EUR/USD Holds June Low, Fills Weekly Opening Gap Despite Greek Threat

DailyFX.com -

Talking Points:

- EUR/USD Holds Month Range, Fills Weekly Opening Gap Despite Greek Threat.

- USD/JPY Gaps to Fresh Monthly Low; Bullish RSI Momentum at Risk.

- USDOLLAR Remains at Risk for Range-Bound Prices as Mixed U.S. Data Weighs on Fed Outlook.

For more updates, sign up for David's e-mail distribution list.

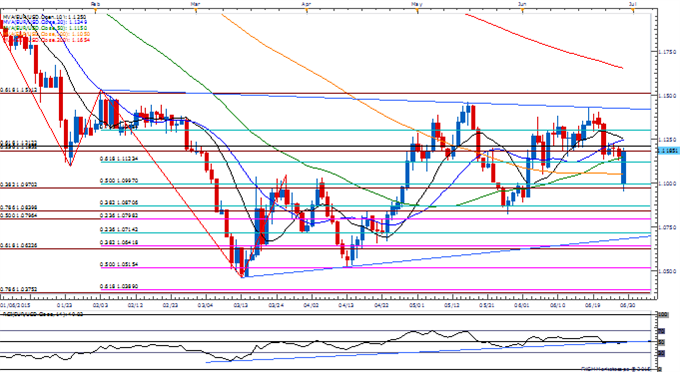

EUR/USD

Chart - Created Using FXCM Marketscope 2.0

Despite the growing threat for a Greek default/exit, EUR/USD fills the gap from the weekly open & holds above the monthly low (1.0886); close above 1,1120-30 (61.8% retracement) may highlight a further consolidation in the exchange rate amid the Greek referendum on July 5.

A material risk for contagion may force the European Central Bank (ECB) to further embark on its easing cycle amid the fragile recovery & reinforce the long-term bearish outlook for EUR/USD as European policy makers struggle to keep the monetary union together.

Nevertheless, DailyFX Speculative Sentiment Index (SSI) shows retail traders remain heavily net-short EUR/USD even as it fills the gap, with the ratio nearing extremes as it currently sits at -2.23.

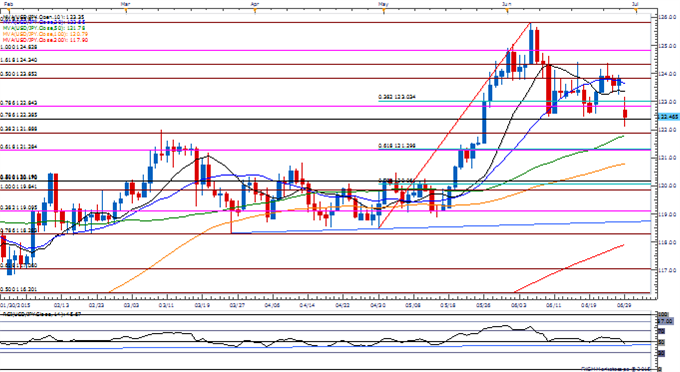

USD/JPY

USD/JPY gaps down to a fresh monthly low of 122.09 as market participants appear to be scaling back their appetite for risk; break of the bullish RSI momentum from earlier this year may foreshadow a larger decline as the pair continues to search for support.

Will keep a close eye on the Tankan surveys as the report is expected to instill an improved outlook for the Japanese economy; may have a larger influence on the Bank of Japan’s (BoJ) policy outlook as market participants still speculate a further expansion in the central bank’s asset-purchase program.

Need a close below 122.30-40 (78.6% retracement) to favor a further decline in USD/JPY, with the next key region of interest coming in around 121.20 (61.8% expansion) to 121.30 (61.8% retracement).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: Pavlovian Weekend

The Weekly Volume Report: Cable Divergence

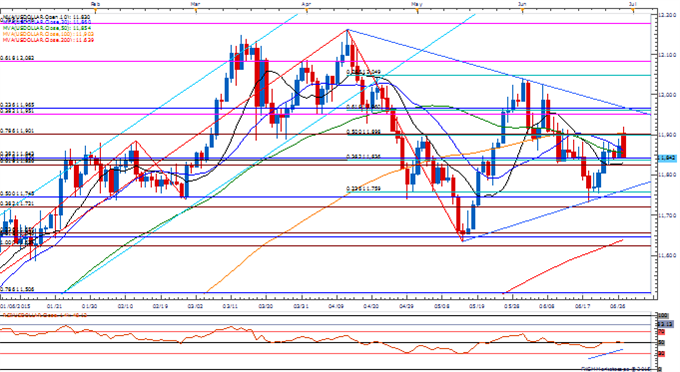

USDOLLAR(Ticker: USDollar):

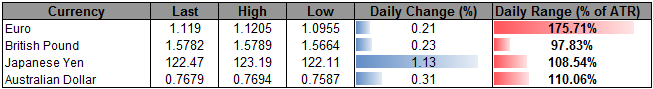

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 11842.08 | 11913.06 | 11841.87 | -0.28 | 105.06% |

Chart - Created Using FXCM Marketscope 2.0

Dow Jones-FXCM U.S. Dollar remains at risk for a further consolidation as it fails to hold its ground & looks poised to mark another closing price below near-term resistance around 11,898 (50% retracement) to 11,901 (78.6% expansion).

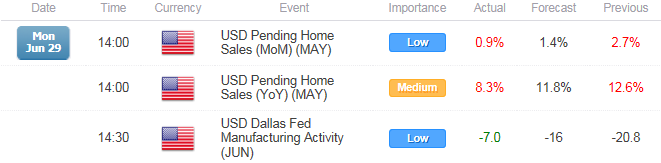

Even though the Federal Reserve remains on course to normalize monetary policy, the ongoing mixed batch of data coming out of the U.S. economy along with the concerns surrounding the global economy may further delay the normalization cycle especially as the central bank struggles to achieve the 2% target for inflation.

Continued closes above 11,826 (61.8% expansion) to 11,843 (38.2% retracement) may continue to produce a tight range going into July, with a break below the key juncture exposing key support around 11,745 (50% retracement) to 11,759 )23.6% retracement).

Join DailyFX on Demand for Real-Time SSI Updates!

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance