EUR/USD Remains Capped; Eyes Bottom of Range Ahead of ECB Minutes

DailyFX.com -

Talking Points:

- AUD/USD 2016 Range in Focus as Pair Extends Recent Series of Higher Highs & Lows .

- EUR/USD Remains Capped; Eyes Bottom of Range Ahead of ECB Minutes.

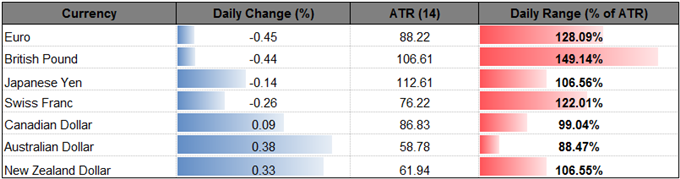

Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

AUD/USD | 0.7396 | 0.7404 | 0.7352 | 28 | 52 |

AUD/USD Daily

Chart - Created Using Trading View

AUD/USD may continue to retrace the decline from the previous month as it extends the recent series of higher highs & lows; the failed test of the May low (0.7145) may bring the 2016 range back into play especially as the Relative Strength Index (RSI) breaks out of the bearish formation carried over from November.

Ahead of the Reserve Bank of Australia’s (RBA) February 7 interest rate decision, the region’s 4Q Consumer Price Index (CPI) is likely to take center stage after the headline reading for inflation climbed to an annualized rate of 1.3% during the three-months through September, and a further pick up in price growth may heighten the appeal of the higher-yielding currency as it puts increased pressure on Governor Philip Lowe and Co. to move away from the easing-cycle.

A push back above the Fibonacci overlap around 0.7390 (38.2% retracement) to 0.7410 (23.6% expansion) may open up the next topside region of interest around 0.7450 (38.2% retracement) followed by the former-support zone around 0.7530 (38.2% expansion).

Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

EUR/USD | 1.0507 | 1.0567 | 1.0454 | 47 | 113 |

EUR/USD Daily

Chart - Created Using Trading View

Longer-term outlook for EUR/USD remains tilted to the downside as price & the RSI preserve the downward trends carried over from the previous year, but the failure to close below 1.0370 ( 38.2% expansion) may produce range-bound conditions in the exchange rate as the near-term rebound appears to be capped by the Fibonacci overlap around 1.0660 (50% expansion) to 1.0680 (78.6% expansion).

With the European Central Bank (ECB) scheduled to release its policy meeting minutes on Thursday, fresh comments from President Mario Draghi and Co. may heighten the bearish outlook surrounding the euro-dollar exchange rate as the Governing Council keeps the door open to expand/extend its quantitative easing (QE) program, while the Federal Reserve appears to be on course to further normalize monetary policy in 2017; with market attention turning to 2017 elections in France and Germany, the ECB may merely try to buy time throughout the first-half of the year amid the uncertainties surrounding the monetary union.

May see a move back towards the bottom of the recent range, with a closing price below 1.0470 (38.2% expansion) opening up the next region of interest around 1.0410 (61.8% expansion) to 1.0420 (100% expansion) followed by 1.0270 (61.8% expansion).

For More Updates, Join DailyFX Currency Analyst David Song for LIVE Analysis!

Click HERE for the Entire DailyFX Webinar schedule.

Click Here for the DailyFX Calendar

If you’re looking for trading ideas, check out our Trading Guides.

Read More:

DAX: Bull-flag Consolidation Taking Shape

Yen Looks To Yield Spread For Direction, Trump Calls Out Toyota

USD/JPY Technical Analysis: Short-Term Look At Recent Pull-Back

January Forex Seasonality Sees Further US Dollar Strength to Start the Year

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance