EUR/USD Daily Forecast – Euro Drops Below Key Support

Risk-On Sentiment Dominates the Markets

The appetite for risk has strengthened a great deal this week as investors see things nearing an end in the trade war between China and the US. Some of this sentiment might be trickling down into the currency markets and driving the dollar higher.

I say it might be because the performance among the major currencies this week does not necessarily signal a broad risk-based move. Indeed, the Japenese yen is one of the biggest underperformers of the week which lines up with the theme of risk-on sentiment.

But the New Zealand dollar is the weakest among the eight major currencies. This is a currency that historically gains demand during times of increased risk appetite.

The reason this has come into the spotlight and why I think it is important to consider is to evaluate if the euro is making a meaningful reversal. The euro is considered a funding currency after all and if risk appetite is here to stay, it’s easy to make a case for more downside.

Technical Analysis

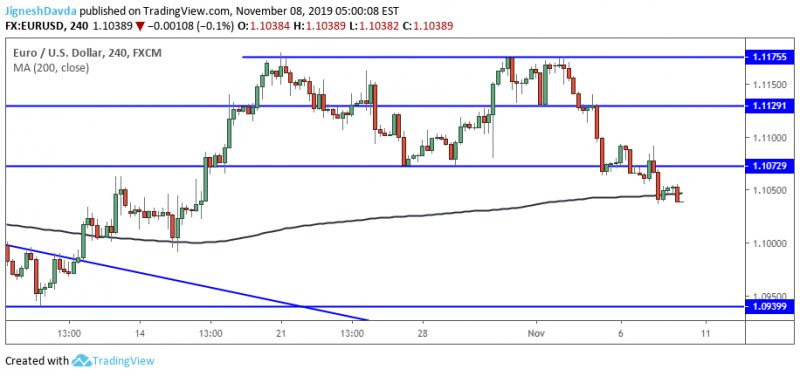

From a technical perspective, EUR/USD has signaled more downside by breaking below support at 1.1072. This level has acted as both support and resistance since August, on a daily close basis.

But more importantly, the break of support has activated a double bottom pattern. This pattern carries a measured move target of 1.1080. This is a fairly significant drop for the pair as it would take out a bulk of the notable gain that we saw in October.

Speaking of last month, the upward move from it has resulted in a bullish engulfing candle on a monthly chart. This might be the only reason I’m not quick to jump on the bearish train in EUR/USD.

For the session ahead, the pair might catch a bid from the 200 moving average. The exchange rate is trading right at the indicator at the time of writing. Resistance for the session ahead falls at 1.1072 which marks the breakout point of the double top pattern.

Bottom Line

EUR/USD has activated a double top pattern to signal more downside.

Measured move targets fall at 1.1080.

Risk sentiment could put further pressure on the euro as it is commonly used as a funding currency for risky trades.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance