EUR/USD Sits at Support Post-ECB; Outlook Favors Further Losses

DailyFX.com -

Talking Points:

- EUR/USD Outlook Mired by Bearish Patterns Even as ECB Sticks to Status Quo.

- USDOLLAR Continues to Hold Above Former Resistance; Fed Expectations in Focus.

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

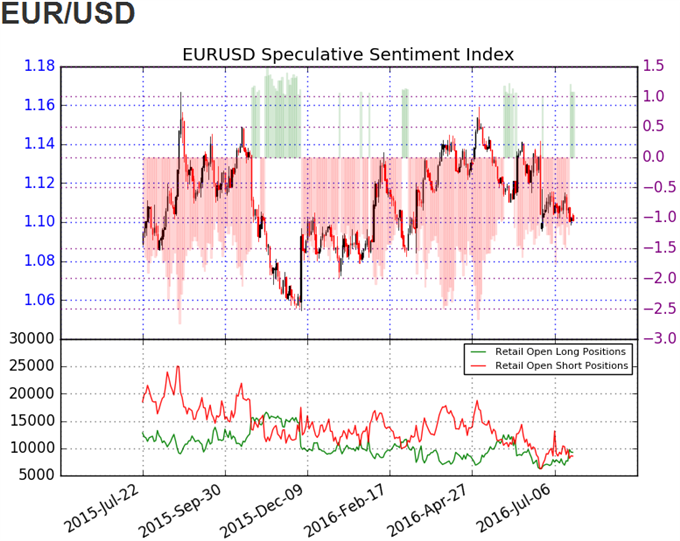

EUR/USD

Chart - Created Using FXCM Marketscope 2.0

EUR/USD struggles to hold its ground even as the European Central Bank (ECB) endorses a wait-and-see approach for monetary policy and preserves the zero-interest rate policy (ZIRP), while keeping the asset-purchase program unchanged at EUR 80B/month; need a break/close below 1.0960 (23.6% retracement) to 1.0970 (38.2% retracement) to favor a further decline in the exchange rate, with the next downside target coming in around 1.0910 (38.2% retracement), which coincides with the June low.

Even though the ECB expects interest rates ‘to remain at present or lower levels for an extended period of time,’ the Governing Council may adjust its quantitative easing (QE) program rather than implementing lower borrowing-costs as central bank officials continue monitor the impact of the ZIRP on the real economy.

Need a move back above 1.1110 (50% retracement) to see EUR/USD preserve the near-term range, but the head-and-shoulders formation from earlier this year may continue to pan out as long as the Relative Strength Index (RSI) retains the bearish formation carried over from April.

The DailyFX Speculative Sentiment Index (SSI) shows a bit of back-and-forth in retail sentiment, with the retail crowd flipping net-short EUR/USD following the ECB interest-rate decision.

The ratio currently sits at -1.03 as 49% of traders are long, with long positions 28.5% higher from the previous week, while open interest stands 8.7% above the monthly average.

Why and how do we use the SSI in trading? View our video and download the free indicator here

USDOLLAR(Ticker: USDollar):

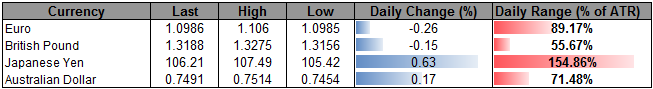

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 12087.41 | 12106.46 | 12060 | -0.05 | 87.60% |

Chart - Created Using FXCM Marketscope 2.0

The USDOLLAR trades on a firmer footing as the slew of second-tier U.S. data highlights an improved outlook for growth and inflation, but the prints may have a limited impact in moving the needle for Federal Open Market Committee (FOMC) as the central bank is widely anticipated to retain its current policy at the next interest-rate decision on July 27.

With Fed Funds Futures still showing limited expectations for a 2016 Fed rate-hike, more of the same from the FOMC may produce near-term headwinds for the greenback as market participants push out bets for higher borrowing-costs, but we may see a growing rift within the committee as the central bank faces a growing risk of overshooting the 2% target for inflation.

String of closing prices above 12,049 (78.6% retracement) to 12,064 (61.8% retracement) raises the risk for a further advance in the USDOLLAR, with the next objective coming in around 12,170 (78.6% retracement) to 12,176 (78.6% expansion).

Click Here for the DailyFX Calendar

Get our top trading opportunities of 2016 HERE

Check out FXCM’s Forex Trading Contest

Read More:

S&P 500: Suspended in Air, Turning to Hourly Chart for Clarity

USD/CHF Technical Analysis: Bullish but Beware the Wedge

Trading NZD/USD? Watch this Level in Lumber

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance