Exploring Ten Pao Group Holdings And Two More Leading Dividend Stocks

Amid a backdrop of fluctuating global markets, Hong Kong's Hang Seng Index has shown resilience, gaining 3.11% recently. This positive movement in the market underscores the importance of considering dividend stocks, which can offer investors potential income stability and growth opportunities in varying economic climates.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.10% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.07% | ★★★★★★ |

China Construction Bank (SEHK:939) | 7.35% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 9.16% | ★★★★★☆ |

Playmates Toys (SEHK:869) | 8.96% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.50% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.44% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.12% | ★★★★★☆ |

Lion Rock Group (SEHK:1127) | 7.38% | ★★★★★☆ |

China Overseas Grand Oceans Group (SEHK:81) | 7.43% | ★★★★★☆ |

Click here to see the full list of 89 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Ten Pao Group Holdings

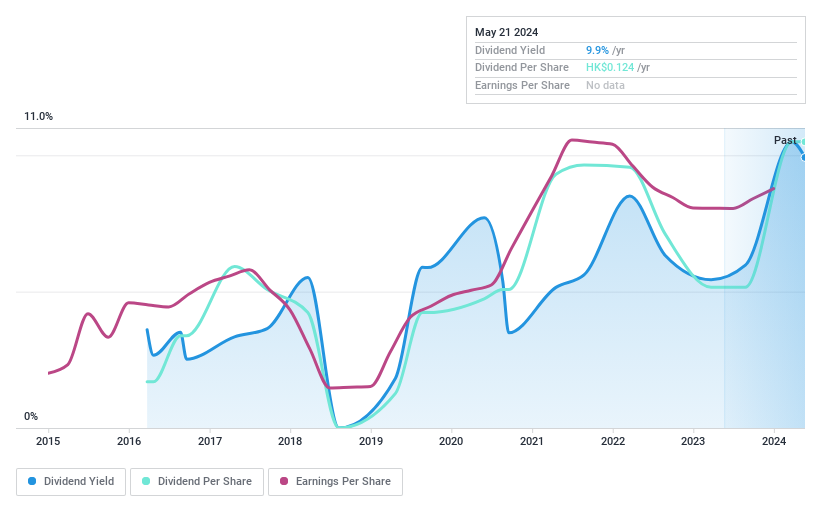

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ten Pao Group Holdings Limited operates as an investment holding company that develops, manufactures, and sells electric charging products across China, Asia, the US, Europe, Africa, and other international markets with a market capitalization of approximately HK$1.29 billion.

Operations: Ten Pao Group Holdings Limited generates its revenue primarily from Smart Chargers and Controllers (HK$1.67 billion), Telecommunication (HK$1.55 billion), New Energy Business (HK$0.76 billion), Lighting (HK$0.32 billion), and Media and Entertainment (HK$0.36 billion).

Dividend Yield: 9.9%

Ten Pao Group Holdings recently proposed a final ordinary dividend of HK$0.096 per share for FY 2023, reflecting a commitment to shareholder returns despite a drop in annual sales from HK$5.48 billion to HK$4.82 billion. The firm's net income, however, rose to HK$328.86 million from HK$296.9 million, supporting a basic EPS increase from HK$0.293 to HK$0.319. While the dividend track record is unstable with less than 10 years of payments and some volatility, the dividends are well-covered by earnings with a payout ratio of 38.9% and by cash flows at 72%.

Pak Fah Yeow International

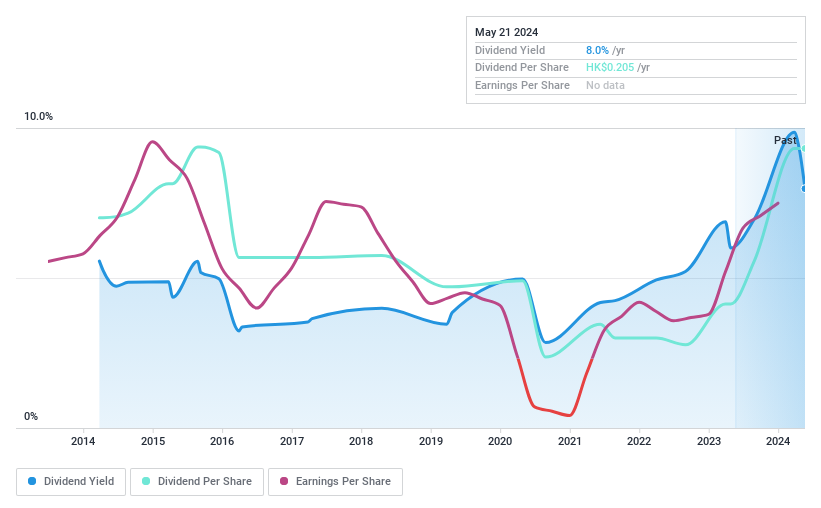

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Pak Fah Yeow International Limited, primarily operating under the Hoe Hin brand, is an investment holding company that manufactures, markets, and distributes healthcare products with a market capitalization of approximately HK$0.80 billion.

Operations: Pak Fah Yeow International Limited generates revenue primarily through its healthcare segment, which brought in HK$245.17 million, alongside smaller contributions from property investments and treasury investments totaling HK$9.61 million and HK$4.38 million respectively.

Dividend Yield: 8%

Pak Fah Yeow International Limited has demonstrated a strong financial performance with a significant increase in sales to HK$259.16 million and net income rising to HK$105.04 million for FY 2023. The company announced both a special final dividend of HK$0.082 and a regular dividend of HK$0.038 per share, signaling confidence in its profitability despite past dividend volatility. These dividends are well-supported by earnings, with a low payout ratio of 20.2%, and cash flows, evidenced by a cash payout ratio of 44.1%.

Bank of China

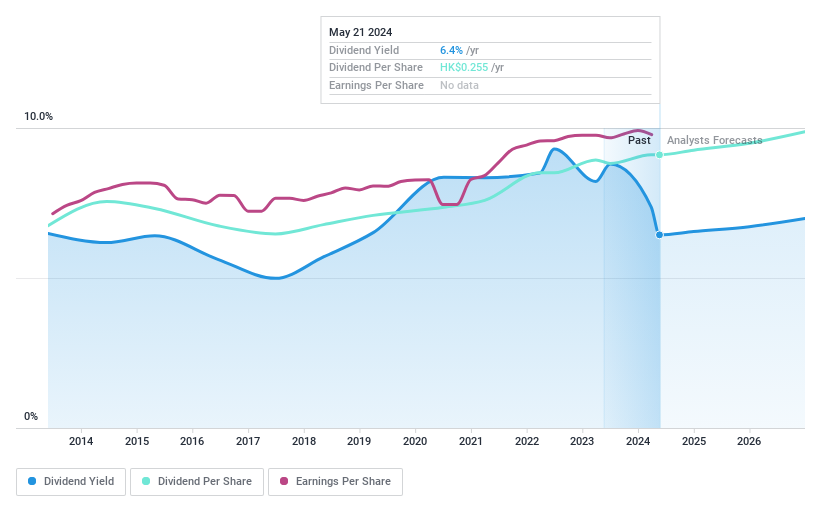

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of China Limited operates as a comprehensive international bank, offering a range of banking and financial services across Chinese Mainland, Hong Kong, Macao, Taiwan, and globally, with a market capitalization of approximately HK$1.36 trillion.

Operations: Bank of China Limited generates its revenue from diverse banking and financial services across Chinese Mainland, Hong Kong, Macao, Taiwan, and international markets.

Dividend Yield: 6.4%

Bank of China Limited has committed to a 2024 interim dividend, capped at 30% of H1 net profits, reflecting prudent profit distribution aligned with corporate governance standards. Recent executive shifts, including the resignation of Mr. Zhang Yi and appointment changes, could influence strategic directions but show no immediate shareholder concerns. The bank maintains a stable dividend history over the past decade with a current yield of 6.44%, though slightly lower than Hong Kong's top quartile payers. Dividends are well-covered by earnings with a payout ratio of 32.6%, ensuring sustainability amidst modest annual earnings growth projections of 3.86%.

Dive into the specifics of Bank of China here with our thorough dividend report.

Upon reviewing our latest valuation report, Bank of China's share price might be too pessimistic.

Next Steps

Navigate through the entire inventory of 89 Top Dividend Stocks here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1979 SEHK:239 and SEHK:3988.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance