Exploring Brenntag And Two Other Top Dividend Stocks In Germany

Amid a backdrop of fluctuating European markets and rising inflation concerns, Germany's economic landscape presents a unique environment for investors exploring dividend stocks. As the DAX index shows signs of volatility, understanding the stability and potential long-term benefits of top dividend-paying companies becomes crucial for those looking to invest in Germany.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.25% | ★★★★★★ |

Edel SE KGaA (XTRA:EDL) | 6.55% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 4.71% | ★★★★★★ |

Südzucker (XTRA:SZU) | 6.35% | ★★★★★☆ |

Deutsche Telekom (XTRA:DTE) | 3.41% | ★★★★★☆ |

MLP (XTRA:MLP) | 4.63% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.02% | ★★★★★☆ |

SAF-Holland (XTRA:SFQ) | 4.91% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 8.08% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.11% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Brenntag

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Brenntag SE operates as a distributor of industrial and specialty chemicals and ingredients across regions including Germany, Europe, the Middle East, Africa, the Americas, and Asia Pacific, with a market capitalization of approximately €9.37 billion.

Operations: Brenntag SE's revenue is generated through its Brenntag Essentials segment, with €4.28 billion from North America, €3.34 billion from Europe, the Middle East & Africa (EMEA), €708 million from Asia Pacific (APAC), and €670.20 million from Latin America.

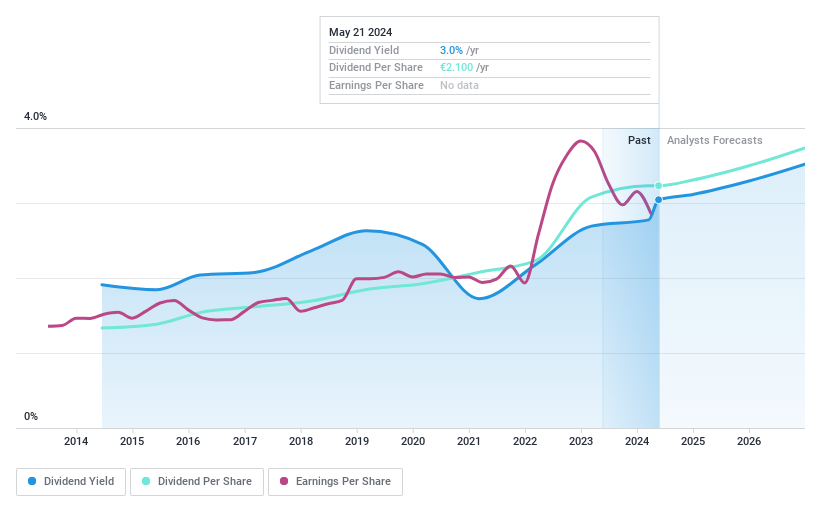

Dividend Yield: 3.2%

Brenntag SE, a notable player in the chemical distribution sector, reported a decline in both quarterly and annual earnings for 2024, with sales dropping to €4.00 billion in Q1 from €4.53 billion the previous year and annual sales falling to €16.82 billion from €19.43 billion. Despite these challenges, Brenntag maintains a stable dividend policy, recently declaring a cash dividend of €2.10 per share with coverage supported by a payout ratio of 48.9% and cash flows covering 28.1% of dividends, signaling prudent financial management amid revenue pressures.

Click here to discover the nuances of Brenntag with our detailed analytical dividend report.

Our valuation report unveils the possibility Brenntag's shares may be trading at a discount.

CR Energy

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CR Energy AG is an investment company focusing on technology firms in Germany, with a market capitalization of approximately €166.99 million.

Operations: CR Energy AG specializes in investments within the technology sector in Germany.

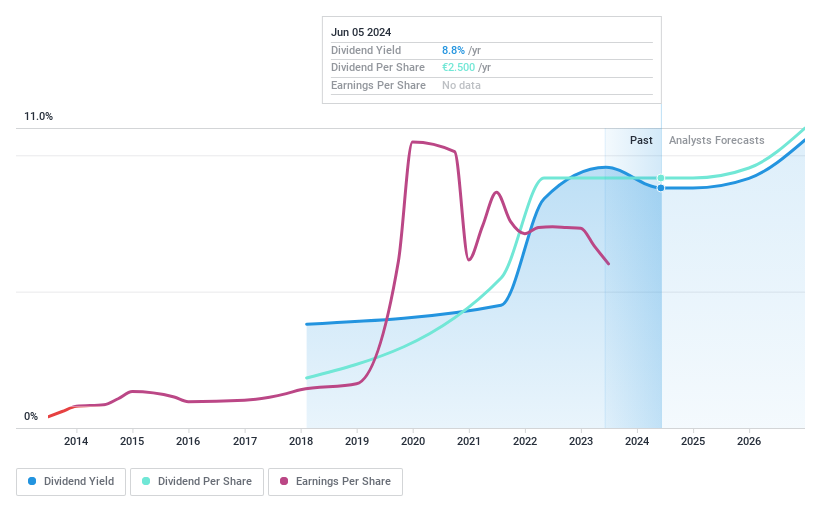

Dividend Yield: 8.8%

CR Energy AG, trading significantly below its estimated fair value at 77.4%, offers a robust dividend yield of 8.8%, well above the German market average of 4.52%. Despite its short dividend history of six years, payments have shown growth and stability, supported by a conservative payout ratio of 18.8% and cash flow coverage at 62.6%. However, recent financials indicate a downturn with revenue falling to €68.64 million and net income to €65.78 million in the last year, reflecting potential challenges ahead.

Unlock comprehensive insights into our analysis of CR Energy stock in this dividend report.

Our valuation report here indicates CR Energy may be undervalued.

DATA MODUL Produktion und Vertrieb von elektronischen Systemen

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DATA MODUL Aktiengesellschaft, Produktion und Vertrieb von elektronischen Systemen operates in the development, manufacture, and distribution of flatbed displays, monitors, electronic subassemblies, and information systems globally with a market capitalization of approximately €117.07 million.

Operations: DATA MODUL Produktion und Vertrieb von elektronischen Systemen generates revenue primarily through two segments: €98.96 million from Systems and €175.39 million from Displays.

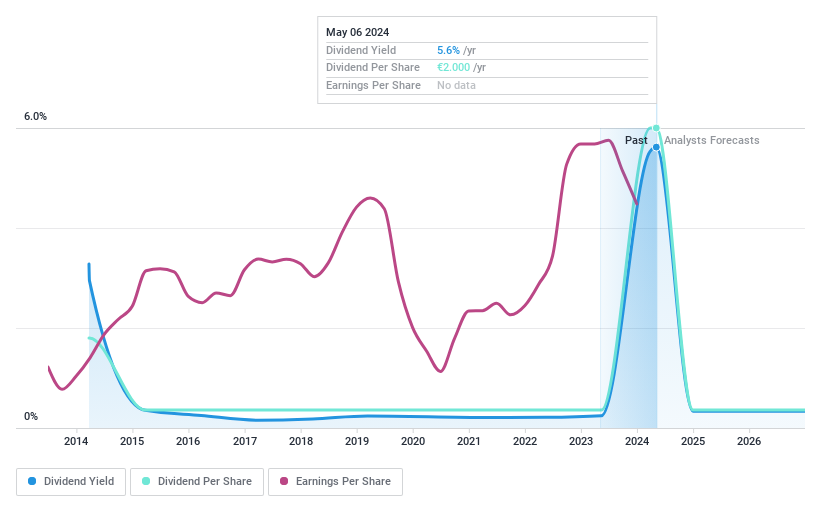

Dividend Yield: 6%

DATA MODUL's recent performance shows a decline in sales and net income, with Q1 2024 sales at €63.53 million and net income at €2.74 million. Despite this, the company maintains a dividend yield of 6.02%, higher than the German market average. The dividends, while volatile historically, are supported by a payout ratio of 50.7% and cash payout ratio of 26.9%. Additionally, its Price-To-Earnings ratio stands at an attractive 8.4x compared to the market's 17.8x.

Taking Advantage

Navigate through the entire inventory of 32 Top Dividend Stocks here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:BNR XTRA:CRZK and XTRA:DAM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance