EUR/USD Downside Levels to Watch Ahead of ECB, NFP

DailyFX.com -

Talking Points:

- EUR/USD Bullish Formation Under Pressure Ahead of ECB Meeting.

- USD/JPY Rebound Mired by Bearish RSI Momentum, Wait-and-See BoJ.

- USDOLLAR Recovery Continues Despite Mixed Data; Widening Dissent Within Fed?

For more updates, sign up for David's e-mail distribution list.

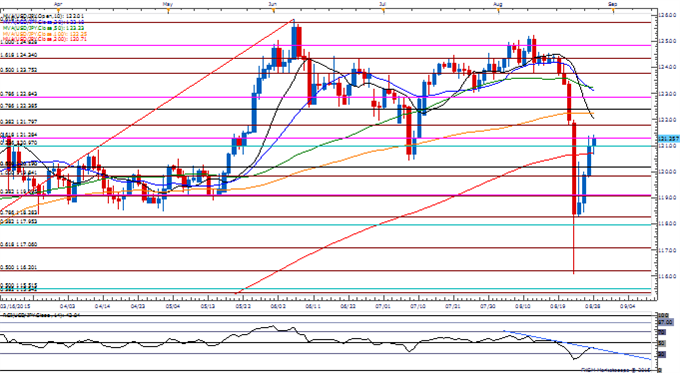

EUR/USD

Chart - Created Using FXCM Marketscope 2.0

Ongoing series of lower highs in EUR/USD may highlight a further decline should former resistance around1.1180 (23.6% expansion) to 1.1210 (61.8% retracement) fail to provide near-term support, with the RSI failing to retain the bullish formation from July.

In light of the dovish rhetoric coming out of the European Central Bank (ECB), a greater willingness to further embark on the easing cycle at the September 3rd policy meeting may produce near-term headwinds for the single currency.

DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long EUR/USD since March 9, but the ratio remains of off recent extremes as it sits at -1.65, with 38% of traders long.

USD/JPY

Sharp rebound in USD/JPY may carry into September should the RSI breakout of the bearish formation; may see the dollar-yen continue to move in tandem with risk sentiment as the Bank of Japan (BoJ) continues to endorse a wait-and-see approach.

Despite the efforts by China to restore investor confidence, may see market sentiment continue to falter without a larger response from the major central banks.

Along with a bullish RSI trigger, would favor a closing price above former-resistance zone around 121.70-80 (38.2% expansion) to favor a resumption of the long-term bull trend.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: Everybody Is An Equity Trader Now

EURJPY Rebound to Offer Short Entries Ahead of ECB- 137.50 Critical

USDOLLAR(Ticker: USDollar):

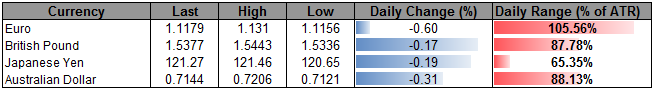

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 12022.67 | 12038.29 | 11975.74 | 0.22 | 99.68% |

Chart - Created Using FXCM Marketscope 2.0

Despite the unexpected slowdown in the U.S. Core Personal Consumption Expenditure (PCE), the Dow Jones-FXCM U.S. Dollar continue to carve a series of higher lows & highs.

May see the dollar trade on a firmer footing ahead of the Fed’s September 17 interest rate decision as Vice-Chair Stanley Fischer sees inflation returning to the 2% target, with the door open for a rate hike next month.

The sharp rebound may spur another test of 12,049 (78.6% retracement), but need a closing price above the key region to favor a resumption of the long-term bullish trend amid the failed attempts from earlier this year.

Join DailyFX on Demand for Real-Time SSI Updates!

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance