Exploring Mitsui DM Sugar Holdings And Two Additional High Yield Dividend Stocks

As Japan's equity markets show resilience with the Nikkei 225 and TOPIX indices both posting gains despite economic headwinds, investors may find opportunities in high-yield dividend stocks. In a market environment where economic contraction and cautious monetary policy prevail, selecting stocks with robust dividend yields could be a prudent strategy for those seeking income alongside potential capital appreciation.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.43% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.57% | ★★★★★★ |

Globeride (TSE:7990) | 3.52% | ★★★★★★ |

Nihon Parkerizing (TSE:4095) | 3.33% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 3.49% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.46% | ★★★★★★ |

Ryoyu Systems (TSE:4685) | 3.45% | ★★★★★★ |

Mitsubishi Research Institute (TSE:3636) | 3.36% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.08% | ★★★★★★ |

Innotech (TSE:9880) | 4.01% | ★★★★★★ |

Click here to see the full list of 355 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Mitsui DM Sugar Holdings

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitsui DM Sugar Holdings Co., Ltd. is engaged in the manufacturing and selling of sugar and food materials primarily in Japan, with a market capitalization of approximately ¥103.75 billion.

Operations: Mitsui DM Sugar Holdings Co., Ltd. primarily generates its revenue from the production and sale of sugar and food materials within Japan.

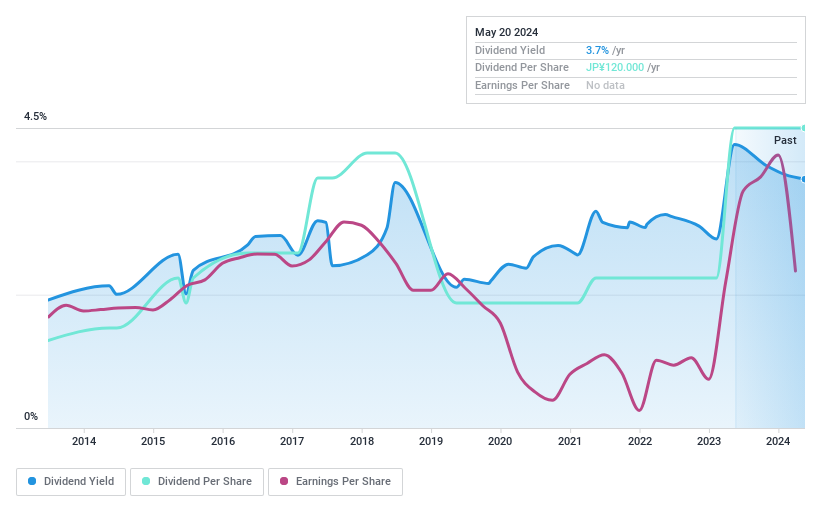

Dividend Yield: 3.7%

Mitsui DM Sugar Holdings offers a dividend yield of 3.73%, ranking in the top quartile of Japanese dividend payers. Despite a lower-than-average price-to-earnings ratio of 12.3x, the company's dividends have shown volatility over the past decade, with an unstable track record. However, both earnings and cash flows substantiate current payouts with payout ratios at 33% and cash payout ratios at 75.3%, respectively. Earnings growth has been robust, averaging 26.1% annually over the last five years.

Persol HoldingsLtd

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Persol Holdings Co., Ltd. operates globally, offering human resource services under the PERSOL brand, with a market capitalization of approximately ¥541.04 billion.

Operations: Persol Holdings Co., Ltd. specializes in providing diverse human resource services on a global scale.

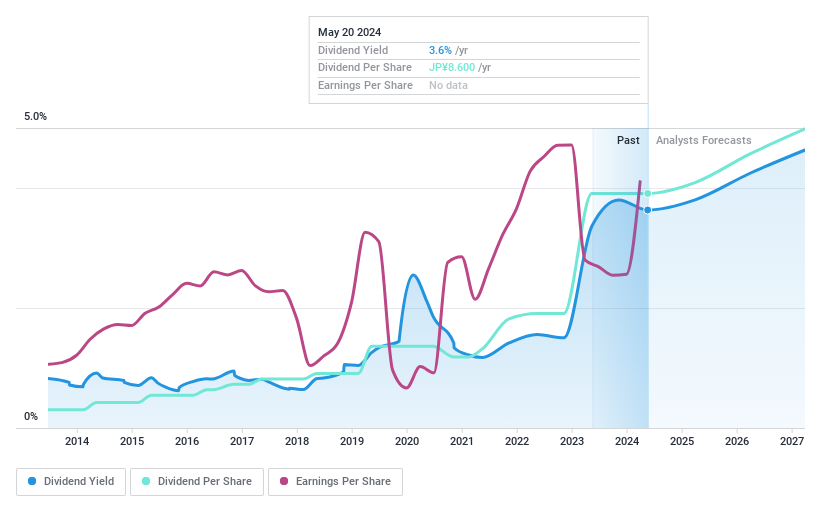

Dividend Yield: 3.6%

Persol Holdings Ltd. offers a dividend yield of 3.63%, placing it among the top 25% of Japanese dividend payers. Despite a high payout ratio of 101.2%, indicating dividends are not well covered by earnings, the cash payout ratio stands at a more manageable 31.6%. The company's dividends have increased over the past decade but have been marked by volatility and unreliability in their growth pattern. Recently, Persol announced a share buyback program worth ¥20 billion to repurchase up to 5.41% of its shares by March 2025, aiming to boost shareholder returns amidst earnings growth forecasts of 11.79% per year.

Fujitec

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fujitec Co., Ltd. specializes in the R&D, production, and servicing of elevators, escalators, and related systems across regions including Japan, East Asia, Europe, the Middle East, South Asia, South America, and North America; it has a market capitalization of approximately ¥332.41 billion.

Operations: Fujitec Co., Ltd. generates its revenue primarily from the design, production, and service of elevators and escalators across various global markets including Japan, East Asia, Europe, the Middle East, South Asia, South America, and North America.

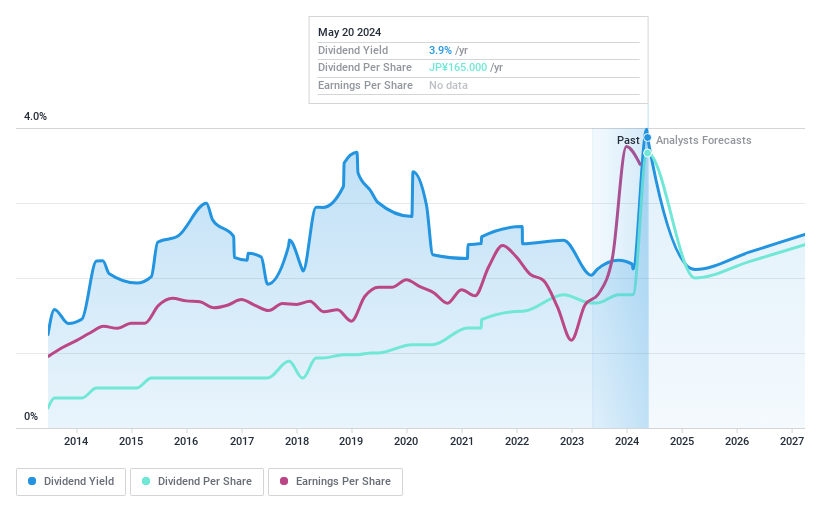

Dividend Yield: 3.9%

Fujitec Co., Ltd. has shown a complex dividend profile; while the dividend yield of 3.87% is competitive, ranking in the top quartile of Japanese stocks, its history reveals inconsistency with volatile payments over the last decade. Despite this, dividends are reasonably backed by both earnings and cash flows, with a payout ratio of 37.2% and a cash payout ratio of 65.4%. Recently, Fujitec announced an increase in its ordinary dividend to JPY 50 per share and a special dividend of JPY 70 per share for FY2024, signaling potential confidence in future financial stability.

Click to explore a detailed breakdown of our findings in Fujitec's dividend report.

Our valuation report unveils the possibility Fujitec's shares may be trading at a premium.

Where To Now?

Unlock our comprehensive list of 355 Top Dividend Stocks by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:2109 TSE:2181 and TSE:6406.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance