Exploring Dividend Stocks In The United States For May 2024

Over the past year, the United States stock market has shown robust growth, increasing by 26%, despite remaining flat over the last seven days. In this context of expected earnings growth of 15% per annum, a good dividend stock combines stable payouts with potential for capital appreciation, aligning well with current market dynamics.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.64% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.05% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.07% | ★★★★★★ |

Regions Financial (NYSE:RF) | 5.07% | ★★★★★★ |

Citizens Financial Group (NYSE:CFG) | 4.78% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.74% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 4.86% | ★★★★★★ |

Ennis (NYSE:EBF) | 4.84% | ★★★★★★ |

Premier Financial (NasdaqGS:PFC) | 6.16% | ★★★★★☆ |

Southside Bancshares (NasdaqGS:SBSI) | 5.49% | ★★★★★☆ |

Click here to see the full list of 206 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

First Bancorp

Simply Wall St Dividend Rating: ★★★★★☆

Overview: First Bancorp, Inc., functioning as the holding company for First National Bank, offers various banking products and services to individuals and businesses, with a market capitalization of approximately $273.96 million.

Operations: First Bancorp, Inc. generates its revenue primarily through banking operations, which amounted to $78 million.

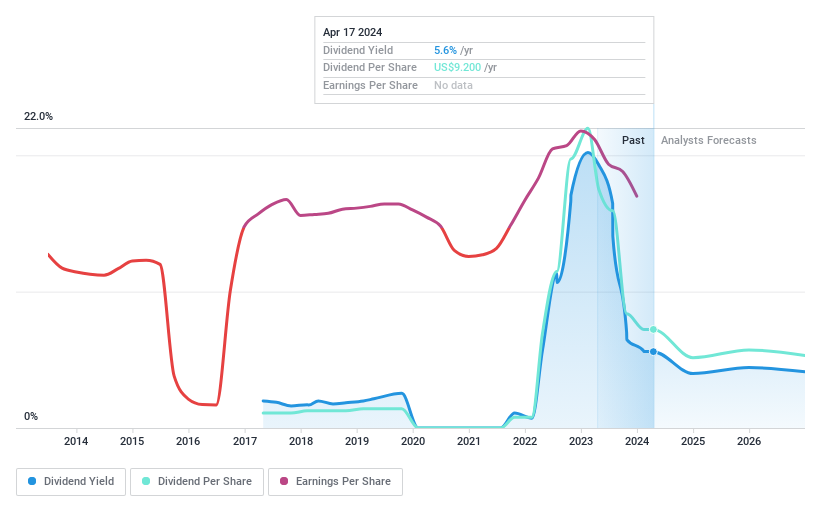

Dividend Yield: 5.7%

First Bancorp has maintained a stable dividend payout, with a recent quarterly cash dividend declared at US$0.35 per share. Despite a decrease in net interest income and net income in the first quarter of 2024, the company's dividends have shown growth over the past decade and offer an attractive yield of 5.73%, placing it among the top 25% of US dividend payers. The payout ratio stands at 56%, suggesting that dividends are well-covered by earnings, though future coverage data is lacking. Trading significantly below its estimated fair value offers potential value for investors looking for income-generating stocks.

Arch Resources

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arch Resources, Inc. is a company focused on the production and sale of metallurgical products, with a market capitalization of approximately $3.14 billion.

Operations: Arch Resources, Inc. generates its revenue primarily through two segments: metallurgical products contributing approximately $1.77 billion and thermal coal from the Powder River Basin totaling around $1.18 billion.

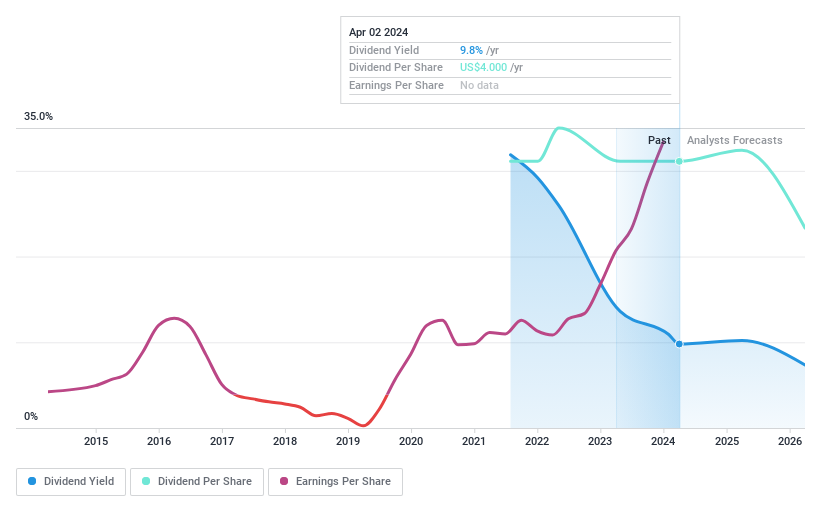

Dividend Yield: 4.7%

Arch Resources recently declared a dividend of US$1.11 per share, drawing from 25% of Q1's discretionary cash. Despite a significant reduction in Q1 earnings and sales year-over-year, the company maintains a dividend supported by a reasonable cash payout ratio of 32% and an earnings coverage ratio of 52.4%. The dividends have shown variability over the past seven years, reflecting some instability in payments despite current adequacy from earnings and cash flow perspectives.

DorianG

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dorian LPG Ltd. operates globally, specializing in the transportation of liquefied petroleum gas (LPG) using its fleet of LPG tankers, with a market capitalization of approximately $1.83 billion.

Operations: Dorian LPG Ltd. generates its revenue primarily from the global shipping of liquefied petroleum gas using its extensive fleet of tankers.

Dividend Yield: 8.7%

Dorian LPG Ltd. recently reported a robust increase in annual sales to US$560.72 million and net income to US$307.45 million, underpinning its financial health. Despite this, the company's dividends have shown inconsistency over the past three years with no growth in payments since initiation. Nonetheless, a recent dividend of US$1 per share was declared, payable on May 30, 2024, backed by a payout ratio of 52.4% and cash payout ratio of 61.2%, suggesting reasonable coverage by both earnings and cash flows.

Get an in-depth perspective on DorianG's performance by reading our dividend report here.

Upon reviewing our latest valuation report, DorianG's share price might be too pessimistic.

Make It Happen

Click here to access our complete index of 206 Top Dividend Stocks.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:FNLC NYSE:ARCH and NYSE:LPG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance