Exact Sciences (EXAS) Cologuard Business Grows Amid Cost Woes

Exact Sciences EXAS continues to make significant progress with its Cologuard test. The integration of PreventionGenetics also buoys optimism. Escalating expenses, its sole reliance on Cologuard and competition are the major downsides. The stock currently carries a Zacks Rank #3 (Hold).

Exact Sciences came up with better-than-expected second-quarter 2022 results. The decline in quarterly loss compared with the year-ago period was encouraging. Robust revenues from the Screening and Precision Oncology segments contributed to the second-quarter top line. The company’s legacy Screening business was driven by impressive Cologuard volume growth and contributions from the PreventionGenetics, Biomatrica and Oncoguard Liver products. In the reported quarter, 9,000 new healthcare providers ordered Cologuard. Further, the growing uptake of the company’s Oncotype DX Breast and therapy selection products instills optimism.

The company is currently focusing on three areas to enhance Cologuard growth. Its first strategy entails building the best and most effective commercial organization in healthcare by investing in its leadership team, training, and sales force effectiveness. Second, it seeks to improve the customer experience by making it simpler to order Cologuard electronically and continue rescreening patients every three years. Third, it looks to screen more people starting at age 45 to catch cancer earlier.

In the second quarter of 2022, the company saw an increase in the number of completed Cologuard tests. The impressive Cologuard volumes were driven by enhanced sales team productivity, marketing agreement with Katie Couric, three-year rescreens and increased usage in the 45-49 age group. On the second-quarter earnings call, the company stated that 282,000 healthcare providers have ordered Cologuard since its launch till the end of the second quarter.

Following the acquisitions of Paradigm and Ashion, Exact Sciences is now offering therapy selection tests for patients with advanced cancer, providing even more value to oncologists, researchers and pharma partners. The Oncotype DX Breast test is witnessing greater market adoption by helping in the diagnosis of 1.3 million women with early-stage breast cancer. It has added a test to support comprehensive tumor profiling for advanced cancer, oncomapExTra. Notably, the Oncotype DX test directs approximately 70% of U.S. patients diagnosed with HR-positive HER2-negative breast cancer to the most effective treatment based on the risk of recurrence.

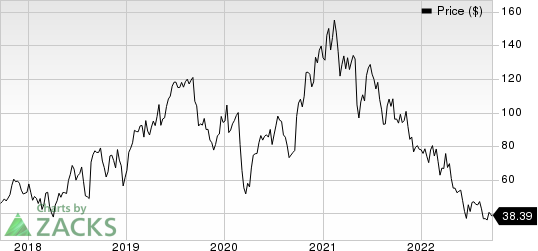

Exact Sciences Corporation Price

Exact Sciences Corporation price | Exact Sciences Corporation Quote

On the flip side, over the past year, Exact Sciences has underperformed its industry. The stock has declined 62.7% compared with the industry's 33.8% fall. In the second quarter, Exact Sciences’ revenues from the COVID-19 tests declined year over year. The lowered sales outlook for full-year 2022 is discouraging.

According to Exact Sciences, the Screening and Precision Oncology businesses have been negatively impacted by the ongoing COVID-19 pandemic, although a large part of it has recovered. The company expects any future outbreaks of COVID-19 and the emergence of new variants to diminish access to healthcare provider offices. Further, pandemic-led cost inflation and supply-chain disruptions continue to impact the company’s operations, with the ongoing inflationary pressure leading to an increase in personnel-related costs.

Exact Science has adopted several strategies to improve its revenue performance. These include portfolio expansion and penetration in the international arena. So far, this has significantly escalated costs and operating expenses of the company.

In the second quarter of 2022, Exact Sciences’ gross margin contracted 151 basis points to 72.3%. Sales and marketing expenses increased 10.8%, whereas general and administrative expenses rose 8.4% year over year. These mounting expenses pushed up adjusted operating costs by 7.5% year over year, resulting in an adjusted operating loss in the quarter under review and placing significant pressure on the company’s bottom line.

Key Picks

A few better-ranked stocks in the medical space are AMN Healthcare Services, Inc. AMN, ShockWave Medical, Inc. SWAV and McKesson Corporation MCK.

AMN Healthcare has a long-term earnings growth rate of 3.2%. The company surpassed earnings estimates in the trailing four quarters, delivering a surprise of 15.7%, on average. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has outperformed its industry in the past year. AMN has lost 4.7% against the industry’s 36.7% fall.

ShockWave Medical, sporting a Zacks Rank #1 at present, has an estimated growth rate of 33.1% for 2023. The company’s earnings surpassed estimates in all the trailing four quarters, the average beat being 180.1%.

ShockWave Medical has outperformed its industry in the past year. SWAV has gained 26.1% against the industry’s 29.7% fall in the past year.

McKesson has an estimated long-term growth rate of 9.9%. The company surpassed earnings estimates in the trailing three quarters and missed in one, delivering a surprise of 13%, on average. It currently carries a Zacks Rank #2 (Buy).

McKesson has outperformed its industry in the past year. MCK has gained 64.3% against the industry’s 15.8% fall.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Exact Sciences Corporation (EXAS) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance