ETH Back Up

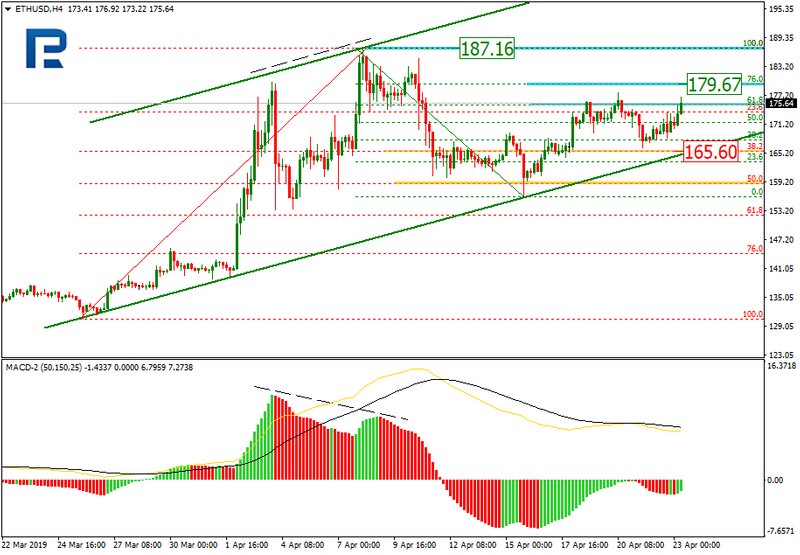

On H4, the Ether was pulled back to 50% Fibo, and then a new upward move started. Currently, the crypto has reached 61.80% Fibo, and is heading towards 76%, or $179.67. The target, meanwhile, lies at the high of $187.16. The support is at $165.60.

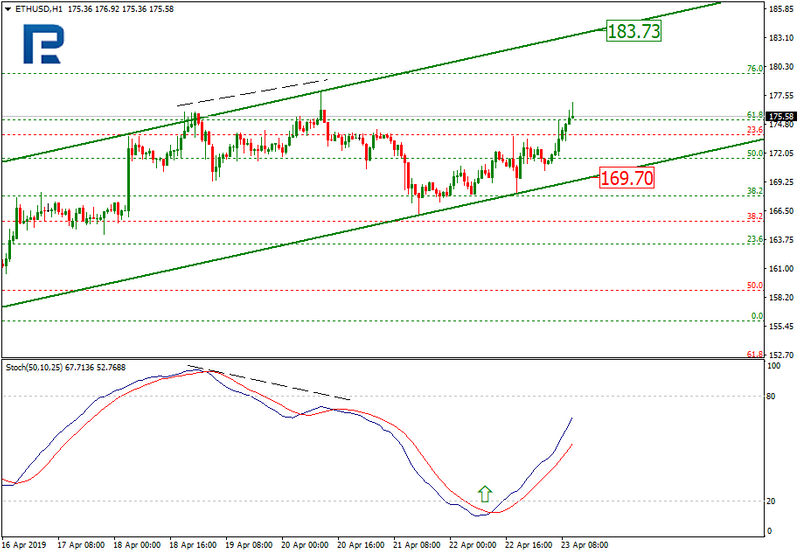

On H1, an ascending channel is being formed. After bouncing off the support, the price is heading towards the resistance at $183.73. In the short term, the ETH may re-test the support at around $169.70.

Donald McIntyre, a crypto enthusiast, says it would be reasonable to merge Ethereum Classic and Ethereum in order to create a powerful and secure blockchain.

Both systems should be integrated one into another, he says, so that one might get a better platform. In McIntyre’s opinion, the strong point of Ethereum is performance and better scalability, while Ethereum Classic has low transaction cost and security. By combining all this, one could get a nearly perfect blockchain.

Besides, the new platform based on two ecosystems could be more competitive and stand ground against EOS and Tezos.

Ethereum Classic has some good potential indeed, but it lacks fundamental drivers on its way through the crypto rating, being just 18th. The ETH, meanwhile, must become more scalable, which would make it more in-demand and competitive.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

Disclaimer

Any predictions contained herein are based on the authors’ particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

This article was originally posted on FX Empire

More From FXEMPIRE:

E-mini Dow Jones Industrial Average (YM) Futures Technical Analysis – April 23, 2019 Forecast

The U.S China Trade War, the UK Pound and the Eurozone Economy in Focus

Earnings Lift U.S. Futures, Trade Tensions Flare Up, Oil Prices Continue To Climb

Silver Price Forecast – Silver markets break hard to the downside

Crude Oil Price Update – Buyers Stepping in to Defend Against Closing Price Reversal Top

Yahoo Finance

Yahoo Finance