Exploring June 2024's Top Undervalued Small Caps With Insider Action

Amid a week of record highs for major indices like the S&P 500 and Nasdaq 100, U.S. stocks experienced a slight decline on Friday, reflecting broader market fluctuations and investor reactions to economic indicators. In this context, identifying undervalued small-cap stocks with insider action could offer potential opportunities for investors looking for growth in a cooling inflation environment.

Top 10 Undervalued Small Caps With Insider Buying In The United States

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Ramaco Resources | 11.5x | 0.9x | 26.44% | ★★★★★★ |

PCB Bancorp | 8.4x | 2.2x | 47.72% | ★★★★★☆ |

Leggett & Platt | NA | 0.3x | 21.16% | ★★★★★☆ |

Columbus McKinnon | 21.7x | 1.0x | 41.38% | ★★★★★☆ |

AtriCure | NA | 2.4x | 48.07% | ★★★★★☆ |

Chatham Lodging Trust | NA | 1.3x | 18.11% | ★★★★☆☆ |

Papa John's International | 20.7x | 0.7x | 31.21% | ★★★☆☆☆ |

Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Alta Equipment Group | NA | 0.1x | -162.51% | ★★★☆☆☆ |

Delek US Holdings | NA | 0.1x | -145.16% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

HomeTrust Bancshares

Simply Wall St Value Rating: ★★★★★☆

Overview: HomeTrust Bancshares operates as a community-oriented financial institution offering traditional banking services, with a market capitalization of approximately $183 million.

Operations: Banking operations generate a consistent gross profit margin of 100%, with the most recent net income margin reported at 33.35%. This sector saw revenues reaching $193.14 million, accompanied by operating expenses of $114.09 million and general administrative expenses of $91.11 million, highlighting a significant contribution to the company's financial structure without reliance on other segments or unallocated costs.

PE: 7.5x

HomeTrust Bancshares, recently bolstered by the appointment of tech veteran Charles Sivley as Chief Technology Officer, reflects a proactive approach in enhancing its technological backbone. Despite a forecasted earnings decline over the next three years, the company's consistent dividend payments and strategic insider confidence—highlighted by recent share repurchases totaling $15.61 million—underscore its potential resilience and adaptability in a challenging economic landscape. This blend of leadership renewal and financial maneuvers may position HomeTrust favorably for future growth opportunities within the undervalued sector.

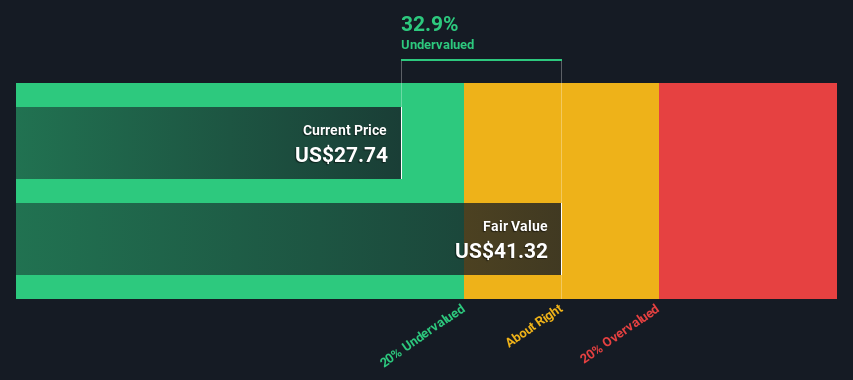

PennyMac Mortgage Investment Trust

Simply Wall St Value Rating: ★★★☆☆☆

Overview: PennyMac Mortgage Investment Trust is a real estate finance company that primarily invests in residential mortgage loans and mortgage-related assets, with a market capitalization of approximately $1.22 billion.

Operations: The entity generates revenue primarily through interest rate sensitive strategies, correspondent production, and credit sensitive strategies, with significant contributions from corporate operations. Over recent periods, it has experienced a gross profit margin as high as 83.18% in the latest quarter of 2024, reflecting its ability to manage costs effectively relative to revenue generation.

PE: 8.3x

PennyMac Mortgage Investment Trust, a notable entity among undervalued entities, recently announced a $200 million follow-on equity offering and shelf registration for various securities. Despite operating with high debt levels and reliance on external borrowing—a riskier funding structure—insider confidence remains robust as evidenced by recent share purchases. The trust consistently rewards shareholders, maintaining a quarterly dividend of $0.40 per share. With new trustee SiSi Pouraghabagher enhancing governance, PennyMac stands poised for strategic advancements amidst financial challenges.

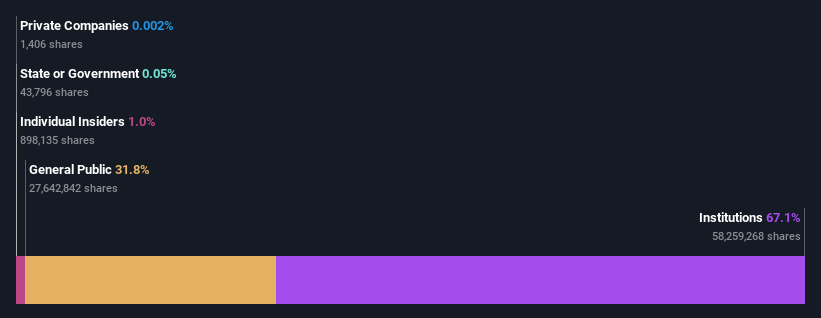

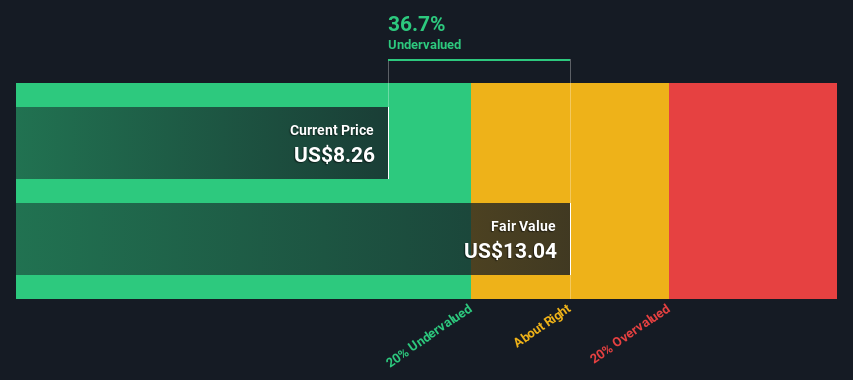

Ready Capital

Simply Wall St Value Rating: ★★★★★☆

Overview: Ready Capital is a real estate finance company that specializes in small business lending and lower middle market commercial real estate, with a market capitalization of approximately $1.07 billion.

Operations: The company has experienced a notable increase in gross profit margin, escalating from 9.58% in late 2013 to 85.36% by mid-2024, reflecting significant improvements in cost management and revenue generation efficiency. Over the same period, net income margin also showed substantial growth, starting at approximately 4.83% and reaching a high of 71.07%.

PE: 6.3x

Recently, Ready Capital has demonstrated insider confidence with substantial share purchases, notably acquiring 3.74 million shares for US$32.72 million by April 2024, reflecting a strong belief in the company's potential despite its challenging financial landscape marked by a significant first-quarter loss of US$74.28 million. These strategic moves coincide with ongoing dividends and active participation in key industry events, suggesting a robust strategy to stabilize and potentially enhance shareholder value amidst revenue forecasts projecting significant growth.

Click to explore a detailed breakdown of our findings in Ready Capital's valuation report.

Gain insights into Ready Capital's historical performance by reviewing our past performance report.

Next Steps

Dive into all 60 of the Undervalued Small Caps With Insider Buying we have identified here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:HTBI NYSE:PMT and NYSE:RC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance