Ownership.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1382 SEHK:2190 and SEHK:9860.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance