EURAUD Recovery Scalp- Rally to Offer Favorable Shorts

DailyFX.com -

Talking Points

EURAUD rebound to offer favorable short entries

Updated targets & invalidation levels

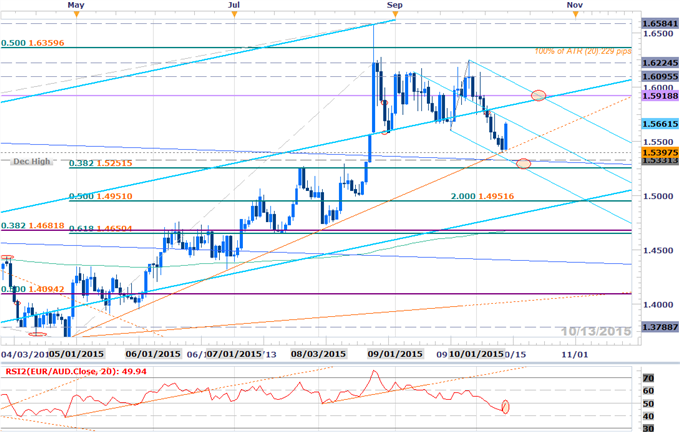

EURAUD Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

EURAUD rebounds off trendline support- rally to offer short entries

Resistance eyed at the median-line off the highs, 1.5780 & 1.5918/25- (bearish invalidation)

Support at 1.5424 (low-day close), 1.5331 & 1.5252 (key support)

Subsequent double top support objective at 1.4951

Daily momentum at 50- breach to confirm more significant topside recovery

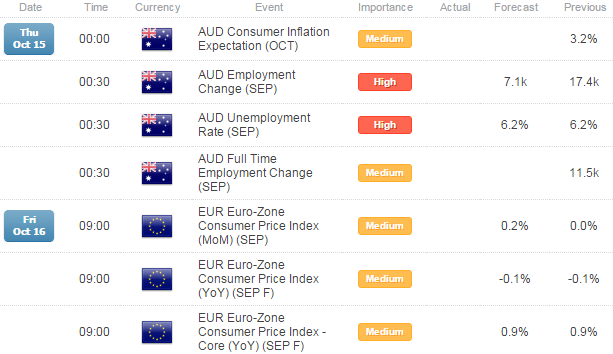

Key Event Risk Ahead: Australia Employment Report

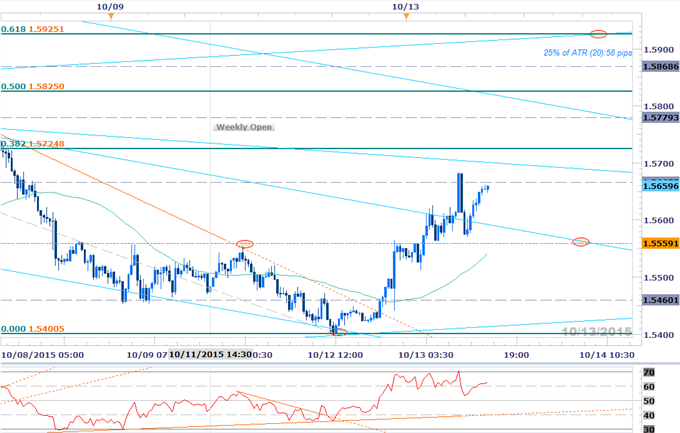

EURAUD 30min

Notes: EURAUD rebounded off confluence support in U.S. trade yesterday with the rally taking out the weekly opening range highs. The immediate focus remains higher while above 1.5560 targeting 1.5725 & 1.5780 / median line resistance. A breach higher there eyes objectives at 1.5825, 1.5869 & more critical resistance into 1.5920/25 (broader bearish invalidation).

Keep in mind the medium-term outlook remains weighted to the short-side with a break of a double top formation last week targeting a stretch down towards 1.4951. That said, the pair is coming off an 8-day decline- the last two instances saw a brief interruption of the decline before resuming lower, so we’ll want to stay nimble.

A break below the low-day close at 1.5424 would be needed to put the bears back in control targeting the measured move into 1.4950 region. A quarter of the daily average true range (ATR) yields profit targets of 20-24 pips per scalp. Caution is warranted heading into the Australian employment report tomorrow with the release likely to fuel added volatility in Aussie crosses. Market expectations are for a 5th consecutive increase in Australia employment with current consensus estimates calling for a gain of 9.6K jobs while the jobless rate holds at 6.2%.

For updates on this scalp and more setups throughout the week subscribe to SB Trade Desk

Relevant Data Releases

Other Setups in Play:

Webinar: USD Weakness Targets Key Support- Comm Bloc Overstretched?

GBPUSD Rebound Testing First Resistance Barrier Ahead of BoE

Webinar: Scalping Aussie Crosses post NFP - RBA, BOE, BoJ on Tap

AUDJPY Rebound Off Slope Support Eyes 86.00 Resistance Ahead of NFP

AUDNZD at Critical Inflection Point- Scalps Target Weekly Opening Range

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForexcontact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)

Struggling with your strategy? Here’s the number one mistake to avoid

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance