Exploring High Insider Ownership Growth Stocks On The Indian Exchange

The Indian market has shown robust performance, with a 1.3% increase over the last week and an impressive 41% rise over the past 12 months, alongside expectations of earnings growing by 16% per annum. In such promising market conditions, stocks with high insider ownership can be particularly appealing, as they often indicate that those who know the company best are confident in its future growth potential.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.1% |

Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 28.6% |

Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 38% | 22.9% |

Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 33.1% |

Pricol (NSEI:PRICOLLTD) | 25.5% | 26.9% |

Aether Industries (NSEI:AETHER) | 31.1% | 39.8% |

Underneath we present a selection of stocks filtered out by our screen.

Apollo Hospitals Enterprise

Simply Wall St Growth Rating: ★★★★★☆

Overview: Apollo Hospitals Enterprise Limited operates a healthcare network offering services in India and abroad, with a market capitalization of approximately ₹85.72 billion.

Operations: The company generates revenue primarily through three segments: Healthcare Services (₹99.39 billion), Retail Health & Diagnostics (₹13.64 billion), and Digital Health & Pharmacy Distribution (₹78.27 billion).

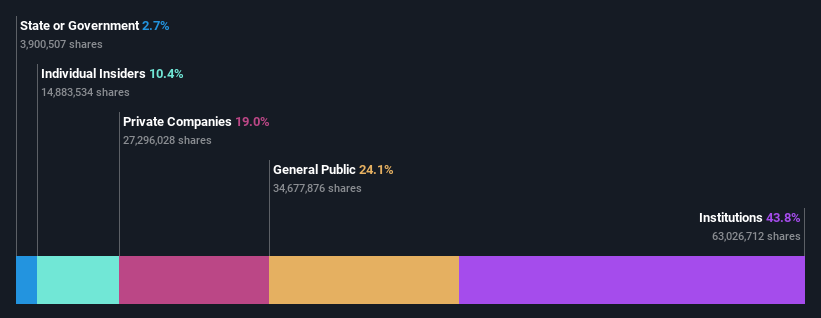

Insider Ownership: 10.4%

Earnings Growth Forecast: 33.1% p.a.

Apollo Hospitals Enterprise is poised for significant growth, with earnings expected to increase by 33.07% annually over the next three years. Despite a high return on equity forecast at 23.6%, revenue growth projections are more modest at 15.9% per year, slightly lagging behind the ideal growth benchmark of 20% but still outpacing the Indian market's average. Recent executive changes and a substantial dividend declaration reflect strategic shifts focusing on digital health and omni-channel pharmacy expansions, underscoring its adaptive business model in a dynamic healthcare sector.

Info Edge (India)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Info Edge (India) Limited is an online classifieds company engaged in recruitment, matrimony, real estate, and education services, operating both in India and internationally, with a market capitalization of approximately ₹790.23 billion.

Operations: The company generates revenue primarily from recruitment solutions at ₹18.80 billion and real estate through its 99acres segment at ₹3.51 billion.

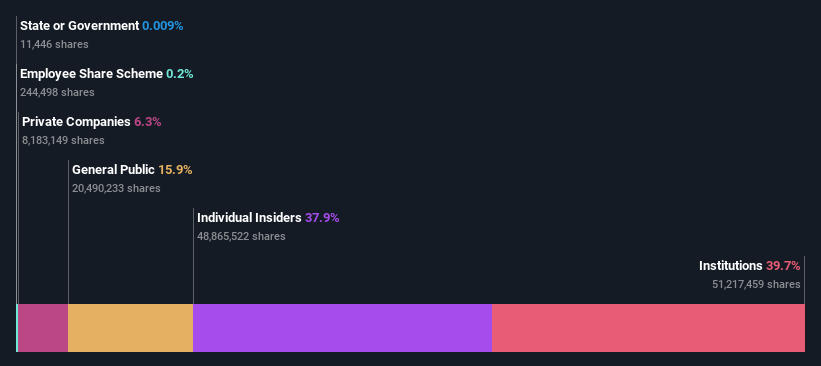

Insider Ownership: 37.9%

Earnings Growth Forecast: 27.8% p.a.

Info Edge (India) Limited, recognized for its robust insider buying over the past three months, shows promising growth with earnings expected to rise by 27.8% annually, outpacing the Indian market forecast of 15.8%. However, its revenue growth at 12.7% per year and a low forecast return on equity of 6.6% in three years present mixed signals about its long-term potential despite recent profitability improvements and strategic participation in significant industry conferences.

Varun Beverages

Simply Wall St Growth Rating: ★★★★★☆

Overview: Varun Beverages Limited, along with its subsidiaries, functions as a franchisee for PepsiCo's carbonated soft drinks and non-carbonated beverages, boasting a market capitalization of approximately ₹1.95 trillion.

Operations: The company generates ₹16.47 billion primarily through the manufacturing and sale of beverages.

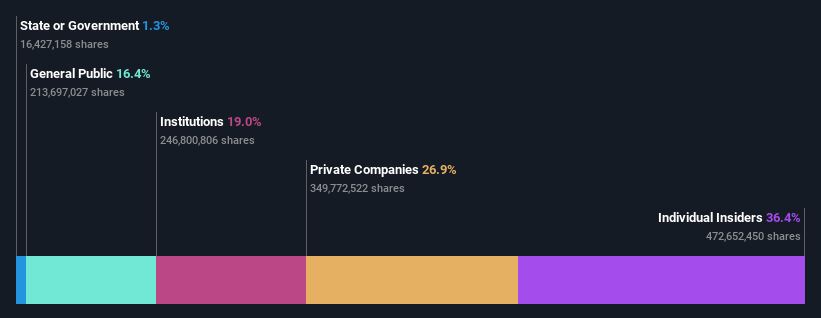

Insider Ownership: 36.4%

Earnings Growth Forecast: 23.8% p.a.

Varun Beverages Limited, amidst recent expansions and a new CFO appointment, reported a robust first quarter with revenues and net income showing significant increases from the previous year. The company's earnings are expected to grow by 23.8% annually, outstripping the Indian market's 15.8%. Despite high debt levels, Varun Beverages is poised for continued revenue growth at 16.4% per year, surpassing the market's 9.5%. However, its substantial insider ownership does not reflect recent buying or selling activities.

Seize The Opportunity

Dive into all 81 of the Fast Growing Indian Companies With High Insider Ownership we have identified here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:APOLLOHOSP NSEI:NAUKRI and NSEI:VBL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance