EUR/JPY Technical Analysis: Prior Support, New Resistance

DailyFX.com -

To receive James Stanley’s Analysis directly via email, please sign up here.

Talking Points:

EUR/JPY Technical Strategy: Flat. Short setup identified.

EUR/JPY is currently showing resistance

If you’re looking for additional trade ideas, check out our Trading Guideand if you’re looking for shorter-term ideas, check out our SSI indicator.

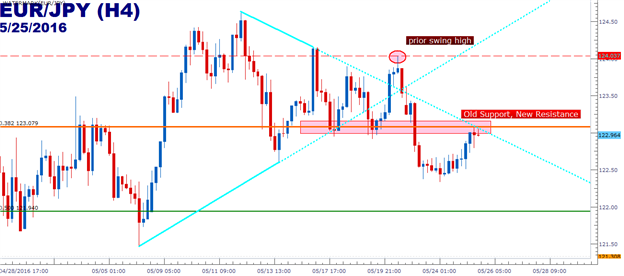

In our last article, we looked at middling price action in EUR/JPY as the pair dug deeper within a symmetrical wedge pattern. As we mentioned, the level at 123.08 could prove compelling for short-side strategies should price action break below this zone, as this is the 38.2% Fibonacci retracement of the secondary move in the pair, taking the 2008 high to the 2012 low.

On Monday we finally saw the bottom-side of that symmetrical wedge pattern give way to falling prices, and this opens the door for short-side continuation moves. The level of 123.08 had also previously functioned as prior support, so this could be an illustration of using old support values as new levels of resistance for down-side continuation plays.

Stops on short positions could be set above the prior swing-high of 124.06; with targets set to the prior price action swing low around the major psychological level at 122.50, followed by 121.94, which is the 50% Fibonacci retracement of the most recent major move, taking the 2012 low to the 2014 high. Below that, we have another price action swing in the 121.50 neighborhood that could function as a tertiary profit target; and should that become broken then the psychological level at 120 becomes an attractive target; as just 10 pips below that major psychological level of 120 we have the 61.8% retracement of the ‘big picture move’ at 119.90 in EUR/JPY, taking the low from the year 2000 all the way up to the 2008 high.

Created with Marketscope/Trading Station II; prepared by James Stanley

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance