Exploring Dividend Stocks On Euronext Paris Three Notable Picks For Investors

As European markets navigate a landscape marked by rising inflation and economic uncertainties, France's CAC 40 Index has experienced a notable decline. In this context, exploring dividend stocks on Euronext Paris presents an opportunity for investors seeking potential stability and steady income streams amidst fluctuating market conditions.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Rubis (ENXTPA:RUI) | 6.00% | ★★★★★★ |

Samse (ENXTPA:SAMS) | 8.40% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.30% | ★★★★★★ |

Fleury Michon (ENXTPA:ALFLE) | 5.31% | ★★★★★☆ |

Métropole Télévision (ENXTPA:MMT) | 9.16% | ★★★★★☆ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 3.83% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 3.87% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.15% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 3.96% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.07% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top Euronext Paris Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative offers a range of banking products and services in France, with a market capitalization of approximately €0.49 billion.

Operations: Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative generates €253.67 million from Proximity Banking and €92.57 million from Management for Own Account and Miscellaneous activities.

Dividend Yield: 4.1%

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative offers a dividend yield of 4.07%, which is below the top quartile of French dividend stocks at 5.12%. However, its dividends have shown stability and growth over the past decade, supported by a low payout ratio of 17.9%, indicating good coverage by earnings. Despite trading at 50.5% below its estimated fair value and recent earnings growth of 19.5% year-over-year, data on future dividend sustainability remains unclear.

Colas

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Colas SA is a global company specializing in the construction and maintenance of transport infrastructure, with a market capitalization of approximately €5.71 billion.

Operations: Colas SA generates revenue through various segments: €5.97 billion from Roads France-Overseas France/IO, €3.36 billion from Roads EMEA (Europe-Middle East-Africa), €2.38 billion from Canada Routes, €2.24 billion from Roads United States, and €1.38 billion from Railways and Other Activities.

Dividend Yield: 4.2%

Colas has increased its dividend payments over the past decade, indicating a commitment to returning value to shareholders. However, with a high debt level and a dividend yield of 4.2%, it falls short of the top 25% in the French market at 5.35%. The dividends are supported by earnings and cash flows, with payout ratios at 81.3% and 58.9% respectively, suggesting sustainability from current financials. Yet, historical volatility in dividend payments points to potential instability moving forward.

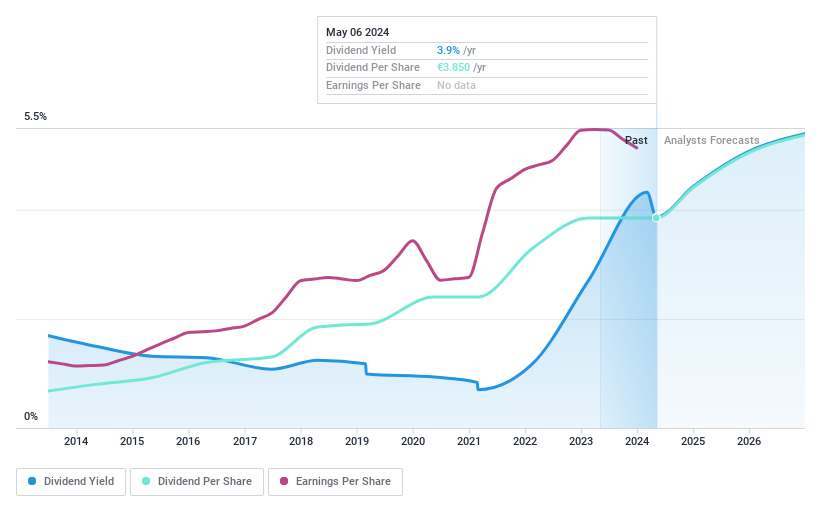

Teleperformance

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Teleperformance SE operates globally, providing customer consultancy services, with a market capitalization of approximately €6.12 billion.

Operations: Teleperformance SE generates revenue through various segments, with €2.54 billion from Core Services & D.I.B.S in Europe, Middle East & Africa, €2.53 billion in North America & Asia-Pacific, €1.57 billion in LATAM, and smaller contributions of €343 million from combined Core Services and Majorel operations and €1.36 billion from Specialized Services.

Dividend Yield: 3.7%

Teleperformance SE, with a dividend yield of 3.75%, offers a lower return compared to the top French dividend payers. Despite this, its dividends are well-supported by earnings and cash flows, with payout ratios of 37.5% and 20.1% respectively, ensuring sustainability. The company's dividends have shown stability and growth over the last decade, although it trades at a significant discount to its estimated fair value and faces high debt levels alongside recent share price volatility.

Seize The Opportunity

Discover the full array of 33 Top Euronext Paris Dividend Stocks right here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:CRTO ENXTPA:RE and ENXTPA:TEP.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance