EUR/USD Eyes 1.0900 Despite Mixed Euro-Zone Data

DailyFX.com -

Talking Points:

- EUR/USD Mounts Larger Rebound Despite Mixed Euro-Zone Data; 1.0900 in Focus.

- USD/CAD RSI Divergence Takes Shape Ahead of Canada Employment Report.

- USDOLLAR to Threaten Range on Strong NFP, Faster Wage Growth.

For more updates, sign up for David's e-mail distribution list.

EUR/USD

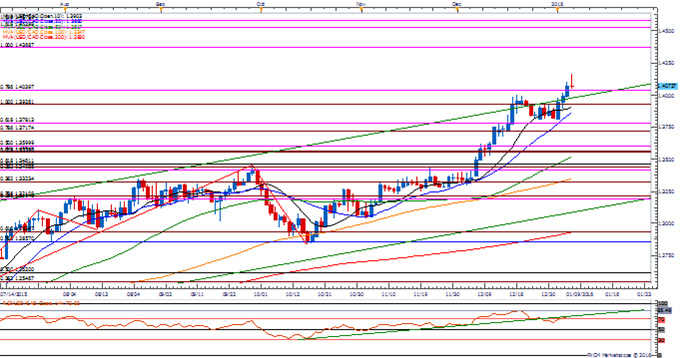

Chart - Created Using FXCM Marketscope 2.0

With EUR/USD extending the rebound from earlier this week, will keep a close eye on former support around 1.0910 (38.2% expansion) for new resistance; the pair remains at risk of giving back the advance following the European Central Bank’s (ECB) December interest rate decision as the Relative Strength Index (RSI) fails to preserve the bullish formation from the end of November.

Despite the mixed data prints coming out of the euro-area, the Governing Council may largely endorse a wait-and-see approach at the next policy meeting on January 21 as the non-standard measures work their way through the real economy.

The DailyFX Speculative Sentiment Index (SSI) shows retail crowd flipped net-short EUR/USD on January 6, with the ratio slipping to -1.33 as 43% of traders are now long.

USD/CAD

Even though USD/CAD climbs to a fresh weekly high of 1.4168 ahead of Canada’s Employment report, a bearish RSI divergence appears to be taking shape especially as the oscillator fails to retain the bullish formation from back in October.

With Canada anticipated to show a 10.0K rebound in job growth, a positive development may boost the appeal of the loonie as it encourages the Bank of Canada (BoC) to endorse a neutral tone for monetary policy as Governor Stephen Poloz turns upbeat towards the economy.

Next topside target stands at 1.4370 (100% expansion), with near-term support holding around 1.3780 (61.8% expansion).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

USDOLLAR(Ticker: USDollar):

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 12186.32 | 12206.04 | 12178.3 | -0.07 | 67.51% |

Chart - Created Using FXCM Marketscope 2.0

Despite market expectations for another 200K expansion in U.S. Non-Farm Payrolls (NFP), the USDOLLAR may face choppy price action ahead of the key event risk as it holds within the previous day’s range; will keep a close eye on Average Hourly Earnings as the U.S. economy approaches ‘full-employment.’

However, the Fed Minutes suggests we may see a rift at the January 27 interest rate decision as central bank doves look for stronger inflation, and a dismal NFP report may drag on rate expectations as Chair Janet Yellen appears to be in no rush to further normalize monetary policy.

Bullish breakout may spur a larger run at the next topside targets around 12,273 (161.8% expansion) to 12,296 (100% expansion).

Read More:

Price & Time: Nikkei 225 – Fear or Greed?

EUR/USD Short-Term Strategy: Sell Rips Sub-1.0880

Bearish NZDUSD As Double-Topping Pattern Develops on Divergence Into 200-DMA

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance