EUR/GBP Into Resistance Ahead of UK Jobs, BoE

DailyFX.com -

EUR/GBP weekly opening range takes shape below resistance

Updated targets & invalidation levels

Compete to Win Cash Prizes with FXCM’s Forex Trading Contest

EURGBP Daily

Chart Created Using FXCM Marketscope 2.0

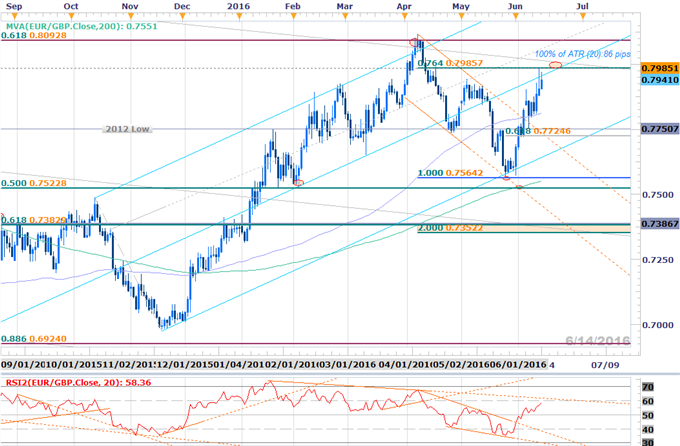

Broader Technical Outlook: EURGBP is testing a region of near-term resistance at 7985-8000 where the 76.4% retracement of the April decline converges on the median-line extending off the August 2015 low. Note that a resistance trigger in momentum is also in view just higher and could cap this near-term advance. The risk remains for a pullback while below this zone with interim support seen at the 100-day moving average, currently at 7812 backed by key support and bullish invalidation at 7725/50. A breach higher keeps the long-bias in play targeting critical resistance at the confluence of the 2016 high-day close and the 61.58% retracement of the 2013 decline at 8092/93.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of SuccessfulTraders” series.

EURGBP 30min

Notes: A breach and retest of channel resistance as support last week saw the pair rally into the aforementioned resistance zone on building divergence. The weekly opening range has taken shape just below this level and we’ll be looking for a break to validate our bias with our general near-term outlook weighted to the downside sub-7985-8000. Interim support rests at 7905 with a break below the weekly open at 7880 targeting subsequent objectives at 7830/40, 7775 and 7725/34- I would be looking for long-triggers / entries on a move into this region.

A breach above near-term resistance invalidates the pullback idea with such a scenario eying targets at 8053 & 8092/93. A third of the daily average true range (ATR) yields profit targets of 27-31 pips per scalp. Added caution is warranted heading key UK event risk with employment figures & the BoE interest rate decision on tap ahead of next week’s highly anticipated Brexit vote on June 23rd. Expect some serious volatility in sterling crosses as we get closer to the referendum. Continue tracking this setup and more throughout the week- Subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount.

Help fine-tune you entries, click here to learn more about the DailyFX Grid Sight Index (GSI)

Relevant Data Releases

Other Setups in Play:

USD/CAD Contained by Clear Price Levels Ahead of Canadian Employment

NZD/USD: RBNZ Breakout Approaching Initial Resistance Targets

Looking for trade ideas? Review DailyFX’s 2016 2Q Projections

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance