Expedia Group (EXPE) Q2 Earnings & Revenues Beat Estimates

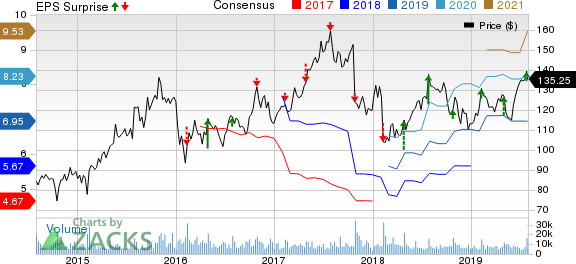

Expedia Group, Inc. EXPE delivered second-quarter 2019 adjusted earnings of $1.77 per share, beating the Zacks Consensus Estimate by 7 cents. The figure also surged 28.3% on a year-over-year basis. Further, the figure reversed the loss of 27 cents in the previous quarter.

Revenues increased 9.5% year over year and 20.8% on a sequential basis to $3.15 billion. Notably, the figure outpaced the Zacks Consensus Estimate of $3.13 billion.

Robust performance of Expedia Partner Solutions, Brand Expedia and Vrbo drove the top line year over year. Further, growing stayed nights and expanding lodging portfolio continued to accelerate revenue generation.

Expedia recorded gross bookings of $28.29 billion in the second quarter, which came ahead of the Zacks Consensus Estimate of $28.24 billion. Moreover, the figure improved 9.2% year over year but declined 3.8% sequentially.

Coming to the price performance, Expedia has gained 1.2% over a year against the industry’s decline of 9.9%.

The company remains optimistic about its strong supply acquisition efforts, strategic investments and product innovation. These initiatives anticipated to aid growth in the Core OTA segment. Further, Expedia’s Vrbo is expected to continue strengthening presence in the accommodation space. Additionally, marketing investments and product enhancements are likely to aid trivago’s performance in the near term.

Click to get this free report Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report Expedia Group, Inc. (EXPE) : Free Stock Analysis Report Best Buy Co., Inc. (BBY) : Free Stock Analysis Report Dollar General Corporation (DG) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance