Even though Guidewire Software (NYSE:GWRE) has lost US$357m market cap in last 7 days, shareholders are still up 43% over 1 year

The simplest way to invest in stocks is to buy exchange traded funds. But if you pick the right individual stocks, you could make more than that. For example, the Guidewire Software, Inc. (NYSE:GWRE) share price is up 43% in the last 1 year, clearly besting the market return of around 23% (not including dividends). That's a solid performance by our standards! Having said that, the longer term returns aren't so impressive, with stock gaining just 5.7% in three years.

In light of the stock dropping 3.7% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive one-year return.

See our latest analysis for Guidewire Software

Guidewire Software isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last twelve months, Guidewire Software's revenue grew by 6.4%. That's not great considering the company is losing money. The modest growth is probably largely reflected in the share price, which is up 43%. That's not a standout result, but it is solid - much like the level of revenue growth. It could be worth keeping an eye on this one, especially if growth accelerates.

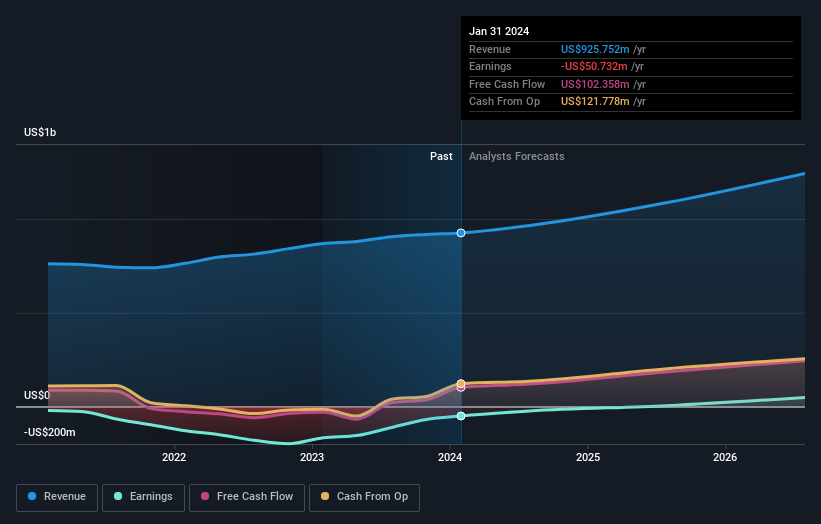

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Guidewire Software is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Guidewire Software will earn in the future (free analyst consensus estimates)

A Different Perspective

It's good to see that Guidewire Software has rewarded shareholders with a total shareholder return of 43% in the last twelve months. That gain is better than the annual TSR over five years, which is 1.7%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Guidewire Software is showing 2 warning signs in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance