Exploring ASX Dividend Stocks In May 2024

Despite a challenging day on the ASX200, where most sectors experienced declines, certain stocks demonstrated resilience or noteworthy performance. As investors navigate this landscape, understanding the characteristics that contribute to a stock's stability and potential for reliable dividends becomes particularly valuable in such fluctuating market conditions.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Fiducian Group (ASX:FID) | 3.98% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 4.88% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 6.88% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.51% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.58% | ★★★★★☆ |

Fortescue (ASX:FMG) | 7.39% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.22% | ★★★★★☆ |

Ricegrowers (ASX:SGLLV) | 8.09% | ★★★★☆☆ |

New Hope (ASX:NHC) | 9.19% | ★★★★☆☆ |

Australian United Investment (ASX:AUI) | 3.56% | ★★★★☆☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

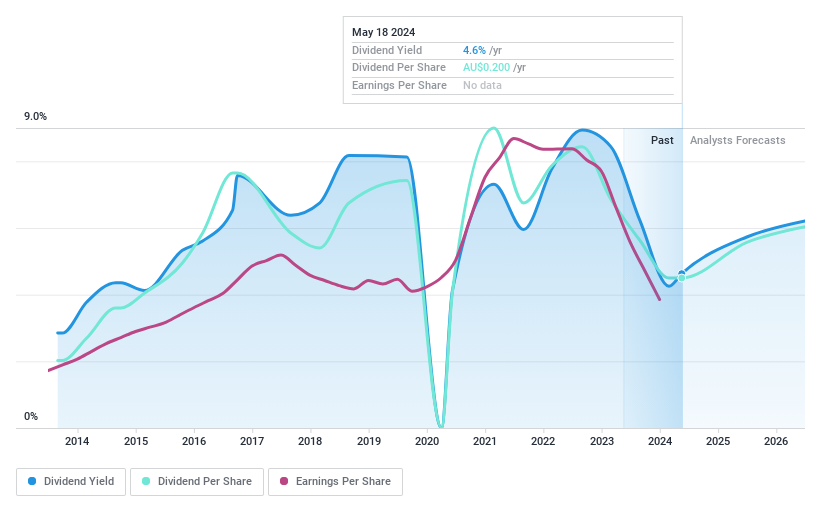

Harvey Norman Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Harvey Norman Holdings Limited operates in integrated retail, franchise, property, and digital system sectors with a market capitalization of approximately A$5.38 billion.

Operations: Harvey Norman Holdings Limited generates revenue primarily through its retail operations in New Zealand (A$0.98 billion), Slovenia & Croatia (A$0.20 billion), Singapore & Malaysia (A$0.69 billion), non-franchised retail (A$0.24 billion), and Ireland & Northern Ireland (A$0.68 billion).

Dividend Yield: 4.6%

Harvey Norman Holdings Limited reported a significant drop in half-year net income from A$365.9 million to A$200.01 million as of December 2023, with earnings per share also declining. Despite this downturn, the company maintains a low cash payout ratio of 39.2%, supporting its dividend sustainability with a coverage by earnings at 73.4%. However, its dividend yield of 4.63% is below the top Australian dividend payers' average, and the company's dividends have shown volatility over the past decade, indicating potential concerns for long-term stability in its dividend policy.

Dive into the specifics of Harvey Norman Holdings here with our thorough dividend report.

Our valuation report here indicates Harvey Norman Holdings may be undervalued.

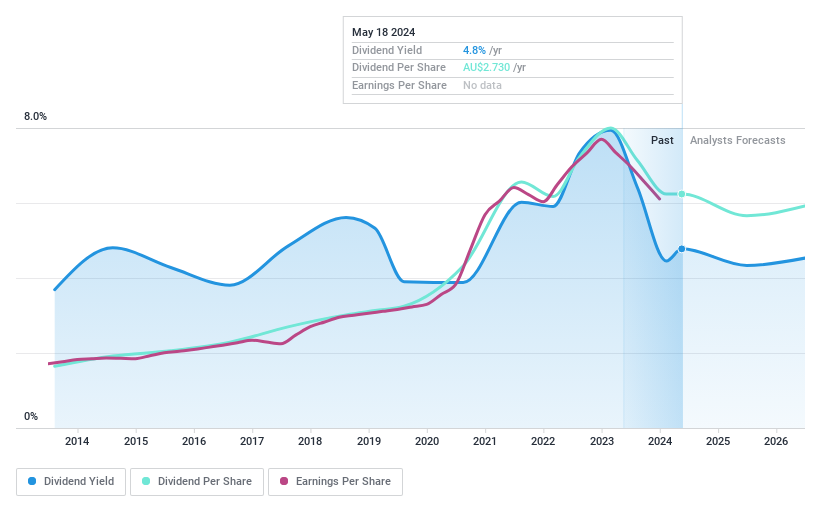

JB Hi-Fi

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JB Hi-Fi Limited operates as a retailer of home consumer products, with a market capitalization of approximately A$6.25 billion.

Operations: JB Hi-Fi Limited generates revenue through three primary segments: The Good Guys at A$2.66 billion, JB Hi-Fi Australia at A$6.57 billion, and JB Hi-Fi New Zealand at A$0.28 billion.

Dividend Yield: 4.8%

JB Hi-Fi's dividend yield at 4.78% falls below the top quartile of Australian dividend stocks, which average 6.25%. Despite a decade of dividend growth, JB Hi-Fi has experienced significant volatility in its payouts, including annual reductions exceeding 20%. The company maintains a sustainable payout with a payout ratio of 65% and a cash payout ratio of 46.7%, indicating dividends are well covered by earnings and cash flow. However, recent sales data shows mixed performance across different segments, with slight declines in some areas as of March 2024.

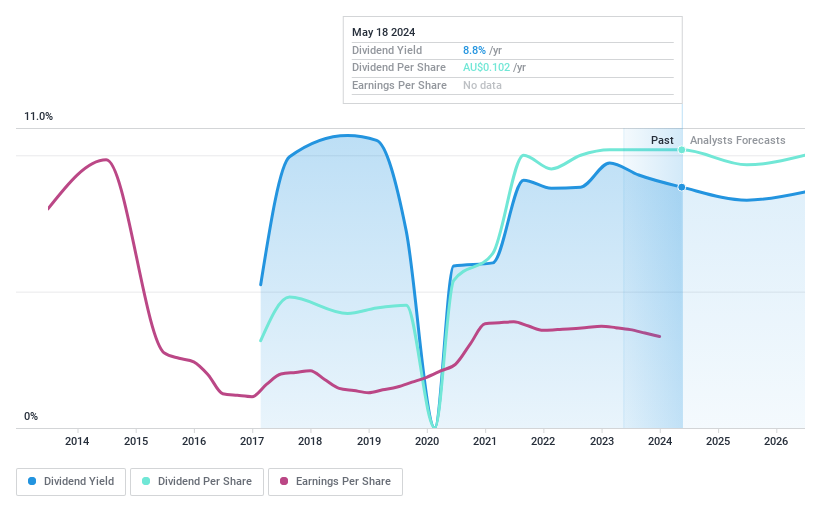

Shaver Shop Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shaver Shop Group Limited is a retailer specializing in personal care and grooming products across Australia and New Zealand, with a market capitalization of approximately A$151.32 million.

Operations: Shaver Shop Group Limited generates its revenue primarily through retail store sales of specialist personal grooming products, amounting to A$219.66 million.

Dividend Yield: 8.8%

Shaver Shop Group, despite a relatively short dividend history of 7 years with some volatility, offers a high yield at 8.83%, ranking in the top 25% in its market. Recent affirmations of dividends and consistent interim payments underscore a commitment to shareholder returns. The stock trades at 56.7% below estimated fair value, suggesting potential undervaluation. However, its dividend sustainability is questionable with an earnings payout ratio of 83.6% and inconsistent past payouts.

Turning Ideas Into Actions

Dive into all 31 of the Top ASX Dividend Stocks we have identified here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:HVN ASX:JBH and ASX:SSG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance