Euro Gaining as Resistance Looms Ahead

Euro traders may believe the currency is undervalued however against the U.S Dollar.

Euro Has Added Value Past Two Days

The Euro has added value the past two trading days and is approaching critical resistance. With the New Year’s holiday ahead, trading volumes in forex remain thin and traders need to be careful if they are attempting short-term positions.

But the Euro appears to be comfortably above the 1.19 level against the U.S Dollar.

Resistance Has Proven Strong Against the Euro

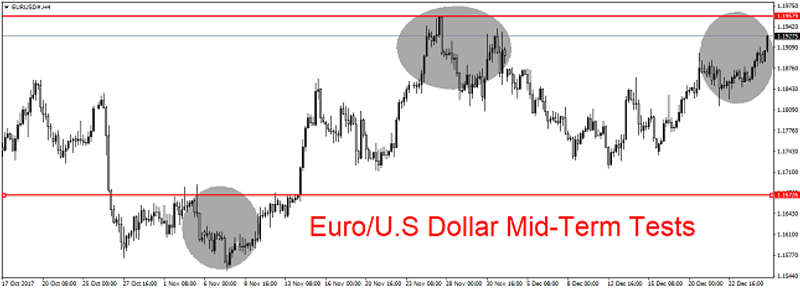

A look at a mid-term chart shows the Euro is near highs but resistance looms, and in September – the Euro was valued higher before getting pushed back.

Inflation data will come from Germany tomorrow, but the report’s impact will be limited due to the lack of institutional investors in the marketplace.

An Opportunity with the Euro Beckons

Strong resistance against the Euro has proven formidable near the 1.20 level against the U.S Dollar.

However, traders may believe an opportunity beckon, and the Euro may be undervalued when taking into consideration the better economic data which the European Union has been able to post the past quarter.

In the short term, we believe Euro may be positive. In the mid-term and long-term, we are unbiased.

Yaron Mazor is a senior analyst at SuperTraderTV.

SuperTraderTV Academy is a leader in investing and stock trading education. Sign up for a class today to learn proven strategies on how to trade smarter.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance