EUR/USD Daily Forecast – Euro Bounces as Risk Sentiment Eases

EUR/USD Remains a Sell on Rallies

In Friday’s daily forecast I made the case that the euro might be more susceptible to correlations with risk assets considering the recent development in the US-China trade war. As a funding currency, it tends to come under pressure when there is a broad-based demand for risk.

For that reason, it does not come as a surprise that the pair is bouncing a bit higher in the early day as most of the equity markets are trading lower while precious metals and bonds are getting a lift.

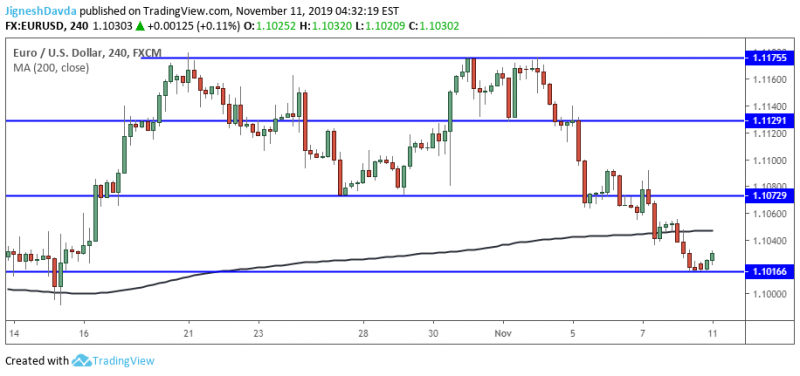

Nevertheless, the EUR/USD technical outlook suggests the pair is a sell on rallies after a technical break came into fruition last week. EUR/USD signaled a double top pattern after making a sustained break below support at 1.1072 on Thursday.

The markets will tend to remain focused on headlines related to the trade war as other drivers such as Brexit sentiment fades. Further, the economic calendar is quite light in the early week with a bulk of the market moving releases falling in the second half of the week.

Technical Analysis

The double top pattern in EUR/USD points to a measured move target of 1.0970. Considering the pattern, I suspect the pair will be faced with sellers and that the current recovery might not gain traction.

A potential area where sellers might look to step in during today’s session is at the 200 moving average on a 4-hour chart. It currently falls around 1.1050. Above that, the break out point of 1.1072 remains a critical resistance area.

The pair appears to be bouncing from a horizontal level at 1.1016 which is a minor support/resistance level that has influence price action since September.

The daily close will be important as the 50-day moving average comes into play. It currently falls at 1.1040. A daily close below it would be a strong show of weakness.

Bottom Line

The dollar is easing back against all of its major counterparts.

EUR/USD carries a bearish bias after breaking lower from a double top pattern late last week.

The breakout point from this pattern falls at 1.1072.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance