21 best ways to make money in 2021

We all know 2020 was a year like no other.

It was a year defined by Covid-19, self-isolation and the resulting global recession. A pandemic that brought the global economy to its knees.

But dozens of experts believe 2021 will be defined by the reopening of the Australian - if not global - economy.

Watch the full episode above: Power Hour: 21 tips to make money in 2021.

So it’s time to take advantage of what we have now and lay our plans to make the most of the years to come.

We asked economists, investors, financial advisors and what their top tips are to get back on track and make money in 2021. Here they are:

Tip #1: Get a better rate, mate

According to Finder.com.au analysis, 38 per cent of Australian home owners don’t know what their mortgage rate is.

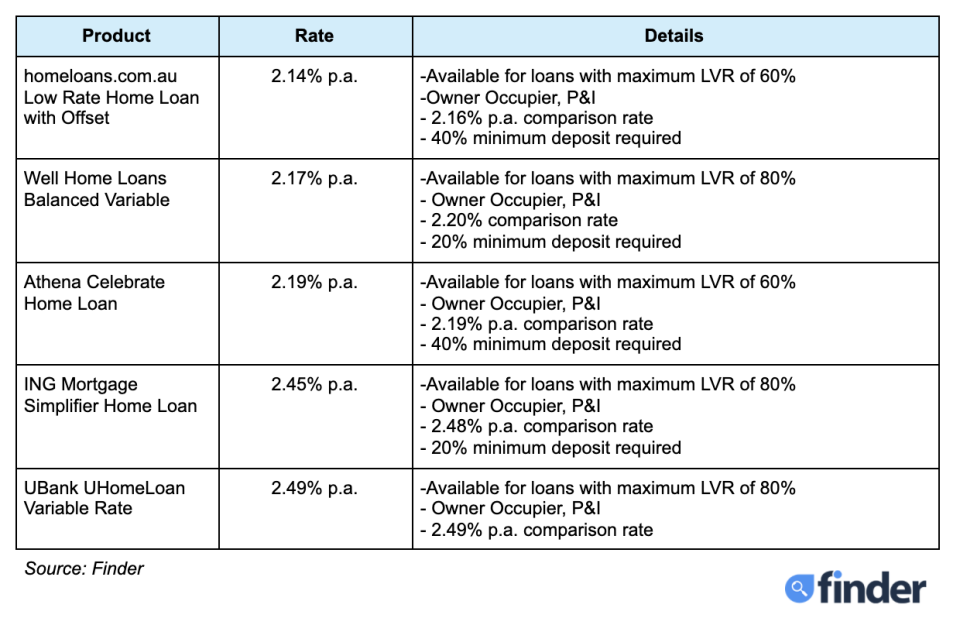

And while the average borrower has a 3.2 per cent interest rate, the lowest variable interest rate on the Finder.com.au database is 2.14 per cent.

Now is the time to find out what interest you’re paying and if you’re paying more than 3 per cent, it’s also time to ask yourself, ‘why?’”

Australian home owners with an average mortgage size of $489,159 could save $273 per month by switching from the average variable rate to the lowest rate. Or, these homeowners could save $98,275 over the course of 30 years.

So it’s time to stop paying too much. As Scott Phillips from Motley Fool said, it’s time to #getabetterrate.

Finder’s lowest variable home loan rates

Tip #2: Is now the time to fix?

Money School founder Lacey Filipich said Ausralians can save themselves $20,000 within an hour with their “clothes on and their dignity intact” by nabbing a better mortgage rate.

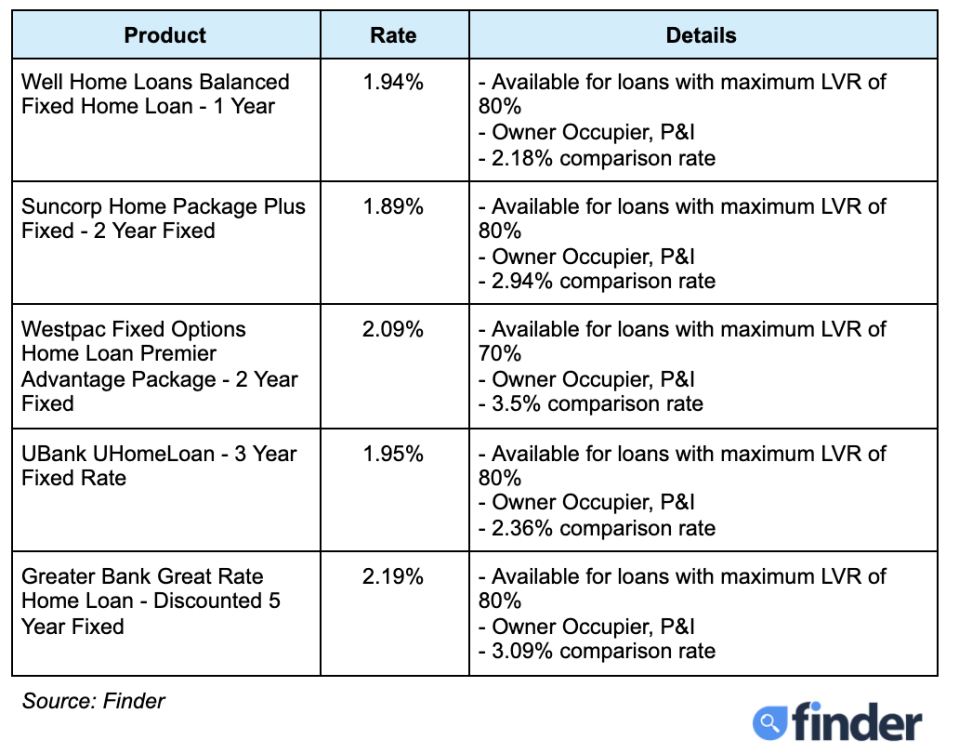

She noted that fixed rates have dropped as low as 1.89 per cent.

Roger Montgomery, chief investment officer of Montgomery Investment Management agreed, saying he believes Australia may have hit the fixed rate floor.

These are the best fixed home loan rates.

Finder’s best fixed home loan rates

However, money expert and author of How to Get Mortgage Free Like Me, Nicole Pedersen-McKinnon said it’s also worth considering only fixing a portion of your loan.

“Fixes are crazy-cheap right now compared to variable rates. Keeping half at variable is clever because it means you can hook up a genuine offset account to that portion and pay off extra into that offset account, so still make massive interest savings. It’s the best of both worlds,” she said.

Tip #3: Make the most of an offset gem

An offset account is a transaction account that can be used like any other spending account. The difference is that this account is linked to your home loan and any money held inside it decreases the amount of interest charged on the loan.

It’s one of Pedersen-McKinnon’s favourite money-saving tools, and she explains the beauty of it here.

Tip #4: Make your savings work harder

Record low interest rates are good news for borrowers, but they’re bad news for savers.

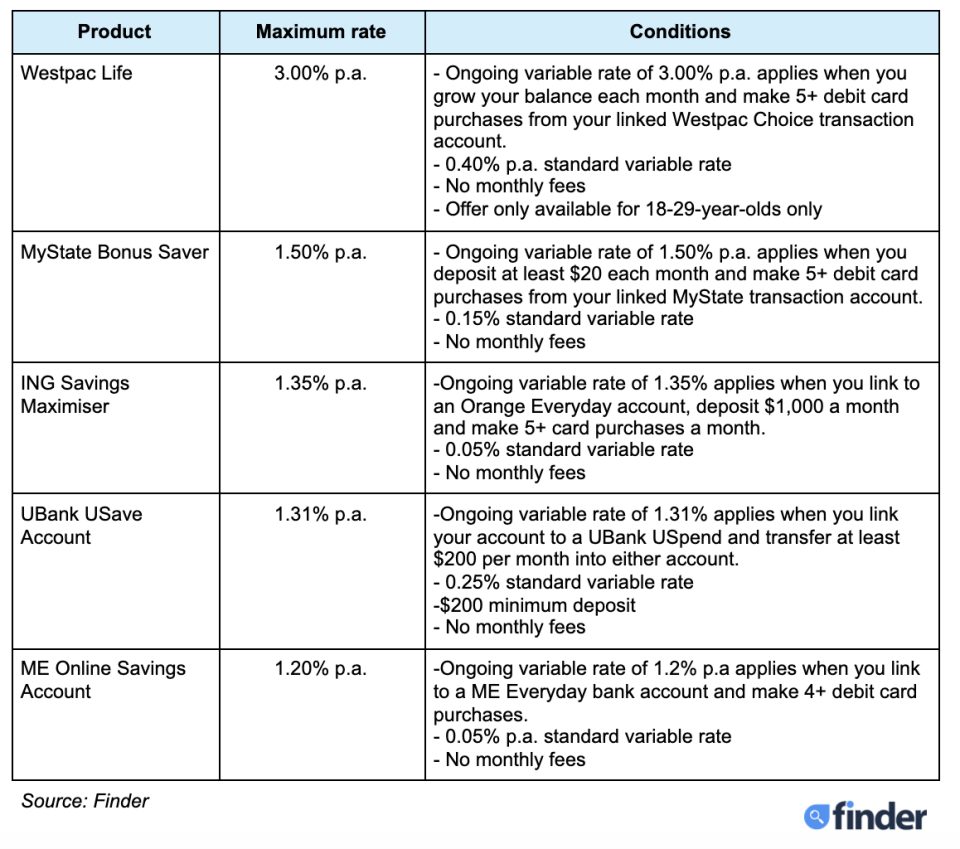

Currently, the best savings rate on the market is Westpac’s 3 per cent p.a. Life product.

Aussies who took up that rate can stand to earn as much as $644 in interest over a year, according to RateCity analysis.

However, this product is only available for Australians between 18 and 29. If you’re over 30 - the best rate you’re looking at is about 1.5 per cent. (See tips 6-12 for ideas on where to put your money instead).

Finder’s best high-interest savings account rates

Tip #5: Avoid strife, automate your life

Think about it - how much would you have in superannuation if it wasn’t compulsory?

Our biggest enemy when it comes to saving and investing is often ourselves.

So therefore remove the barriers of decision making and will power and make automation your friend.

“Write yourself up a budget and determine how much money you can put into savings, expenses, spending, emergencies and luxury or fun accounts. Then simply automate the money to go into each account the day after your payday so you don't need to think about a thing!” says Shivani Gopal, founder of The Remarkable Woman.

“Let those dollars build up exactly as you planned for them to.”

Ladies Finance Club founder Molly Benjamin agrees. She said it’s important to “tell your money where to go”, rather than wondering where it went.

Here are five ways you can automate your life. (And there are so many more cool apps and tools to help you automate every are of your life).

ING: Like many banks, ING offers automatic roundups. That means that you can round up transactions to the nearest dollar, $5 or $10 so you save as you spend. ING also partnered with fintech If This Then That to allow savers to attach saving triggers to their daily spending. For example, a saver with ING could attach a savings trigger to their daily step count, and every time they exceed a certain number of steps, a certain sum is moved from their spending account to their savings account.

Raiz: Want to start investing but don’t like the idea of losing money or don’t feel like you have enough? Micro-investing app Raiz could be one solution. Raiz allows investors to round-up their purchases and invest the spare change in the stock market, or set up automatic deferrals. Here’s the deal.

Super Rewards: Want to contribute to your super while you shop? Super Rewards is a cashback service that funnels the savings straight to your super every time you shop at participating retailers.

Sipora: If you’re an Afterpay addict, or just looking to pay off some pesky loans, this could be the app for you. Sipora is another roundup app, except this app allows you to channel your roundups towards a purchase you want, or to pay off a loan.

Points: If you plan to do a lot of travel once restrictions are eased, it could be worth looking into a points card. The golden rule is to ensure you never pay a cent in interest, so make sure your limit is at a level you can easily and quickly pay off every cycle.

Regardless of how you choose to do it, building up a solid pool of savings is critical.

Financial adviser Dawn Thomas and Women with Cents founder Natasha Janssens both emphasised the importance of having an OMG or FU fund of at least three months savings in the case that you are made redundant, need to quit your job or pay for unexpected expenses.

TIP# 6: Want to invest? Start now!

When AMP Change Leader Sharon Connolly first began investing, she thought it was a scam as her money grew so quickly. Today, she’s a successful investor and her advice to others is simple: just start.

Financial wellness coach Betsy Westcott also suggested digging into a micro-investing app or a robo advisor if you’re just starting out with a small amount of money.

Tip# 7: Be smart, invest in what you know

eToro market analyst Josh Gilbert said investors should start by investing in the areas they know.

“A tip for newbie investors or even someone getting started would be to read One up on Wall Street by Peter Lynch. The reason I like this book so much is Peter Lynch went from being a golf caddy to one of Wall Street's biggest fund managers. The book, in short, tells you that anyone can invest in the stock market, you don't have to have a degree as long as you do the research,” Gilbert said.

“We have touchpoints everyday with companies that are available to invest in on the stock market. If you know everyone is buying Samsung products instead of Apple, should you be investing in Samsung stocks?”

His lesson? Investing doesn’t have to be complicated.

Burman Invest founder and chief investment officer told Yahoo Finance that that’s how many successful investors operate. She gave the example of expert stock picker Peter Lynch. He was an early investor in Hanes pantyhose because his wife raved about how great they were, and how they were the only stockings sold in supermarket stores - not department stores.

It went on to become massively successful, but Lynch said it was simply a logical investment.

Tip# 8: Add to watchlist: Travel stocks

While 2020 saw the world shut down, Roger Montgomery believes the new year will be defined by the reopening. For this reason, he said it’s a good idea to keep an eye on travel stocks.

“Success on the vaccine front should see stocks in companies that were beaten down the most during the depths of the pandemic recover strongly,” Montgomery said.

“Stocks in cruise operators listed on the New York Stock Exchange and the Nasdaq fell as much as 85 per cent during the pandemic and remain down as only tentative first steps are made towards a return to cruising. The level of pent up demand to travel again, when released, will surprise most analysts and travel-related stocks should continue to do well.”

Financial advisor Brendan Gow agrees. He said tourism and travel stocks will eventually recapture their pre-pandemic prices. He said investors should take a look at stocks like Qantas (QAN), Sydney Airports (SYD) and Flight Centre (FLT).

Tip# 9: Add to watchlist: Service stocks

Along the same lines as travel stocks are services stocks. Montgomery said service stocks will benefit in 2021 as the millions of people who spent 2020 cooped up go looking for fun.

“During the lockdown, concerts, pubs, restaurants and other entertainment, as well as gyms and wellbeing services all suffered. Money instead was spent on goods and mostly ordered online. A reopening and a vaccine should see the pendulum swing the other way.”

Tip# 10: Add to watchlist: Renewables

Gow said another area to watch is the renewable technology space.

“On the politics front, Joe Biden is backing cleaner renewable energies, such as Lithium, electric vehicle batteries and other energy sources which reduce carbon emissions. Ioneer (INR), and Elixir Energy (EXR) are excellent options to consider.”

Tip# 11: Investing: The future is digital

Josh Gilbert said the future is digital.

“2020 has been the catalyst for a move to an online world and I believe 2021 will see eCommerce, payment providers and AI technology come even more to the fore,” Gilbert said.

“More than ever, consumers feel more comfortable shopping from the comfort of their own home because they’ve had to. In 2021, I believe this acceleration of digital transformation will continue into many parts of our lives and we’ll be looking to technology providers to make our buying experiences even easier.

“This includes how we pay for things and one example is PayPal who will integrate crypto assets into their platform.”

Tip# 12: It's a rollercoaster, buckle up

But above all, make sure you’re prepared for volatility.

This year we saw stock markets crash in record speed before returning to fresh highs in November.

“The sharemarket is volatile, but it bounces back! Internalise that lesson now, so that next time it comes around, you'll be mentally (and emotionally) prepared to withstand the storm,” Motley Fool chief investment officer Scott Phillips said.

Tip# 13: Feeling adventurous? Invest overseas

Yahoo Finance journalist Jessica Yun interviewed American stock broker, and CEO of Euro Pacific Capital Peter Schiff and American investor and financial commentator Jim Rogers to get their views on where the big opportunities would be next year. Here’s what they had to say:

Tip# 14: Challenge your money beliefs

Money Barre founder and author of Unf*ck your Finances Melissa Browne said it’s critical that we reassess our beliefs around money, property and investing.

While many Australians think they need to pay off their home loan before they begin investing in shares, Browne said this is a “recipe for disaster”.

That’s because waiting to invest means Australians will miss out on years of earnings.

Tip# 15: Property: look outside the big smoke

Market Economics economist Stephen Koukoulas said the pandemic and resulting work-from-home revolution will see regional areas boom.

“Regional areas, a little outside the main city CBDs are likely to do very well. Prices there are still lower than in the 'big smoke' and lifestyles can be great. I'd look at regional cities,” he said.

Financy Women’s Index editor and founder Bianca Hartge-Hazelman agrees.

“I'm big on buying land or dwellings in regional areas that are set to benefit from the Sea and Tree Change out of major areas due to COVID. Buying to rent out a dwelling in an increasingly popular area where internet coverage is good, is one idea,” she said.

Tip# 16 and Tip# 17: Don't search, do your research AND location, location, location

Metropole Property Group director Michael Yardney said that when it comes to property investing, research is the key. Here’s his top tips:

Tip# 18: Don't try and time the market

Jessica Brady, co-founder of Fox and Hare said that trying to time the market is a “dangerous game”, and that investors will never know the bottom of the market until it’s past. Something 2020 has really driven home for us.

Michael Yardney agrees, saying experts can’t time the property market, so don’t even try. He also believes when we look back we’ll see that mid-October was when the property market turned around.

Tip# 19: Stop getting ripped off today

Energy bills are among the leading causes of stress for one quarter of Australian households, but the average customer could save $296 per year by swapping to the cheapest deal on the market, according to Finder.

If you think you’re paying too much, head to Energy Made Easy, where you can see how your bills compare to what you should be paying.

Victoria has a state comparison site: Victorian Energy Compare, as does NSW: Energy Switch.

Your mobile provider is another area where you can save. Finder found that Australians with prepaid monthly mobile plans with 30GB of data could save $90 per year by switching to a smaller telco provider.

As it stands, 78 per cent of Australians are with one of the three big telcos - Telstra, Vodafone or Optus.

But superannuation is the are where Australians can make staggering savings - with one phone call.

According to Stockspot’s Fat Cat Funds report, Australians who swap from a super fund charging 2 per cent in fees to one charging 1 per cent in fees are on average $200,000 better off by retirement. That’s $200,000 simply by making sure you’re on the lowest fees. Huge savings.

Here are the super funds to look out for.

Tip# 20: Remember your greatest asset is you

Robert Kiyosaki, author of Rich Dad, Poor Dad, told Yahoo Finance: “Tips are for losers…and the flip-side: Winners focus, study, and learn so they can understand, evaluate and make decisions that are right for them. I encourage you to make 2021 the year you study and learn…and get smarter with your money."

While the economic recovery could be around the corner, unemployment remains stubbornly high at 7 per cent. That means it’s time to consider your skills and how you can make sure they match up with the jobs of the future.

These are Airtasker’s most in-demand business skills and these are Upwork’s most coveted tech skills.

Another thing to consider is your soft skills. Leadership expert Shadé Zahrai has revealed that warmth and competence are the biggest things you are judged on in the office, and the world’s best investor Warren Buffett says public speaking is the one skill that will increase your worth by 50 per cent.

But it all comes back to investing in your own happiness and health, Thrive Global founder Arianna Huffington said.

Tip# 21: Write a goal for November 2021

The last tip, but probably the most important one, is to set a goal and write it down.

Molly Benjamin said by making a SMART goal (Smart, Measurable, Achievable, Realistic and Timely) and writing it down, it will increase your chances of hitting it by 42 per cent.

Never underestimate the power of goal setting. So let’s forget 2020, and look forward to a fresh new year.

Want to hear Australian influencers reveal their best finance tips? Join the Broke Millennials Club on Facebook, and receive one hot tip per day in December.

And if you want 2021 to be your best (financial) year yet, follow Yahoo Finance on Facebook, LinkedIn, Instagram and Twitter. Subscribe to the free Fully Briefed daily newsletter here.

Yahoo Finance

Yahoo Finance