Even after rising 21% this past week, Infinity Pharmaceuticals (NASDAQ:INFI) shareholders are still down 64% over the past year

Infinity Pharmaceuticals, Inc. (NASDAQ:INFI) shareholders should be happy to see the share price up 24% in the last month. But that isn't much consolation to those who have suffered through the declines of the last year. Specifically, the stock price slipped by 64% in that time. So the bounce should be viewed in that context. Of course, it could be that the fall was overdone.

While the stock has risen 21% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for Infinity Pharmaceuticals

With just US$1,858,000 worth of revenue in twelve months, we don't think the market considers Infinity Pharmaceuticals to have proven its business plan. You have to wonder why venture capitalists aren't funding it. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. It seems likely some shareholders believe that Infinity Pharmaceuticals has the funding to invent a new product before too long.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. It certainly is a dangerous place to invest, as Infinity Pharmaceuticals investors might realise.

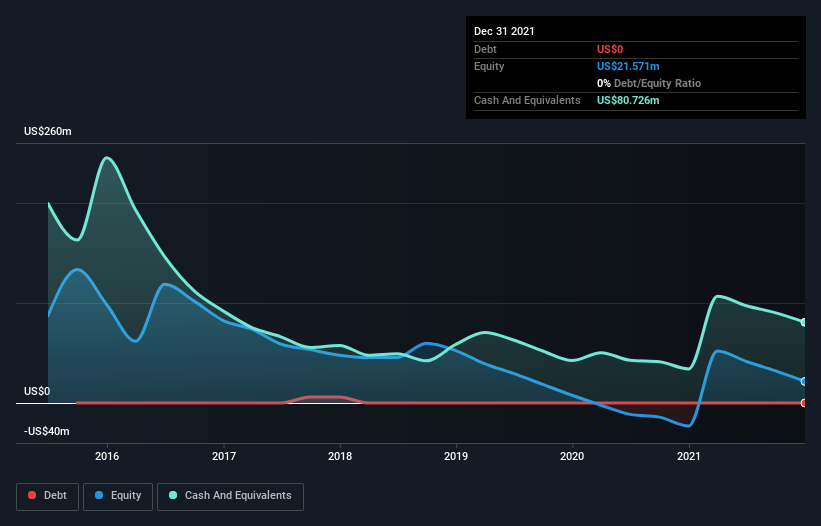

When it reported in December 2021 Infinity Pharmaceuticals had minimal cash in excess of all liabilities consider its expenditure: just US$18m to be specific. So if it has not already moved to replenish reserves, we think the near-term chances of a capital raising event are pretty high. With that in mind, you can understand why the share price dropped 64% in the last year. You can click on the image below to see (in greater detail) how Infinity Pharmaceuticals' cash levels have changed over time.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Would it bother you if insiders were selling the stock? It would bother me, that's for sure. You can click here to see if there are insiders selling.

A Different Perspective

While the broader market gained around 6.4% in the last year, Infinity Pharmaceuticals shareholders lost 64%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Infinity Pharmaceuticals better, we need to consider many other factors. Take risks, for example - Infinity Pharmaceuticals has 4 warning signs (and 1 which can't be ignored) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance